Dow posts eighth gain in a row

US stocks extended gains Monday on receding US-China trade war fears. The S&P 500 gained 0.1% to 2730.13 led by healthcare stocks up 0.7%. Dow Jones industrial rose 0.3% to 24899.41. The Nasdaq composite index advanced 0.1% to 7411.32. The dollar strengthening resumed: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 92.64 and is steady currently. Stock indices futures point to lower openings today.

Market sentiment was buoyed by President Trump’s tweet overnight he has asked for a stay of his order banning US companies from selling to China’s ZTE (HK:0763) corporation. Treasury yields were supported by Cleveland Fed President Loretta Mester’s comment the central bank may need to raise interest rates above 3% to achieve its dual mandate of stable prices and maximum employment.

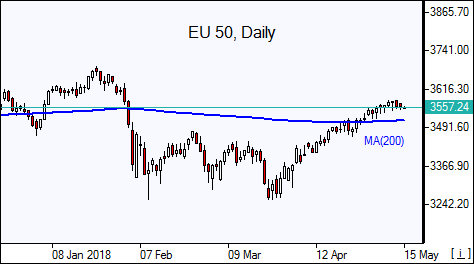

European indices pull back

European stocks pulled back on Monday as investors weigh ramification of newly announced Italian coalition for the European Union. The British Pound’s extended the slide against the dollar while euro turned higher with both currencies receding against dollar currently. The Stoxx Europe 600 index slipped less than 0.1%. The DAX 30 lost 0.2% to 12977.71, France’s CAC 40 ended marginally lower and UK’s FTSE 100 lost 0.2% to 7710.98. Markets opened 0.2% lower today.

Traders were weighing implications of the announcement over the weekend the euroskeptic 5 Star Movement and hard right League party agreed to form a governing coalition. Forming of a coalition government will end more than two months of political deadlock in Italy.

Chinese fixed asset investment and retail sales below forecast

Asian stock indices are lower today after weak Chinese economic data. Nikkei lost 0.2% to 22818.02 despite continued yen slide against the dollar. China’s markets are mixed as fixed asset investment growth slowed to 7.0% in January-April from a year earlier and retail sales growth slowed to 9.4% in April: the Shanghai Composite Index is up 0.5% while Hong Kong’s Hang Seng Index is 1% lower. Australia’s ASX All Ordinaries is down 0.6% despite Australian dollar continued slide against the US dollar.

Brent slips

Brent futures prices are edging lower today. Prices rallied yesterday on rising Middle East tensions as Palestinians clashed Monday with the Israeli military at the fence dividing the Gaza Strip and Israel. July Brent crude settled 1.4% higher at $78.23 a barrel on Monday.