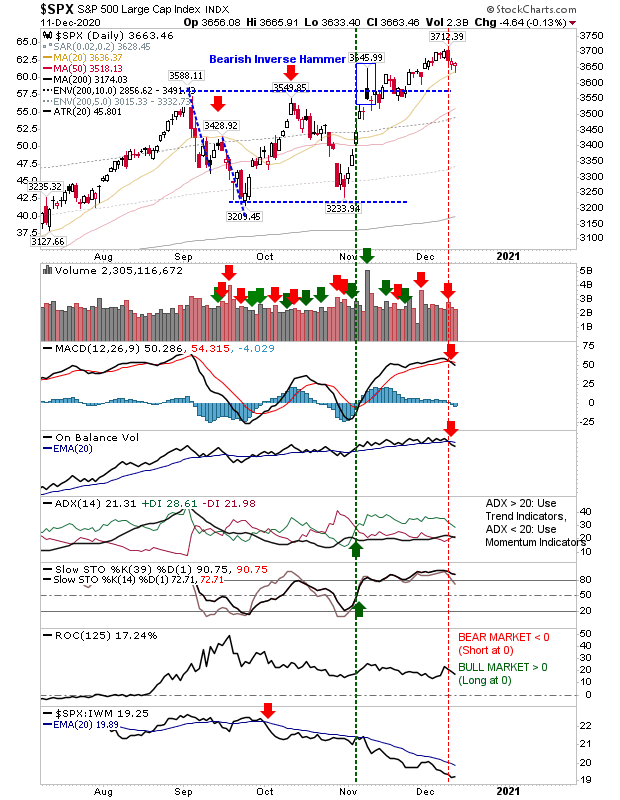

There wasn't a whole lot to Friday's action, but there were some positives. First of all, the 20-day MA of the S&P successfully tested its 20-day MA on a small doji. The NASDAQ finished on a bullish harami just above its 20-day MA. While the Russell 2000 finished on an inside day along rising support.

While the S&P tested its 20-day MA it also experienced 'sell' triggers in the MACD and On-Balance-Volume

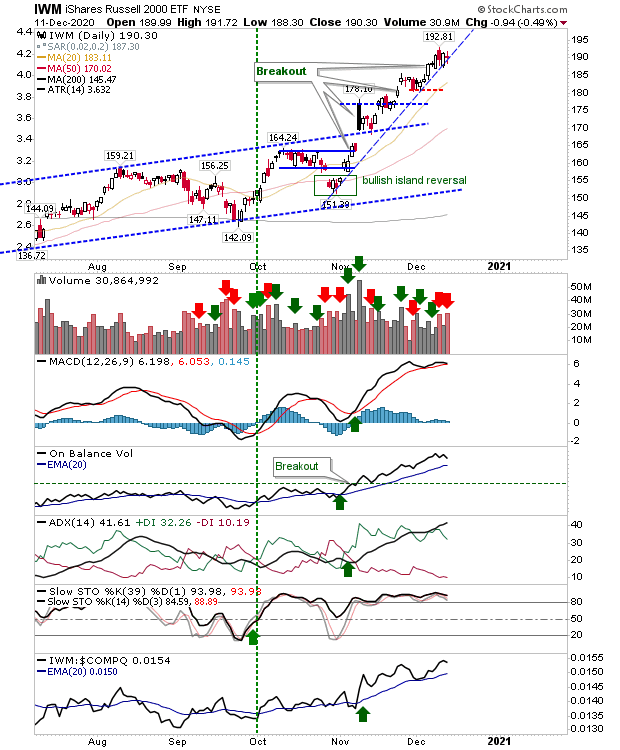

The Russell 2000 (via IWM) inside day is resting on support established from the rising trendline. Technicals are net positive but the MACD is on the verge of a new 'sell' signal, not helped by two days of heavier volume distribution. I would see this as a swing trade, setting a stop on the flip side of the break from Friday's doji.

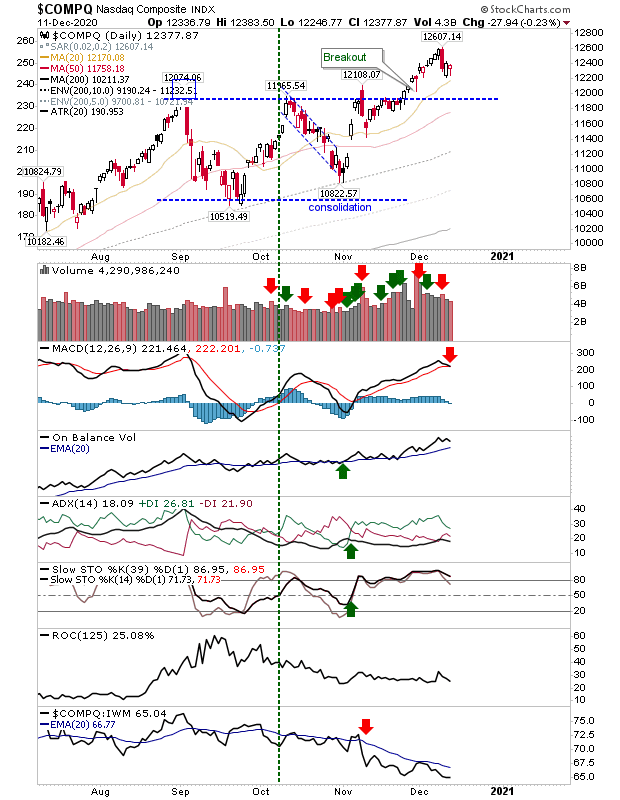

The NASDAQ bullish harami also came with a bullish hammer for the second of the two candlesticks of the harami. There was also the MACD trigger 'sell' but other technicals are still net positive.

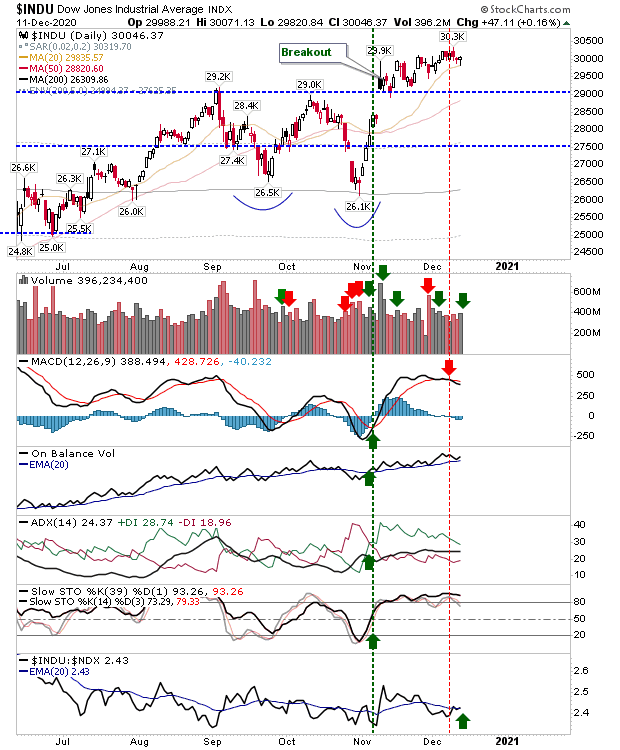

Like the S&P, the Dow Jones Industrials managed a positive test of the 20-day MA on higher volume accumulation. Although the MACD is on a 'sell' trigger.

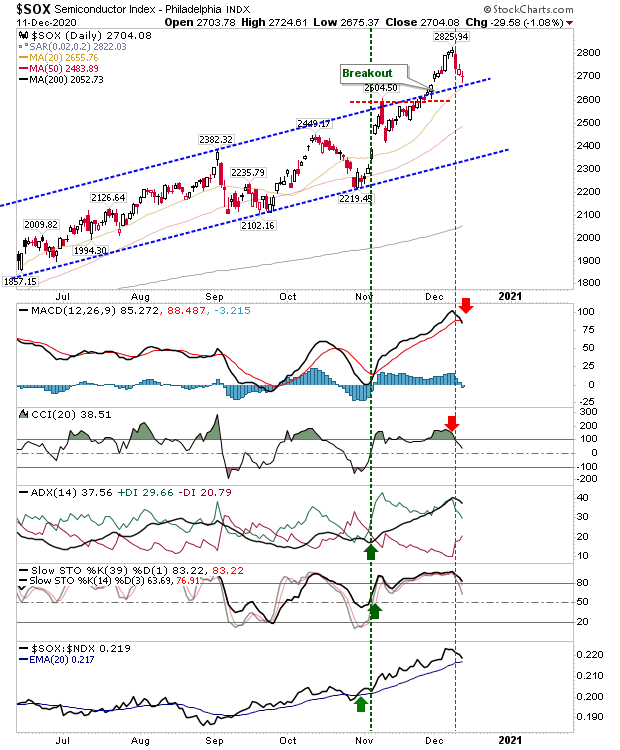

The other index to watch is the Semiconductor Index; it successfully defended its 20-day MA and also former channel resistance, now support. There were 'sell' triggers in the MACD and CCI but price action is doing the heavy lifting so technicals are less important here.

There are only a couple of weeks left until Christmas so can indices keep the Santa rally rolling? Markets are set up for a positive start to the week, now it's up to them to deliver.