- Oil prices rose due to Chinese rate cuts and Middle East uncertainty.

- The IMF downgraded its global growth forecast to 3.2%.

- Technically, Further upside is possible if conditions remain consistent. Geopolitics remains key.

Oil prices are enjoying a mini-renaissance to start the week thanks to Chinese rate cuts and the ongoing and ever-changing situation in the Middle East. This has been the rhetoric and driving force over the past few weeks and not much has changed.

Every data release from China or potential ceasefire discussions in the Middle East is resulting in swings in oil prices. The China situation may have a more long-lasting impact though as an economic slowdown in China means one for the rest of the world.

This was made more evident following the IMF revising down its global growth forecast to 3.2%. A slight downgrade but a downgrade nonetheless, pointing to the scope of downside risks in global markets. The IMF warned that the risks could come from further wars or trade protectionism, something which has become a hot topic on the US election campaign trail.

The projections by the IMF showed growth to remain mediocre in the medium term with a lot of uncertainty. There was also a downgrade to China’s 2025 forecasted growth by the IMF to 4.8% from a previous 5%. This brings the IMF in line with many institutions that have done the same in recent weeks.

Source: IMF

Another sign that points to a potential slowdown in China comes from demand and supply dynamics. According to Commersbank’s commodity analyst, China was oversupplied by 930k barrels p/d in September.

The oil market in China is a concern. This is evident from China’s implied oil demand, which is calculated by subtracting net exports of oil products from the amount of crude oil processed. Exports have been on the decline and many hope the recent stimulus will help local demand as well. Only time will tell if the stimulus is enough.

The Week Ahead

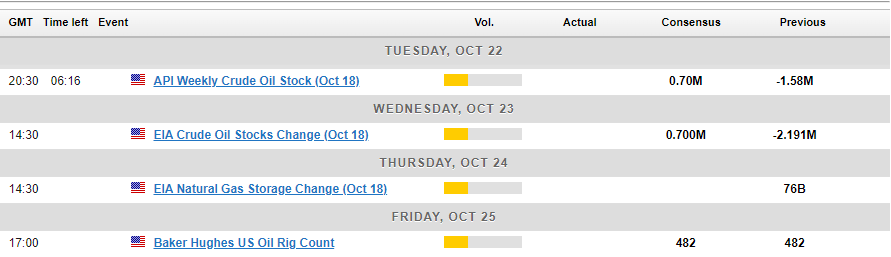

There is a lack of high-impact US data this week with eyes firmly focused on the geopolitical situation in the Middle East. Wednesday we get inventory data filtering through from the API and Thursday from the EIA, both of which could stoke some short-term volatility and moves for oil prices.

Technical Analysis

From a technical perspective, Oil has retested and hugged the descending trendline for the last 5 days before moving higher this morning.

Having come within a whisker of the key support area at 72.38, Oil prices are now approaching resistance at 76.35, up around 1.9%. Yesterday’s daily candle closed as an inside bar hinting at further upside. If today’s candle can close around 75.50 or higher this would form an imperfect morningstar candlestick pattern, which would hint at further upside.

Brent Crude Oil Daily Chart, October 22, 2024

Source: TradingView

Dropping down to a four-hour chart (H4) and looking at price action we have seen a change in character. Markets are now printing higher highs and higher lows meaning bulls are now in control.

Immediate resistance rests at 76.00 where we also see the 100-day MA resting making this a key confluence area. Oil has already rejected off this level today, will the bulls have enough to break through? If oil can get above the 76.35 handle there is an open run toward the 78.90 handle.

Brent Crude Oil Four-Hour (H4) Chart, October 22, 2024

Source: TradingView

Support

- 74.63

- 72.38

- 70.00 (key area of confluence)

Resistance

- 76.00

- 78.90

- 80.00

Most Read: Markets Weekly Outlook – PMI Data and IMF Meeting Dominate the Agenda