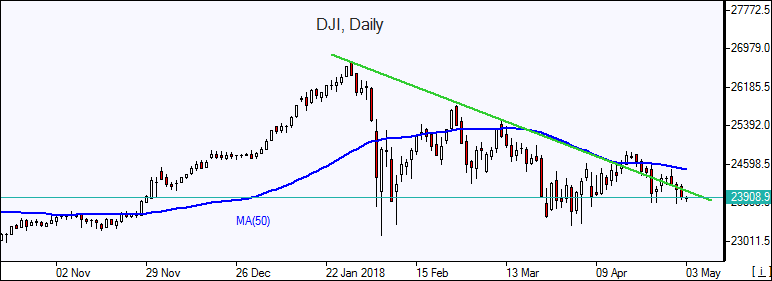

Dow falls for the fourth session in a row

US stocks ended lower erasing earlier gains on Wednesday as the Fed left monetary policy unchanged while acknowledging firming inflation. The S&P 500 fell 0.7% to 2635.67, with ten of 11 main sectors finishing lower. The Dow Jones Industrial lost 0.7% to 23924.98. The NASDAQ Composite slid 0.4% to 7100.90. The dollar strengthening continued: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.3% to 92.676, though is receding currently. Stock indices futures indicate mixed openings today.

The Federal Reserve didn’t hike its benchmark interest rate, keeping the federal funds rate in a range of 1.50% - 1.75%. The Fed said it expects inflation to “run near” its 2% target “over the medium term”. It stated that monetary policy would remain accommodative for now and that risks were roughly balanced, saying they expect further interest rate hikes will be needed in coming months. Investors interpreted the Fed statement as dovish, with fed fund futures pricing roughly even odds of three more rate hikes this year. In economic news, the ADP agency reported the private sector added above-expected 204,000 jobs in April.

DAX leads European indices rebound

European stocks rebounded on Wednesday on upbeat earnings reports. Both the British Pound and euro slowed their slide against the dollar and are up currently. The STOXX Europe 600 gained 0.6%. Germany’s DAX 30 outperformed jumping 1.7% to 12824.3. France’s CAC 40 gained 0.2% and UK’s FTSE 100 rose 0.4% to 7572.98. Markets opened mixed today.

Upbeat corporate updates supported market sentiment despite weak economic data: the euro-zone economy slowed in the first three months of this year as the GDP grew 2.5% on the year, down from 2.8% in the fourth quarter of 2017, according to preliminary reading on gross domestic product.

Asian indices mixed

Asian stock indices are mixed today. Markets in Japan are closed for a four-day holiday. Chinese stocks are mixed: theShanghai Composite Index is 0.6% higher while Hong Kong’s Hang Seng Index is down 1.27%. Australia’s ASX All Ordinaries is up 0.8% despite Australian dollar gain against the greenback.

Brent rising

Brent futures prices are gaining today despite reports of rising US crude oil output. Prices rose yesterday as the International Monetary Fund threatened to expel Venezuela for its failure to adequately provide economic data. The US Energy Information Administration reported that domestic crude supplies rose by 6.2 million barrels last week to 435.96 million. July Brent crude rose 0.3% to $73.36 a barrel on Wednesday.