Dow halts four-session skid

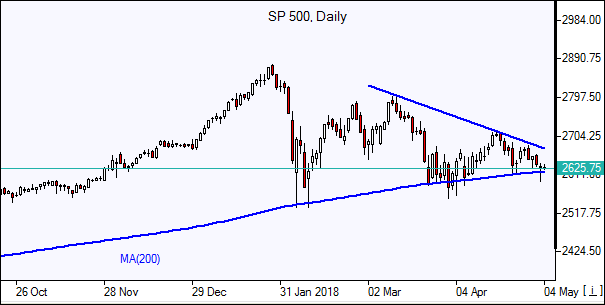

US stocks extended losses on Thursday while Dow ended higher. Dow Jones industrial average added less than 0.1% to 23930.15, halting four-session retreat. The S&P 500 lost 0.2% to 2629.75. The NASDAQ Composite slid 0.2% to 7088.15. The dollar strengthening stopped : the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 92.40 but is rising currently. Stock indices futures point to higher openings today.

Upbeat corporate reports haven’t propped up the three main US stock indices as investors worry about the effects of Fed monetary tightening and possible US-China trade war. On Wednesday the Federal Reserve acknowledged US inflation is rising and said it expects further interest rate hikes will be needed in coming months. Higher interest rates result in slowing business investment as increases in borrowing costs make capital investments less attractive. Economic data were mixed: the Markit services purchasing managers index for April rose to 54.6 compared with 54 in March. The Institute for Supply Management’s nonmanufacturing index fell more than expected in April, dropping to 56.8.

DAX paces European indices losses

European stocks ended solidly lower on Thursday erasing previous session gains. The euro turned higher against the dollar while the British Pound extended losses, both sliding against dollar currently. The STOXX Europe 600 index lost 0.7%. Germany’s DAX 30 fell 0.9% to 12690.15. France’s CAC 40 lost 0.5% and UK’s FTSE 100 slid 0.5% to 7502.69. Markets opened 0.1%-0.4% higher today.

Surprise fall in euro-zone inflation also weighed on investor confidence. Eurostat, the European Union’s statistics agency reported Thursday that consumer price index was 1.2% higher in April compared with that of April 2017. Inflation was 1.3% in March.

Asian markets retreat

Asian stock indices are mostly lower today with traders cautious ahead of US April nonfarm payrolls report. Japanese markets remained closed for a holiday. Chinese stocks are falling despite a report China’s services sector activity accelerated in April: the Shanghai Composite Index is 0.3% lower and Hong Kong’s Hang Seng Index is down 1.5%. Australia’s ASX All Ordinaries is down 0.6% as Australian dollar is little changed against the greenback.

Brent slides

Brent futures prices are edging lower today. They ended higher yesterday on speculation the US may re-impose sanctions on Iran: Brent for July settlement rose 0.4% to close at $73.62 a barrel on Thursday.