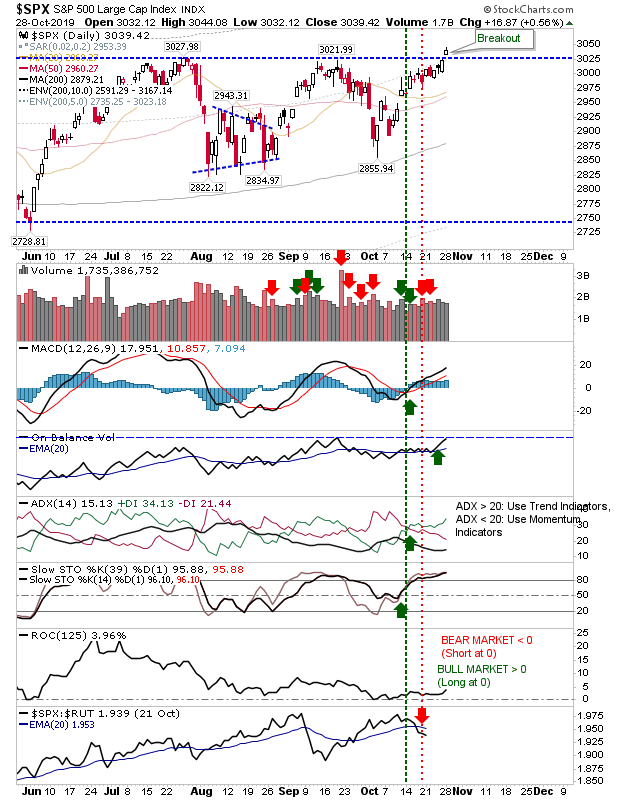

It didn't take long yesterday for the S&P 500 to follow the lead of the Semiconductor Index with a breakout of its own. The move was not substantial, barely registering above a 0.5% gain, but it did clear 3,025 resistance, which is now new breakout support.

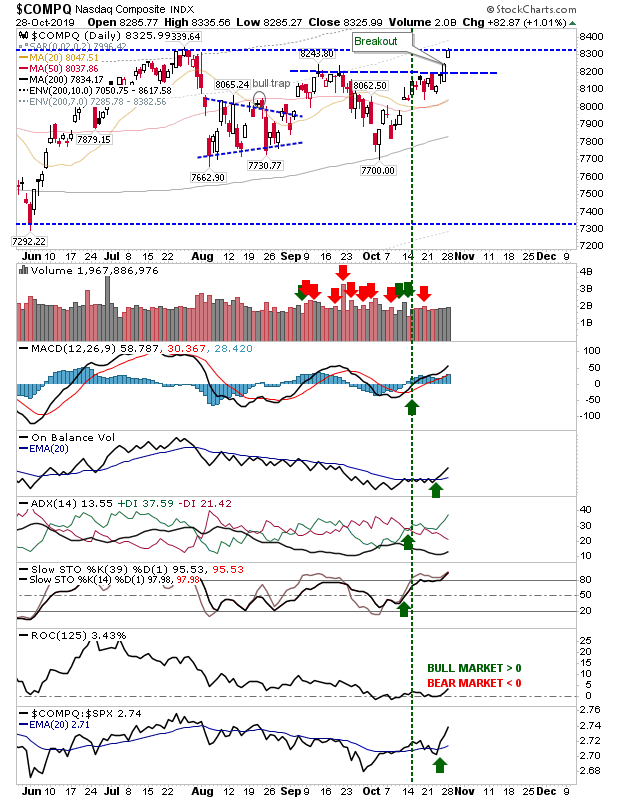

The NASDAQ posted a minor follow-through as it finished just shy of a new all-time high. There was continued improvement in the technical picture with a sharp improvement in relative performance against the S&P.

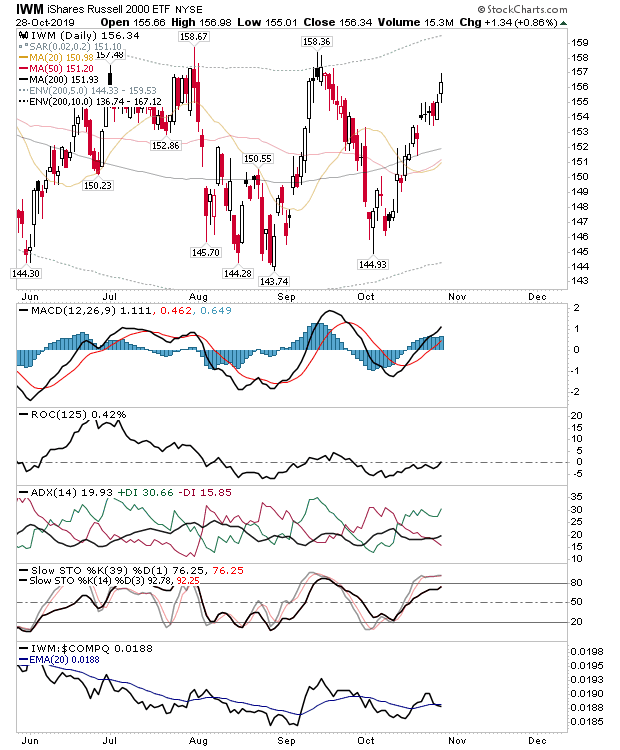

Data is missing for the Russell 2000 on Stockcharts, but the iShares Russell 2000 ETF (NYSE:IWM) showed a continued advance towards prior swing highs, but still has some way to go.

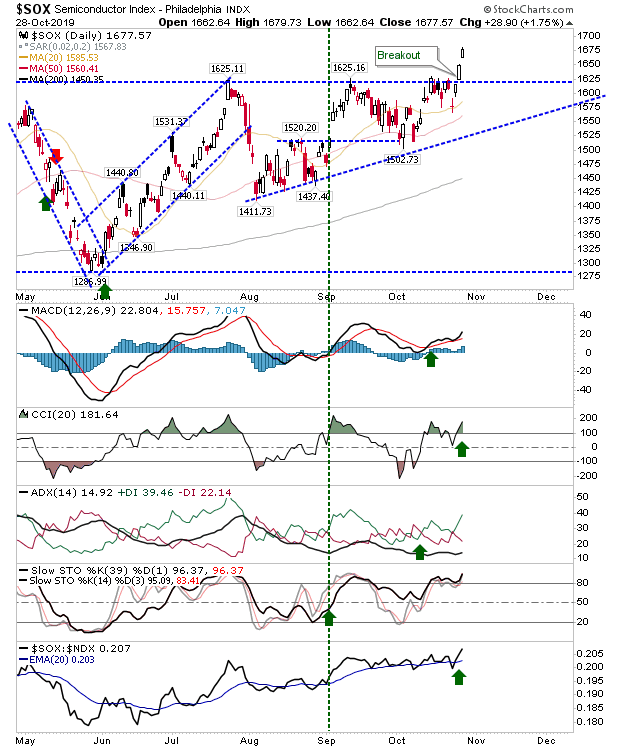

The Semiconductor Index was not one to be left out. It added another 1.75% to its breakout. It now has a decent buffer back to breakout support.

For today, it will be for indices to continue to push higher and for the NASDAQ to follow the nascent breakouts in the Semiconductor Index and S&P. Stock breakouts should strengthen after this.