With Jay Powell’s Jackson Hole Speech last Friday morning, and the FOMC’s new (apparent) commitment to lowering the fed funds rate at future FOMC meetings, as well as the pending release of Nvidia's (NASDAQ:NVDA) Wednesday night, August 28th, the 2nd revision of the July ’24 GDP data on Thursday morning, August 29th, and the July PCE data on Friday morning, July 30th have all been kicked to the curb in terms of market relevance.

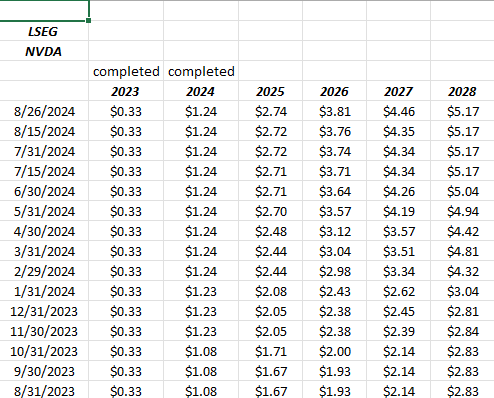

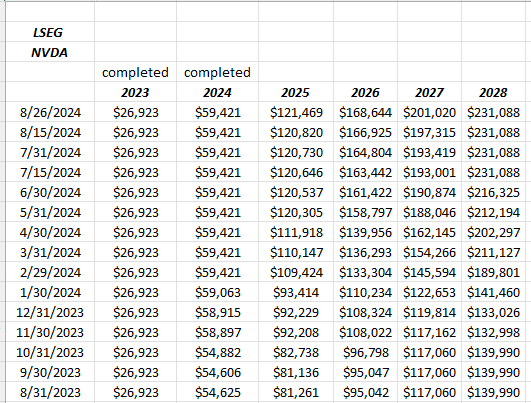

NVDA’s EPS and Revenue Estimate Revisions

EPS and revenue estimate revisions source: LSEG

Readers should focus on the fiscal ’25 progressions in both tables.

Since last August 31 ’23, NVDA’s revenue estimate has been revised higher by 49% while the EPS estimate (first spreadsheet table) has been revised higher by 64%.

This blog has no direct long or short in NVDA, but is playing the stock through the SMH.

Even with the Blackwell delay, the NVDA EPS and revenue revisions are still quite robust, but that is not a suggestion or opinion on how to play the stock.

The biggest issue this blog has with NVDA is it’s outsized contribution to S&P 500 performance this year, it’s $3 trillion market cap, and the fact that it’s a very crowded trade. (This is all too reminiscent of the late 1990’s.) Still the SMH has a 21% weight in NVDA, which is why clients are long the SMH.

GDP and Inflation Data

The first look at Q2 ’24 GDP data released in late July was actually pretty strong at +2.8%. The GDP data was released just prior to the early August higher jobless claims and a weaker July ’24 payroll report.

The Q2 ’24 GDP report was effectively ignored by the stock and bond markets, so we’ll see what the revisions are – if any – to the +2.8% GDP release in late July ’24.

July Core PCE due out Friday morning, August 30 is looking for a rather benign +0.1%.

Most of the Core CPI and Core PCE data is below 2% when shelter is excluded, so effectively the Fed / FOMC is already at the desired inflation target.

As was once told to me by a member of the JP Morgan fixed-income team, the Fed’s biggest fear (seemingly) is that they will be viewed as political. With a Presidential election 9 – 10 weeks away, it’s probably not a stretch to think that the Fed can’t let economic growth deteriorate as the rate of inflation has gradually declined.

The 10-Year Treasury Yield

The bigger risk to the Treasury market despite the Fed lowering the fed funds rate is a steepening yield curve.

Watch the 3.785% level on the 10-year Treasury. The panic low for the 10-year Treasury yield was 3.66% on Monday, August 5th, ’24 after the yen carry trade scare.

I’m not a technician, but a Friday weekly close below 3.785% for the 10-year Treasury yield, and I’d expect lower yields to follow, at least temporarily.

However, Treasury issuance and deficit funding is keeping bond bulls cautious.

Remember there is still a lot of the banking system sitting with unrealized losses on Treasury / Agency securities after 2022. The discount window opening after Silicon Valley Bank (SIVB) was wiped out helped alleviate the post-collapse panic for regional banks, but I suspect the Fed would like to solve this issue using normal monetary policy rather than the discount window.

S&P 500 Earnings Data

- The forward 4-quarter estimate rose this past week to $259.61 from last week’s $258.31, it’s first sequential increase of the quarter;

- As of last Friday’s close, the PE on the forward estimate was 21.7x versus the prior weeks 21.50x

- The S&P 500 earnings yield as of last Friday is now at 4.61%, versus 4.63% to start the quarter;

- The S&P 500 “EPS upside surprise” ended last week at 4.6%, well below the 8% levels of the last few quarters;

With Walmart’s (NYSE:WMT) earnings, the Q2 ’24 earnings season for the S&P 500 is unofficially over, but you can’t ignore Nvidia’s earnings Wednesday night, August 28th, and it’s importance for the top 10 S&P 500 names, all of the tech names tied to the AI cycle.

Conclusion

It’s not rocket science that if Nvidia doesn’t deliver a big beat and raise, it will likely impact the overall S&P 500 and certainly the Nasdaq Composite and the Nasdaq 100 negatively, as the S&P 500 nears it’s former all-time-high, and as we enter one of the worst months of the year – September – in terms of historical market returns.

After August 5th’s scare, we look to be right back to “overbought” on the market indices and the S&P 500’s 11 sectors.

But, lower interest rates and an easier Fed are typically positive for “expected, forward, stock price returns”.

I’d love to see a 1 to 2-week flush that puts the fear trade back on, and then we get the next FOMC meeting.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. All S&P 500 and Nvidia EPS and revenue data is sourced from LSEG. Investing can involve the loss of principal, even for short periods of time.

Thanks for reading!