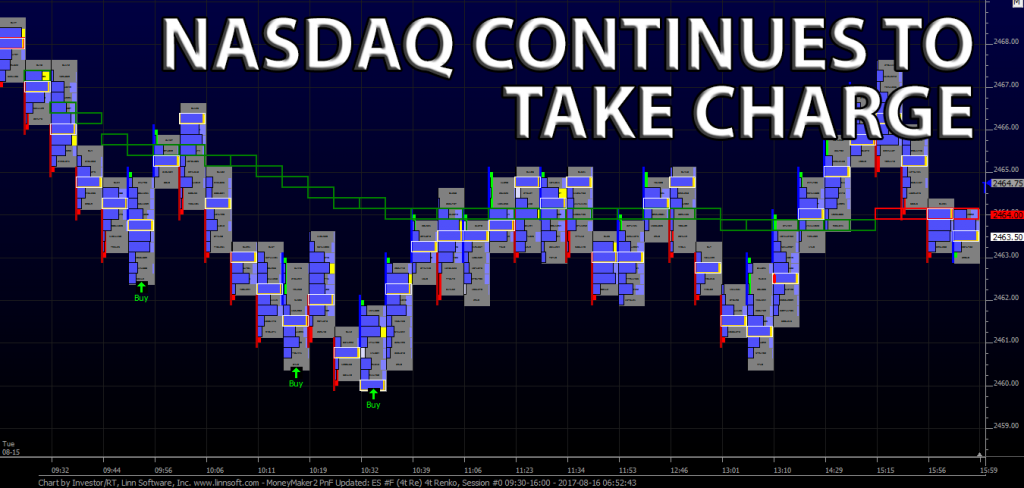

Well, it was another rally all the way up to 2473.25 on Globex Monday night, and then a pullback to open at 2468.50 on the 8:30 CT futures open. After the open, the Nasdaq 100 futures (NQU17:CME) sold off, and the S&P 500 futures (ESU17:CME) went along for the ride. At 9:15 the the NQ dropped down to 5895.50, and the ES traded down to 2460.50. From there, the ES bounced a little before going back down and making another new low at 2460.00 when the NQ sold off again, but the low held. After that, it was all smapp pops and drops, with the ES unable to overcome the vwap. The ES has been held captive to the NQ for a long time, and when the markets are quiet, it’s even more noticeable.

Around 1:30 CT, the MiM ( https://mrtopstep.com/l/mim/ ) started giving an early reading of $770 million to buy, and not long after the ES traded up to 2465.50. The ES was lagging against the NQ and YM all day, and even when the NQ went ‘bid’, the ES did not move very much. The ES started taking out some buy stops above the vwap at 2465.00, and traded up to 2467.50 at 2:46, and then came falling back down to 2463.00 going into the 3:00 cash close.

In the end it was another long day on a list of many. Some early action in the first and last hour, and a lot of mindless chop in between. On the close the, S&P 500 futures (ESU17:CME) settled at 2463.75, up +0.25 handles, or +0.01%, the Dow Jones futures (YMU17:CBT) settled at 21977, up +25 points, or +0.11%, and the Nasdaq 100 futures (NQU17:CME) settled at 5912.00, up +2 points, or +0.03%.

While You Were Sleeping

Overnight, equity markets in Asia traded mostly higher, led by the JSX Composite, which closed up +0.98%. The strength in Asia followed through into the European session, where most markets are also trading higher this morning, led by the CAC, which is up +1.07%.

In the U.S., the S&P 500 futures opened last night’s Globex session at 2464.50, and traded down to the overnight low at 2461.50 in the first hour of trade. From there it was a slow grind higher, and eventually, at 4:45am CT, the high print was made at 2471.25, extending the Globex range to nearly 10 handles. As of 6:45am CT, the last print in the ES is 2468.00, up +4.25 handles, with 118k contracts traded.

In Asia, 8 out of 11 markets closed higher (Shanghai -0.14%), and in Europe 11 out of 12 markets are trading higher this morning (FTSE +0.67%).

Today’s economic calendar includes the MBA Mortgage Applications (7:00 AM ET), Housing Starts (8:30 AM ET), Atlanta Fed Business Inflation Expectations (10:00 AM ET), EIA Petroleum Status Report (10:30 AM ET), FOMC Minutes (2:00 PM ET).

Our View

The Fed will release the minutes from the last meeting today. It’s possible the will ES sell off during that, but I think it will recover. At yesterday’s high, the ES was only 10 handles off its all time contract high. The ES has gone a long way in a few days. China and the U.S. are trying to work together to cool down North Korea, but the U.S. and South Korea military games are starting August 21, which could inflame Pyongyang.