In prepping to write this weekly update, the S&P 500’s “forward earnings yield” at 5.28% is as low as I’ve seen it post 2008. Yes, that’s a long time. The lowest I’ve seen it prior to this is the week of January 26th, 2018 when it closed the week at 5.35%. Yes, that week, when volume spiked dramatically and the S&P 500 corrected 8% in two weeks.)

However, don’t assume the same thing will happen this time around. Read further:

Well, the next quarter is only a few days away, and since the “forward estimate” will comprise Q1 ’20 through Q4 ’20, the “forward estimate” starting January 1 ’20 will simply be the current calendar 2020 S&P 500 EPS estimate and that is – per IBES by Refinitiv – $177.27.

Here's the current data (which was neglected to be published last week):

Trailing data:

Summary / conclusion: Next week, when the new forward estimate is plugged in, some of the valuation metrics will look a bit better. For instance if we use the forward estimate of $177.27 divided by the S&P 500 (or the “forward S&P 500 earnings yield”), the forward earnings yield assuming no change in the S&P 500 next week, is 5.47% and not the 5.28% noted this week.

The S&P 500 earnings yield peaked at 7.02% the week of December 21, 2018.

This week’s S&P 500 earnings yield is pretty low by historical standards.

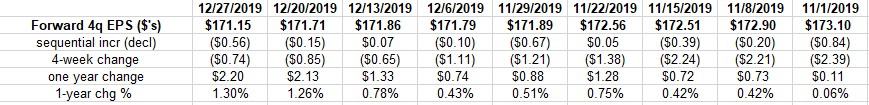

Readers were told we’d keep the change in the forward growth rate updated so here is the spreadsheet with this week’s data:

Note how that “1year chg %” continues to grow since November 6th, ’19.

In hindsight that was likely the turning point for the ” rate of change in the forward estimate.”

That S&P 500 earnings yield makes me nervous – that’s a very low level.

Many think the S&P 500 has risen too far, too fast, since early October ’19. The low level of the earnings yield supports that notion.