S&P 500 got close to its all-time high, as market mood turned bullish again. But the index retraced some of the rally. So will the uptrend continue?

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

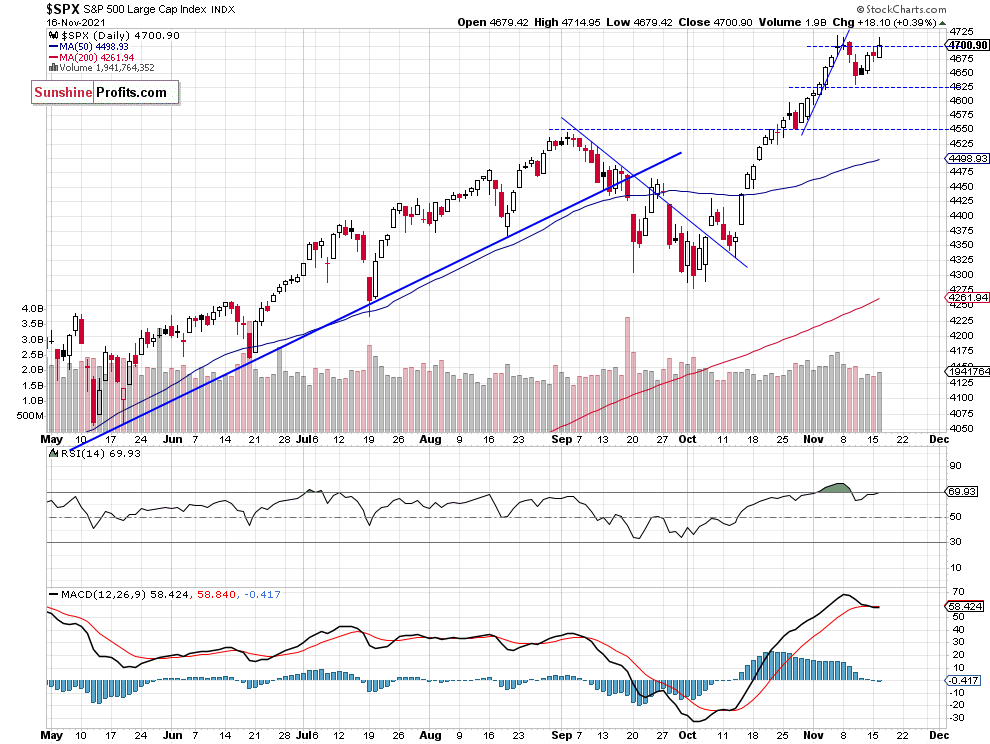

The S&P 500 index gained 0.39% on Tuesday, Nov. 16, as it closed slightly above the 4,700 mark. The market reached the daily high of 4,714.95 before retracing some of the intraday advance. It got close to the Nov. 5 record high of 4,718.50. Last week it fell to the local low of 4,630.86 and it was almost 88 points or 1.86% below the record high.

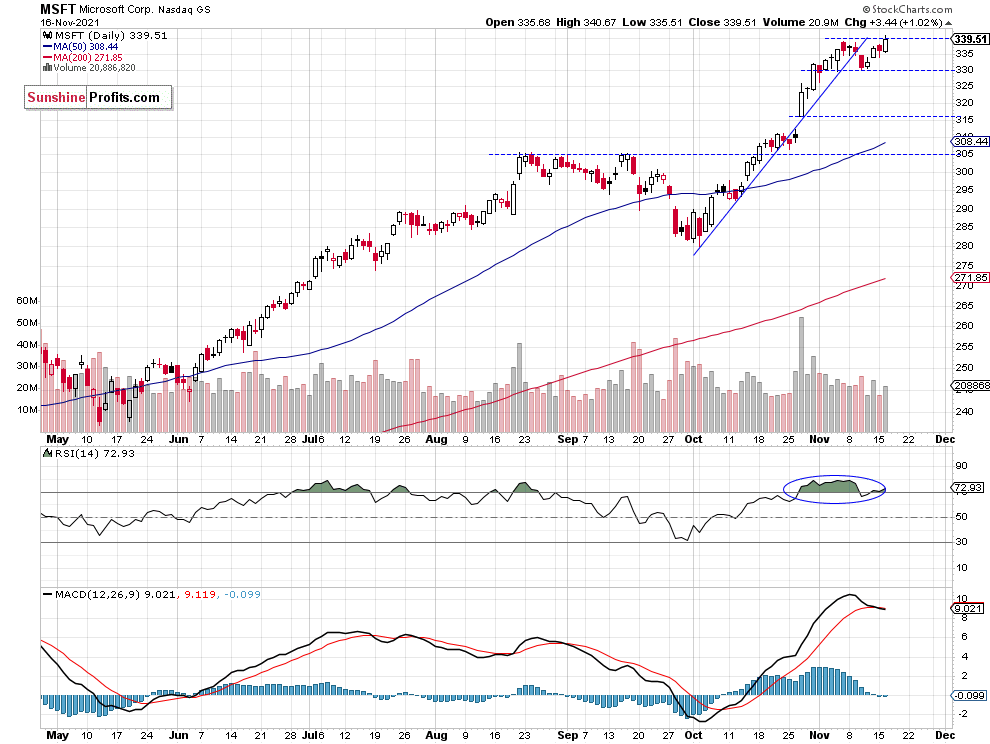

The early November rally was not broad-based and it was driven by a handful of tech stocks like Microsoft (NASDAQ:MSFT), NVIDIA (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA). The market seemed overbought in the short-term and it traded within a topping pattern. Then the index retraced some of that advance, as it fell the mentioned 88 points from the record high.

The nearest important support level remains at 4,630-4,650 and the next support level is at 4,600. On the other hand, the resistance level is at 4,700-4,720. The S&P 500 broke below its steep short-term upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Nasdaq Extended Its Short-Term Uptrend

Let’s take a look at the Nasdaq 100 chart. The technology index broke above the 16,000 level recently and it was trading at the new record high. The market accelerated higher above its short-term upward trend line. But last week it retraced some of the advance and it got back to the 16,000 level. Since then it has been advancing and yesterday it got back closer to the record high, as we can see on the daily chart:

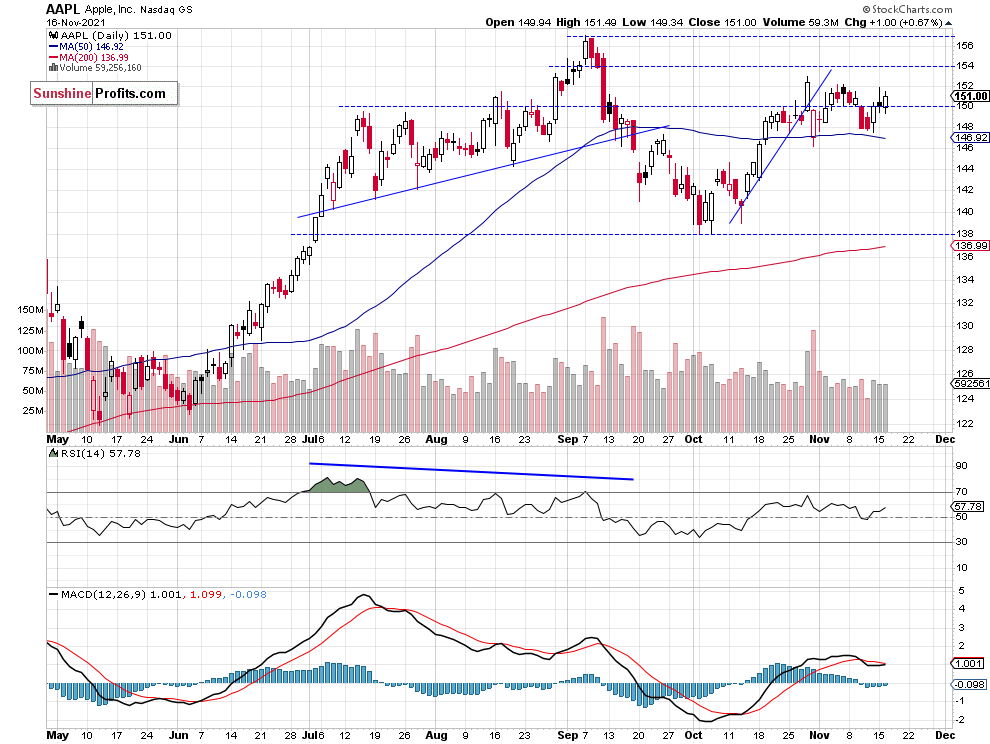

Apple Above $150, Microsoft At New Record High

Let’s take a look at the two biggest stocks in the S&P 500 index, Apple Inc (NASDAQ:AAPL) and MSFT. Apple broke above the $150 price level yesterday. However, it remains well below the early September record high. Microsoft stock retraced all of its recent decline and it reached the new record high of $340.67 yesterday, as we can see on their daily charts:

Conclusion

The S&P 500 index is expected to open virtually flat this morning. We may see another attempt at breaking above the 4,700 level. However, the market will likely continue to fluctuate along that level following mixed economic data releases.

Here’s the breakdown:

- The S&P 500 bounced from its last week’s local low and it got back above the 4,700 level yesterday. It still looks like a short-term consolidation.

- Still no positions are justified from the risk/reward point of view.