- Leading indicators of liquidity growth and economic growth suggest both cycles should continue higher into the first half of 2025.

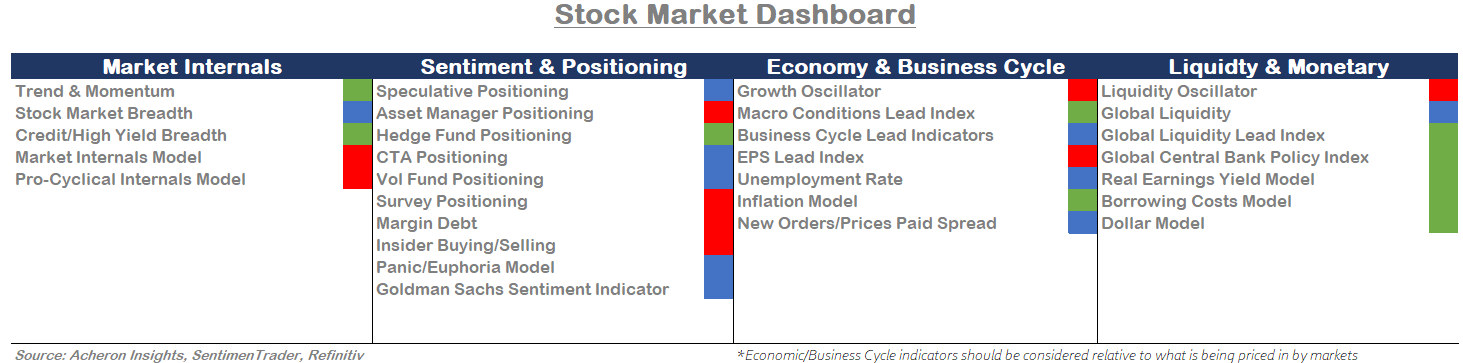

- In addition, sentiment and positioning toward risk assets appear relatively neutral on most measures and are far from levels that align with notable market tops.

- Unless lead indicators deteriorate markedly in the short term, dips in risk assets should continue to be bought as the market appears well-supported into the first quarter of 2025.

The Economy Is Supportive for Stocks

For a bear market in stocks to occur, we generally need to see at least one of the following: a sharp and unexpected slowdown in economic growth; a significant tightening of financial and monetary conditions; and/or an unexpected decline in corporate earnings growth.

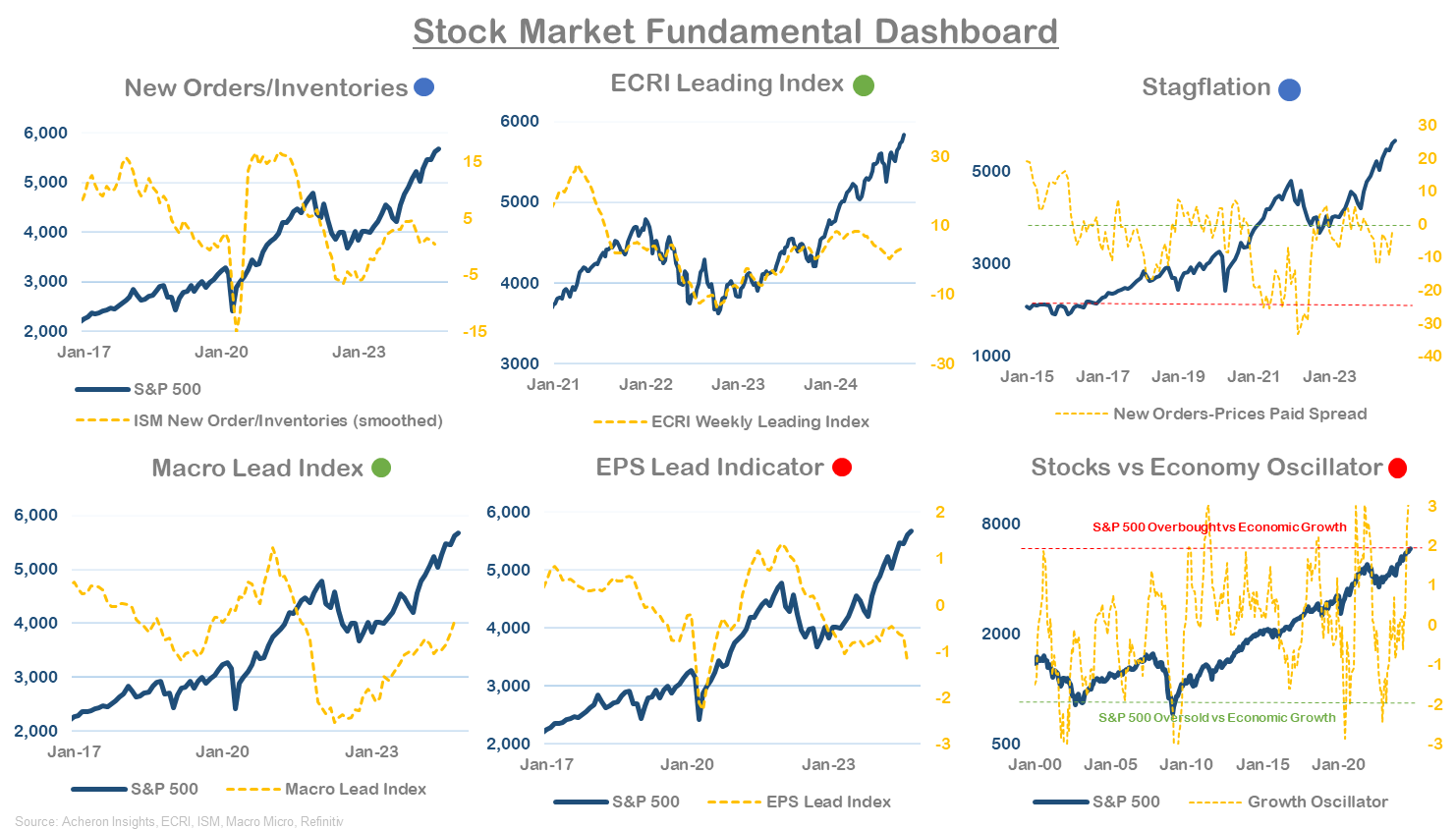

As we shall see, the outlook for the business cycle and liquidity cycle appears robust over the short to medium term, but the outlook for corporate earnings looks less robust over the medium term.

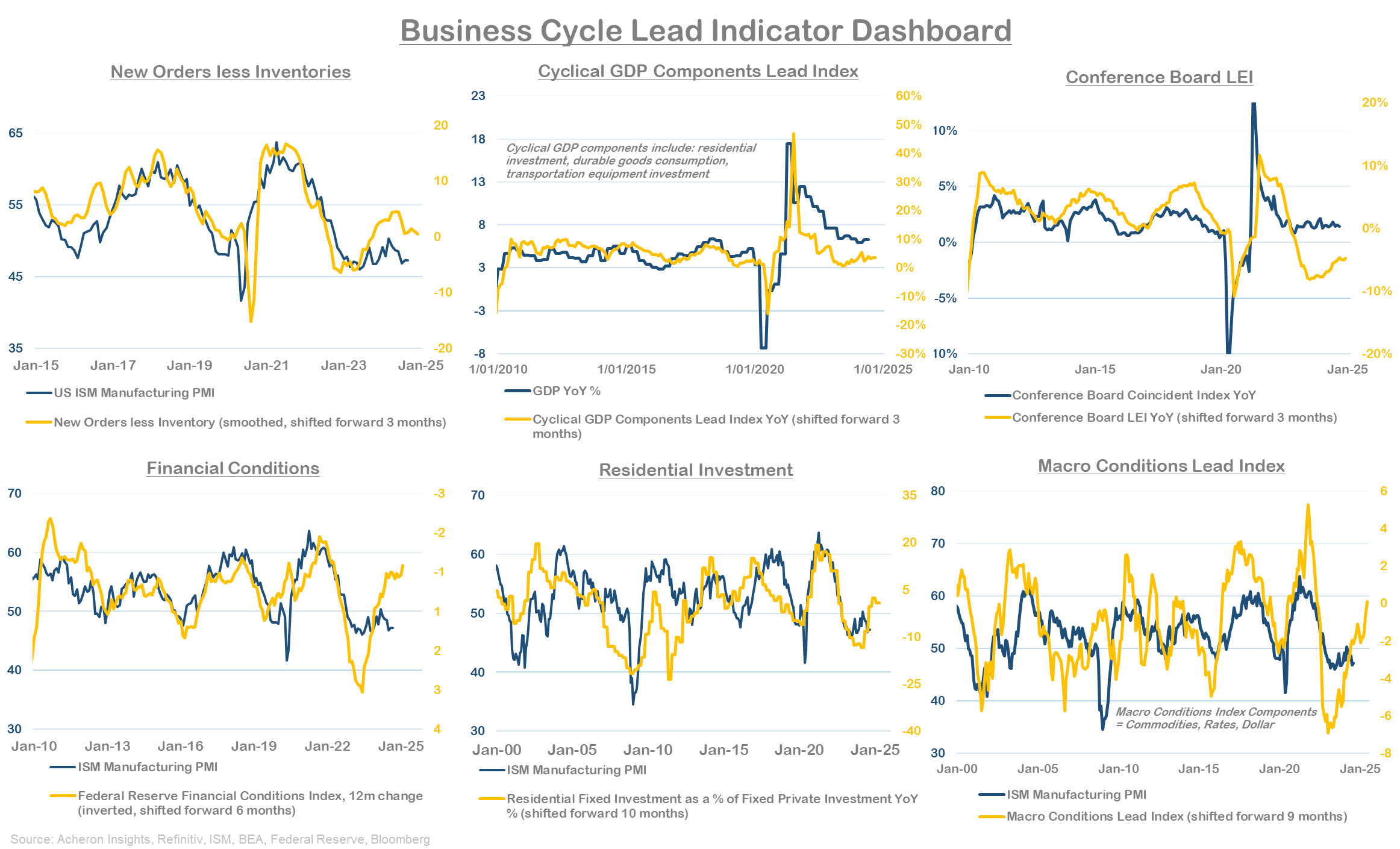

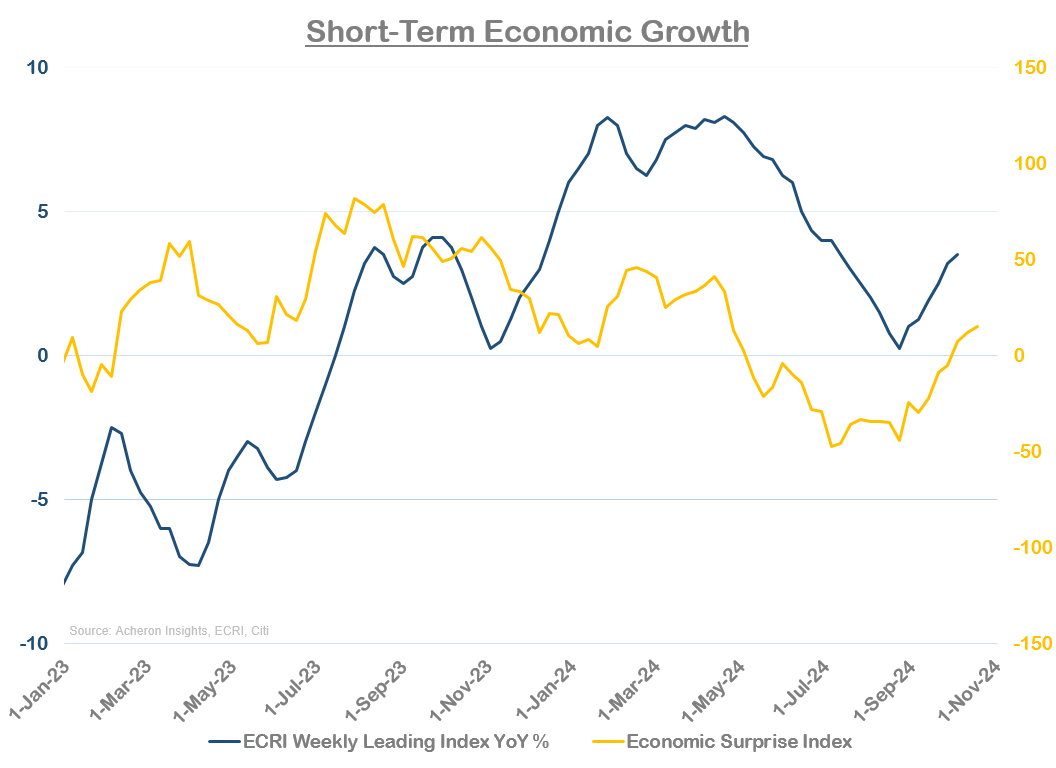

Beginning with the economy, as it stands the leading indicators of the business cycle continue to suggest a significant slowdown in economic activity is unlikely over the medium-term.

What’s more, economic expectations became relatively depressed through Q2 and Q3 of this year as we did see economic growth disappoint. This left the market in a situation where if we were not going to see recession (as the lead indicators suggested we weren’t), then upside surprises in growth were likely forthcoming. This is exactly what we have seen in recent weeks and should be expected to continue into 2025.

While it is true lead indicators are not universally pointing higher, none are suggesting any sign of an imminent recession or major slowdown. Overall, this is a supportive economic backdrop for equities over the medium term.

Once economic growth does start to slow and lead indicators turn lower, stocks should be concerned from a growth perspective. But that is likely a story for some time later in 2025.

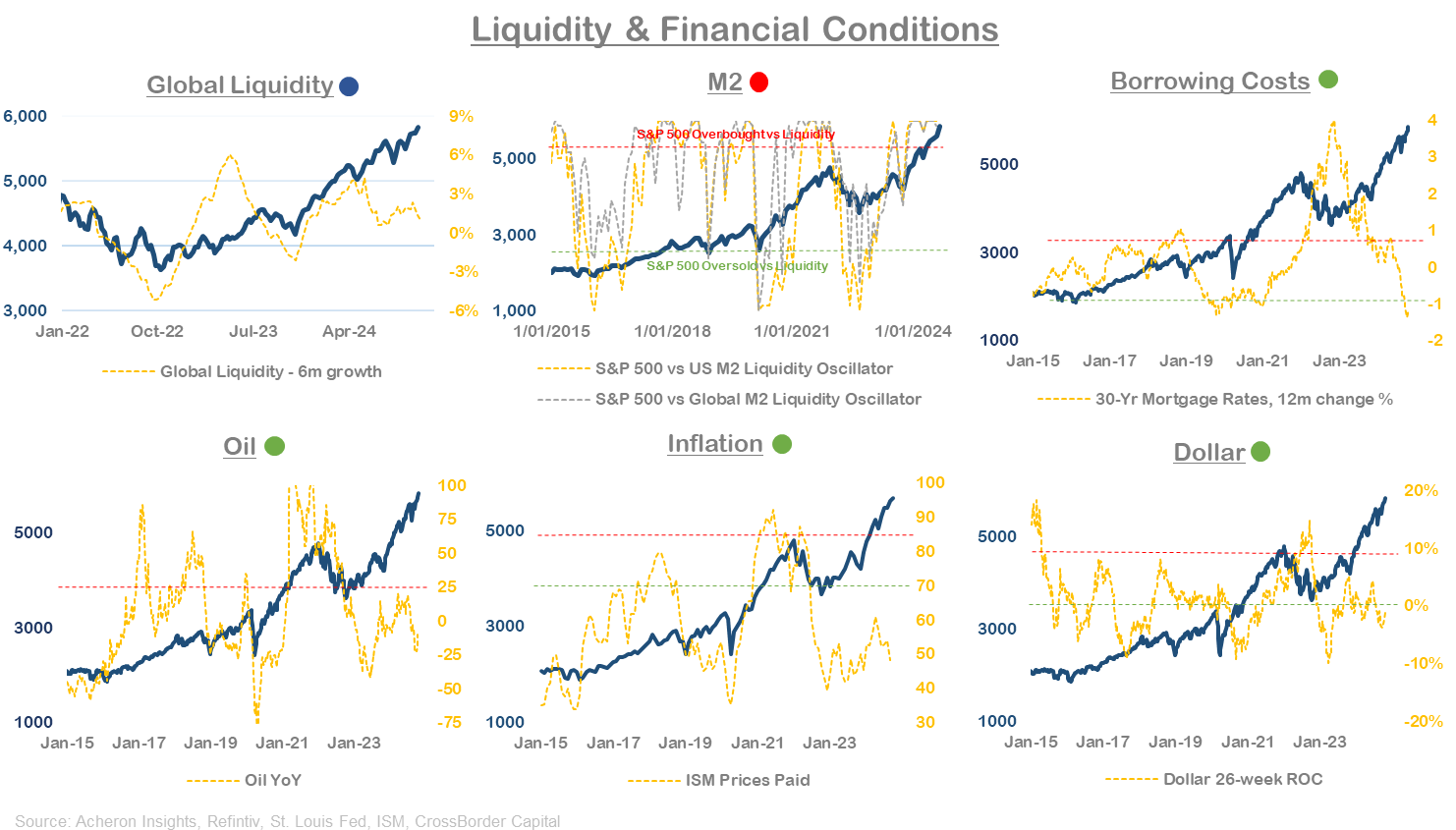

Monetary and Liquidity Conditions Are Easing

On the liquidity, financial, and monetary conditions front, the outlook remains just as robust. As I discussed in detail recently, the Fed has signaled its intention to ease monetary policy despite above-average inflation and little supportive economic data to do so. Easing financial conditions into a robust economy is a recipe for an extension of the business cycle and is a supportive backdrop for risk assets.

While liquidity might be challenged in the short-term due to the recent rise in yields and bond market volatility, medium-term leading indicators of liquidity such as the US dollar, currency volatility, asset prices, inflation and economic growth are all supportive of continued liquidity growth over the coming three to six months.

Warning Signs Are Emerging From the Earnings Front

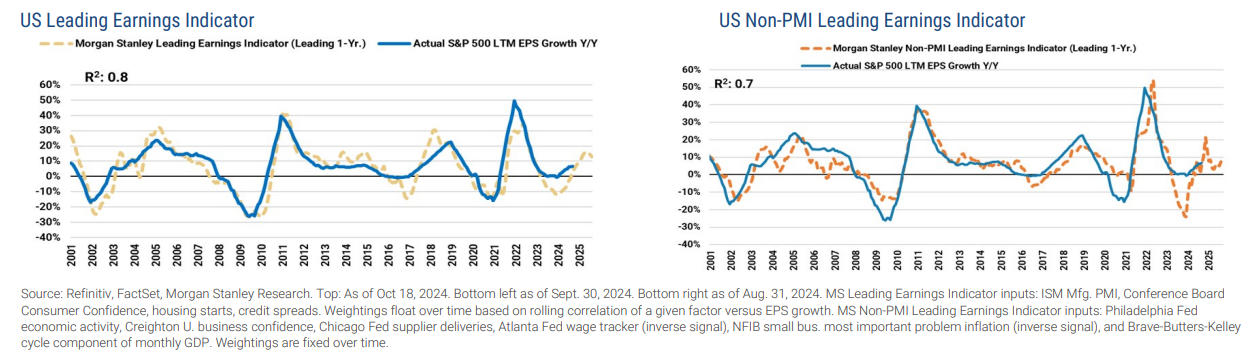

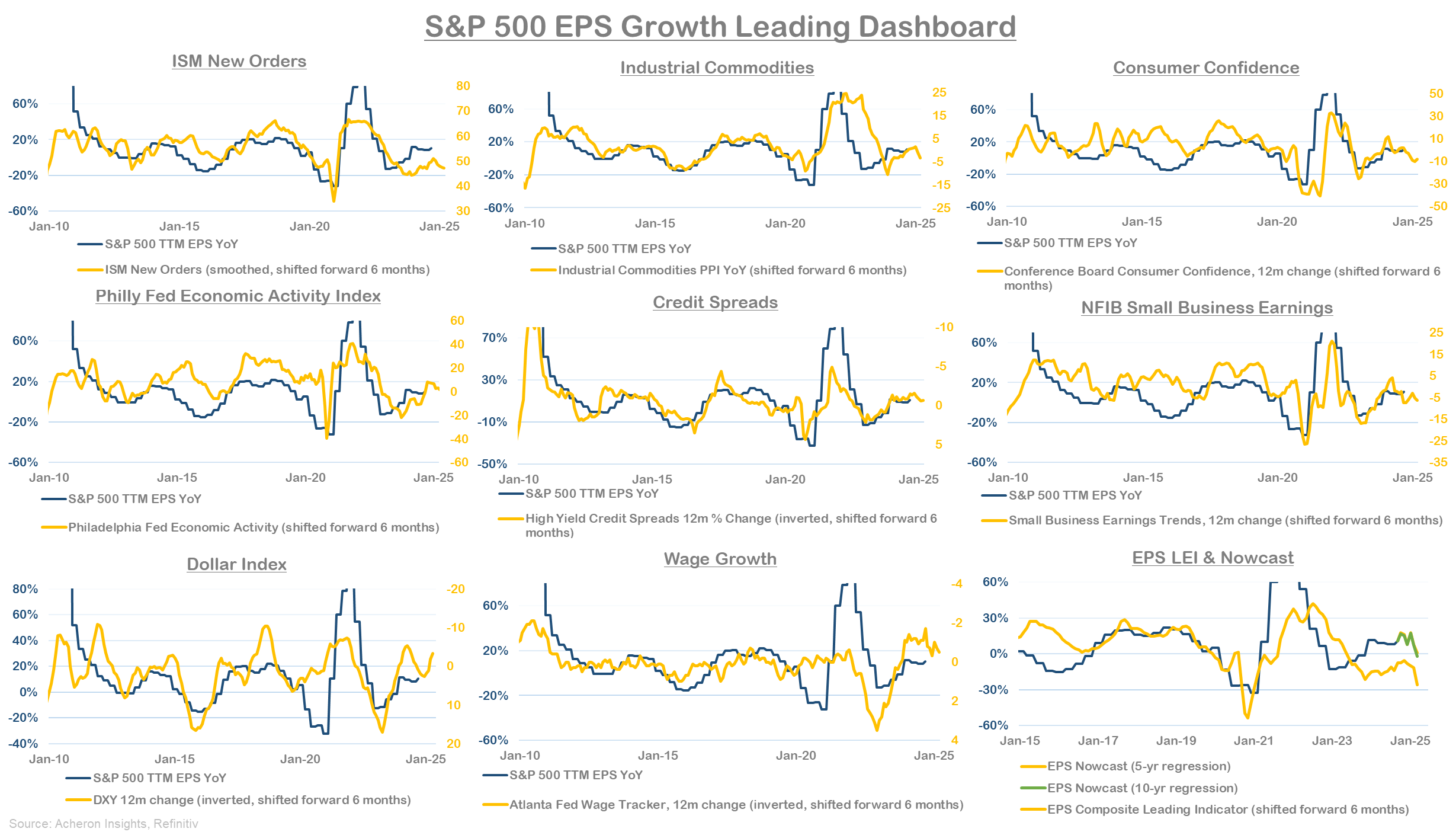

Where we are starting to see warning signs emerge however is on the earnings front. EPS growth lead indicators remain relatively positive over the short-term, but as we can see below, lead indicators are starting to roll over. This suggests earnings growth is likely in the process of peaking.

We can see this outlook confirmed via a number of individual lead indicators of corporate earnings, nearly all of which are starting to trend lower as we can see below.

This dynamic likely matters little over the short term, but lower-than-expected earnings growth appears to be a bearish dynamic the market will need to deal with as we progress through 2025.

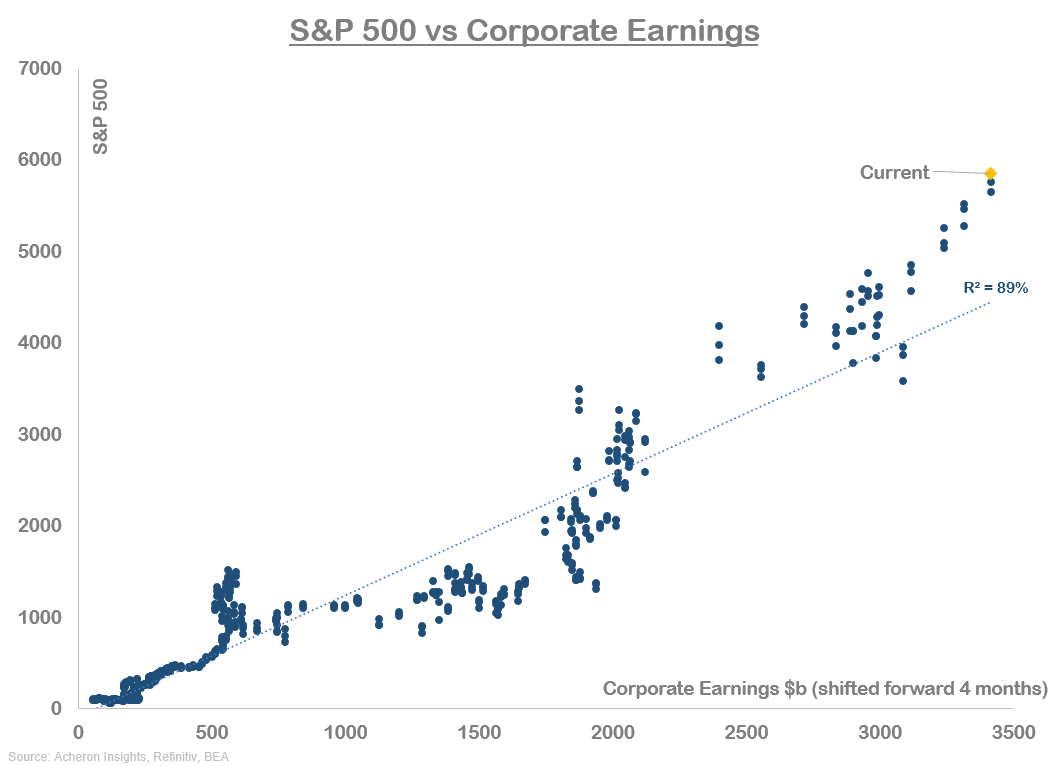

Importantly, when we compare the outlook for earnings growth to how extended the S&P 500 has become relative to underlying corporate earnings, the market could be vulnerable to a mean-reversion in this trend.

Sentiment and Positioning Remain Supportive of Markets

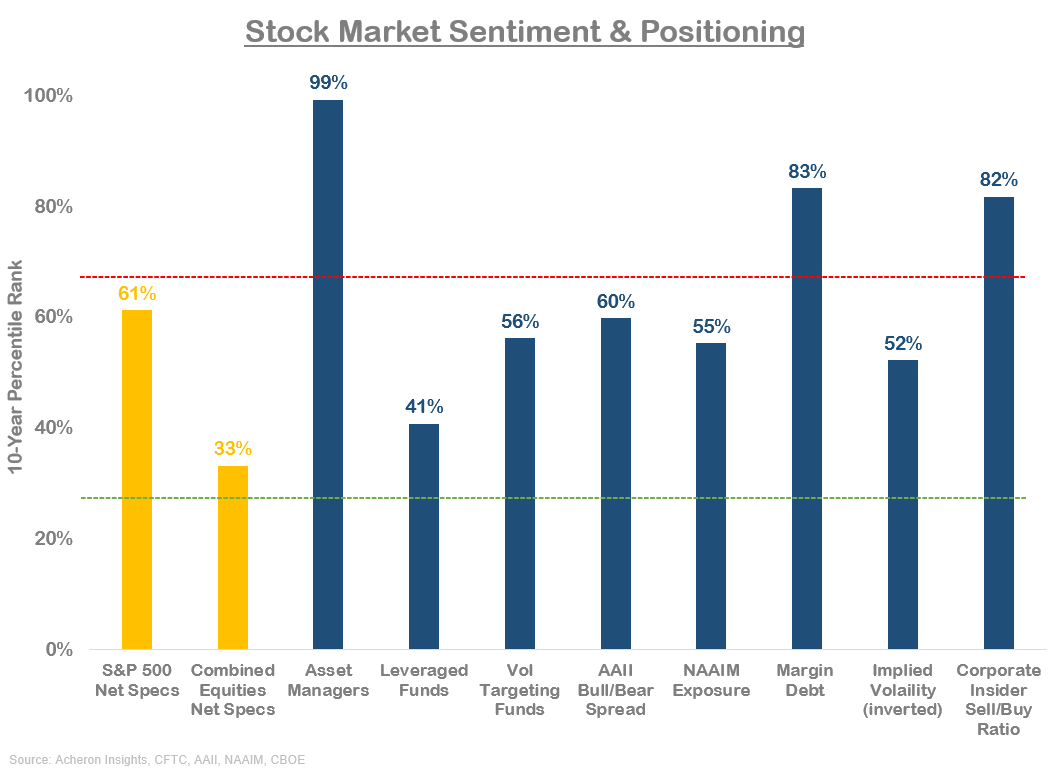

But again, these earnings headwinds are unlikely to matter for the market until later in 2025, especially when we consider sentiment and positioning towards the stock market is still in a relatively neutral position overall.

Some measures are reaching extremes, such as Asset Manager positioning, margin debt growth and the corporate insider sell/buy ratio, but most measures are only at average levels. Most importantly perhaps is the overall speculative positioning in equities (which includes the S&P 500, Nasdaq, Russell 2000, Emerging Markets, Nikkei and EAFE), and is only at the 33rd percentile for the past decade.

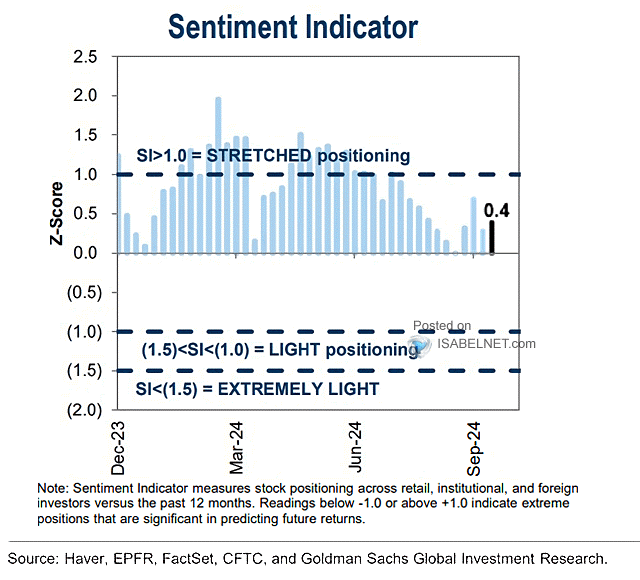

Current positioning dynamics are not what you generally exhibit at notable market tops. A number of other longer-term sentiment measures are confirming this notion, such as the Goldman Sachs Sentiment Indicator.

Investors Should Continue to Buy the Dip

For now, given the robust outlook over the medium-term for economic growth, liquidity and monetary conditions in addition to relatively neutral market positioning, investors should continue to buy and dip in equities with a view to further upside into the first half of 2025.

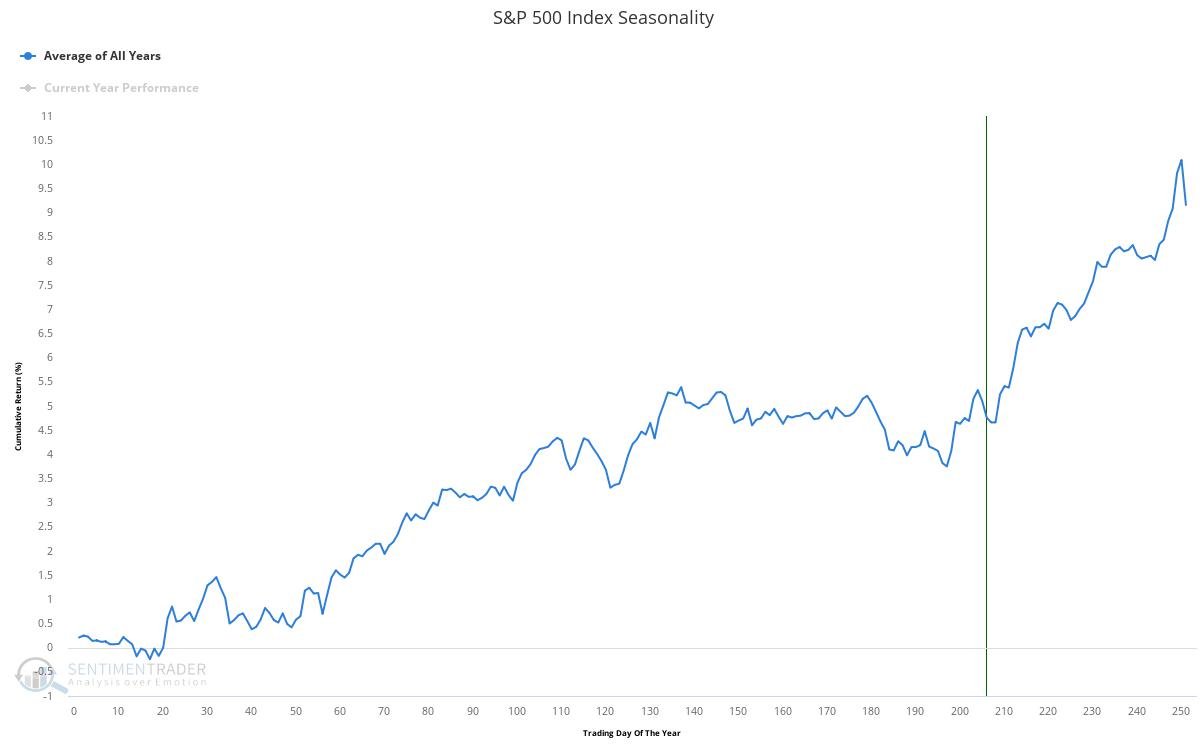

After all, we must remember the structural factors that support markets in the final months of the year, particularly during years that have already seen notable gains. In addition, the event-vol surrounding the election should be very supportive of markets when it is unwound if we don’t see a significant sell-off imminently.

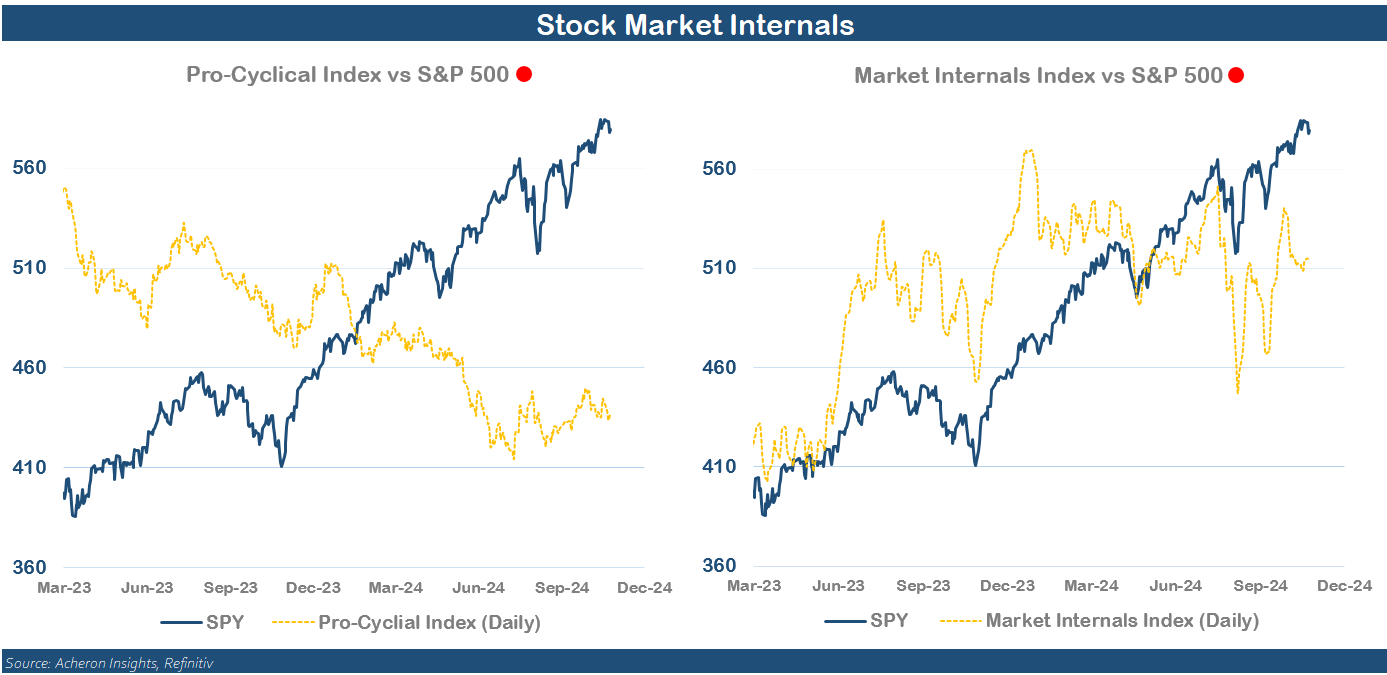

Having said that, there are a couple of signs markets could be in some short-term weakness, which could present a buyable dip. Firstly, market internals have weakened markedly in recent weeks, with both my Pro-Cyclical Index and Market Internals Index having diverged lower.

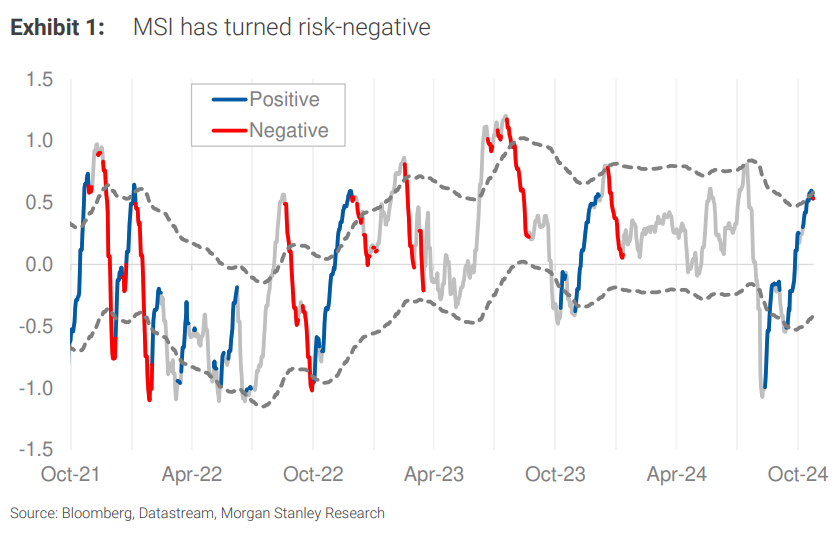

In addition, a short-term sentiment measure that has just turned bearish is Morgan Stanley’s Market Sentiment Index, which suggests we may see further short-term volatility in the market.

Again, should these indicators prove true and we see a dip in the short-term, it should provide a buying opportunity into what remains a relatively well-supported stock market over the medium term. Yes, there may be headwinds for the market arriving later in 2025, but we are not there yet.