The S&P 500 earnings yield has retreated again, down to close to 5%—at 5.20% to be exact. This level is always worrisome.

Here is the article from last December ’19 on the low S&P 500 earnings yield.

—————

S&P 500 Earnings data (format revised):

——————-

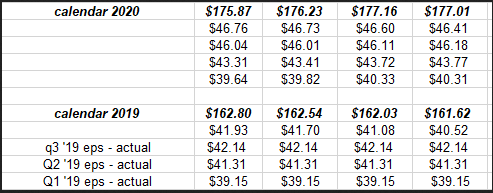

Looking at 2020 bottom-up quarterly estimates for S&P 500:

Note the expected acceleration in Q3 and Q4 ’20 bottom up estimates, both over $46 per share.

Someone is looking for a stronger 2nd half to 2020. Note the dollar estimates of Q3 and Q4 of 2020 to the first half of 2020 and all of 2019.

Note the upward revision to Q4 ’20’s dollar estimate. I wonder if there is an indirect “election call” being made?

Summary / conclusion: An earnings yield drifting down towards 5% always makes me nervous. If a longer article was done on the S&P 500 earnings yield post 2008, it would show that it has rarely been this low the last 10-12 years.

The NASDAQ 100 is up 10.36% YTD and the S&P 500 is up 4.89% YTD. (Source: Bespoke).