- Major US stock indexes are struggling due to a combination of factors, including US earnings reports and hawkish comments from Federal Reserve policymakers.

- Earnings season has seen mixed results, with some companies exceeding expectations (like General Motors and others falling short (like Verizon and GE Aerospace).

- The Dow Jones Industrial Average is showing potential for further upside, while the Nasdaq 100 remains rangebound.

The major Wall Street indexes have struggled since the market opened this week. A combination of factors are in play as US earnings filter through, while Fed policymakers continue to lean on the more hawkish side.

US Treasuries increased as markets reacted to more aggressive comments from Federal Reserve policymakers. The US Presidential debate is also impacting Treasury markets, with investors watching for any possible changes to fiscal policy as betting odds favor a Donald Trump victory.

US earnings picked up this week with a host of companies reporting. The surprisingly positive start to earnings season last week left market participants hopeful. Verizon (NYSE:VZ) was the biggest decliner on the blue-chip Dow Jones after the telecom giant missed estimates for third-quarter revenue with a 4.9% loss.

3M (NYSE:MMM), a major company in the Dow, fell by 0.6%, wiping out its earlier pre-market gains, even though it increased the lower end of its full-year adjusted profit forecast.

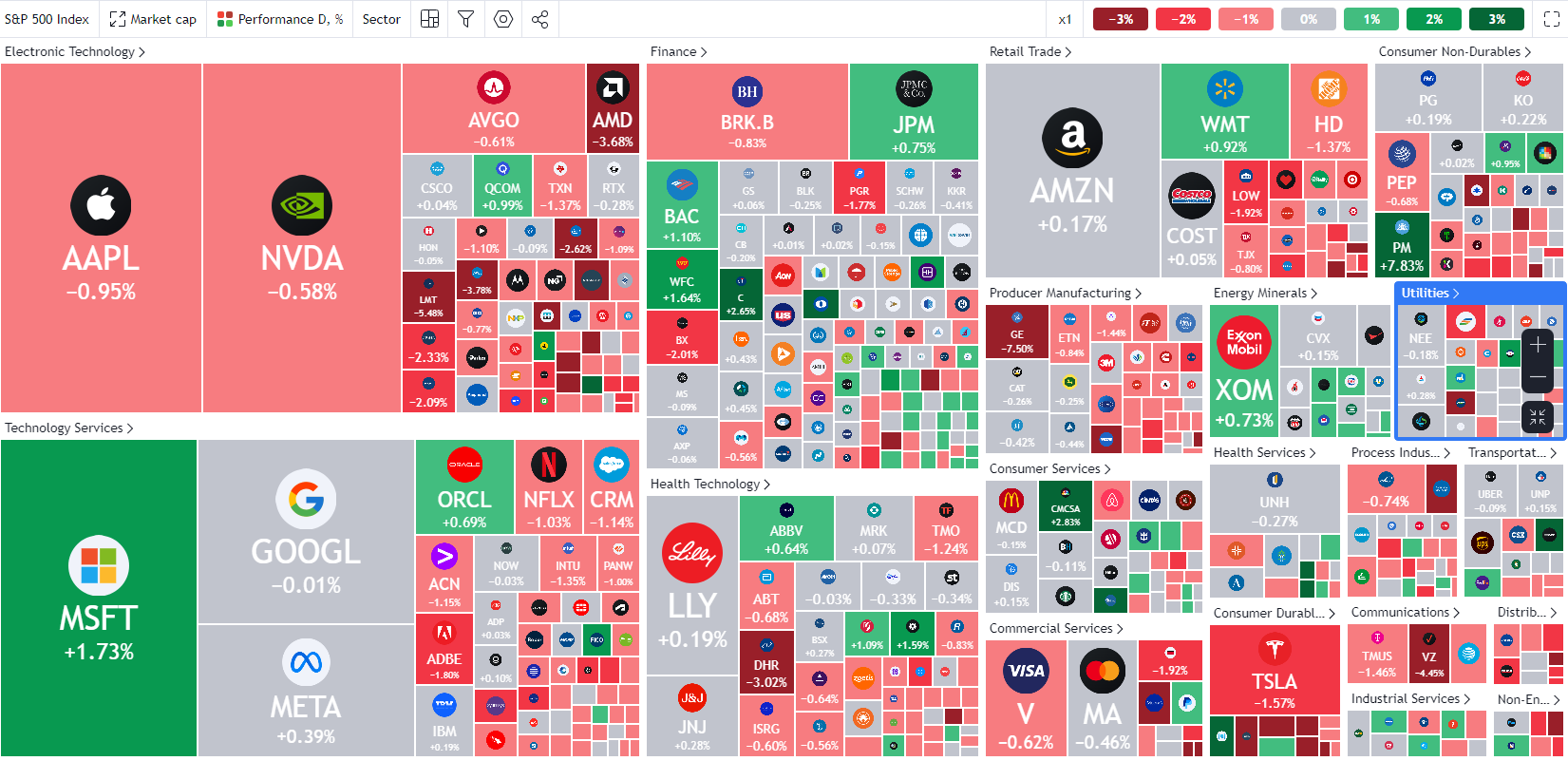

S&P 500 Heatmap

Source: TradingView

Among other notable names reporting today, GE Aerospace (NYSE:GE) dropped 6.3% even after boosting its 2024 profit forecast, due to ongoing supply issues affecting its revenue, showing the challenges companies might face in impressing investors this year.

Meanwhile, General Motors (NYSE:GM)) rose 7.3% after its third-quarter results exceeded Wall Street expectations, while Lockheed Martin (NYSE:LMT) fell 4% following its results.

Magnificent 7 Hold the Key for S&P, Nasdaq 100

Markets are no doubt waiting for the magnificent 7 to report with Tesla (NASDAQ:TSLA) kicking things off this week. Given that the magnificent 7 stocks alone currently account for around 35% of the S&P 500, near the most on record, its impact will be big.

The 7 companies are still trading around $800 billion below their all-time high posted July 10th despite the recent recovery which saw Nvidia (NASDAQ:NVDA) post fresh all-time highs. Nvidia is also closing in on Apple (NASDAQ:AAPL) for the title of the world’s most valuable company. The Chip Maker is only $100 billion away from surpassing Apple.

US Equity Market Concentration

Source: The Kobeissi Letter

Technical Analysis

Dow Jones Industrial Index (US30)

From a technical standpoint, the US30 (Dow Jones) is flashing interesting price action at present. Having experienced a 300-odd point selloff yesterday, the index dropped lower in European trade before rebounding aggressively around halfway through the US session.

Looking at the four-hour chart (H4) today, we can see that the Dow has bounced off a key support area around the 42764 handle. This level served as support on October 14 and 16 respectively.

A H4 candle close with little to no upside wick would hint at further upside for the Dow with a retest toward the resistance handle at 43198 a possibility.

A H4 candle close below the 42764 handle would invalidate the bullish continuation setup.

Dow Jones DJ30 (US30) Four-Hour Chart, October 22, 2024

Source: TradingView

Support

- 42764

- 42599

- 42446

Resistance

- 43000

- 43198

- 43370

Nasdaq 100

The Nasdaq 100 remains rangebound between two key levels at 20000 and 20484. Having discussed the magnificent 7 and its potential impact on the S&P 500 and Nasdaq.

The Nasdaq may find itself struggling for a breakout with a deeper pullback ahead of the releases next week also a possibility.

Immediate resistance rests at 20484 before the all-time highs around 20790 come into focus.

Conversely, there is immediate support at the psychological 20000 handle, before the 19589 support level comes into focus. Lower than that we have 19123 as a key area to focus on.

Nasdaq 100 Daily Chart, October 22, 2024

Source: TradingView

Support

- 20000

- 19750

- 19536

Resistance

- 20484

- 20790 (all-time highs)

- 21000

Most Read: Brent Crude – Oil Rises on China Rate Cuts but Middle East Uncertainty Lingers