Sector Performance Appears To Be Shifting

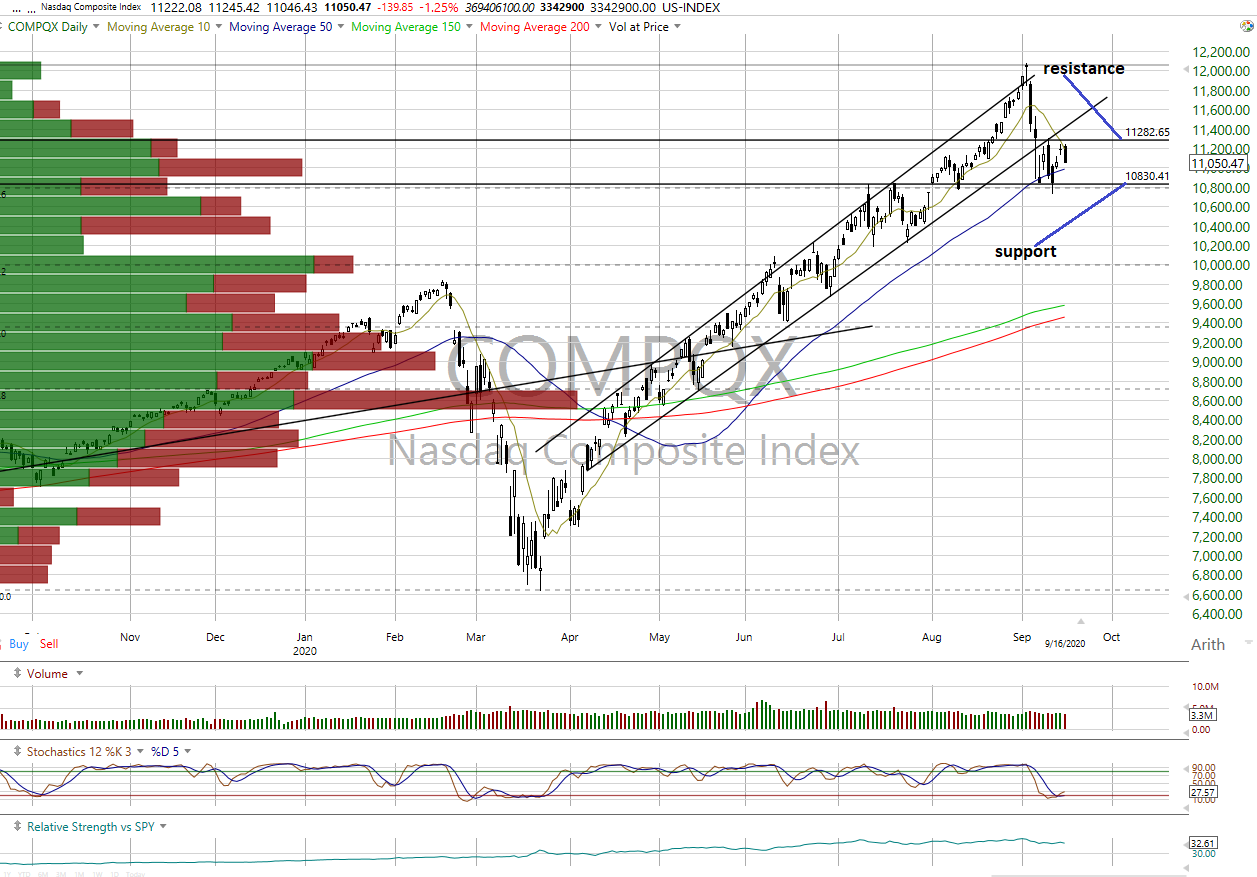

The major equity indexes closed mixed Thursday with positive internals on the NYSE and NASDAQ as trading volumes rose on the NYSE and declined on the NASDAQ from the prior session. The weakness appeared to be coming largely from the technology sector that had been leading the market’s rally from the March lows.

In our opinion, yesterday’s action is suggestive of a potential shift in market leadership that is supported by the positive breadth yesterday as the large cap indexes declined. However, no changes were registered in the near-term index trends while valuation and advisor sentiment remain cautionary.

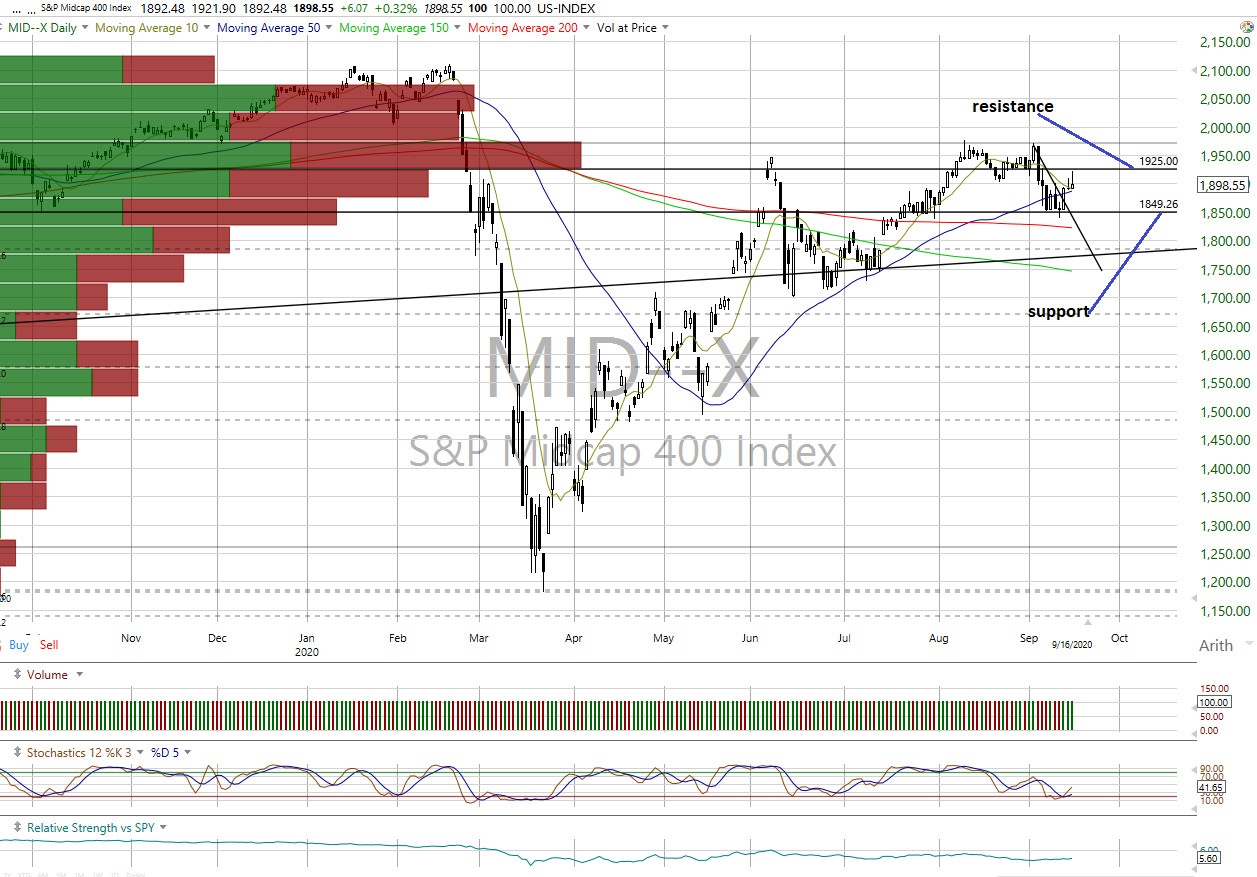

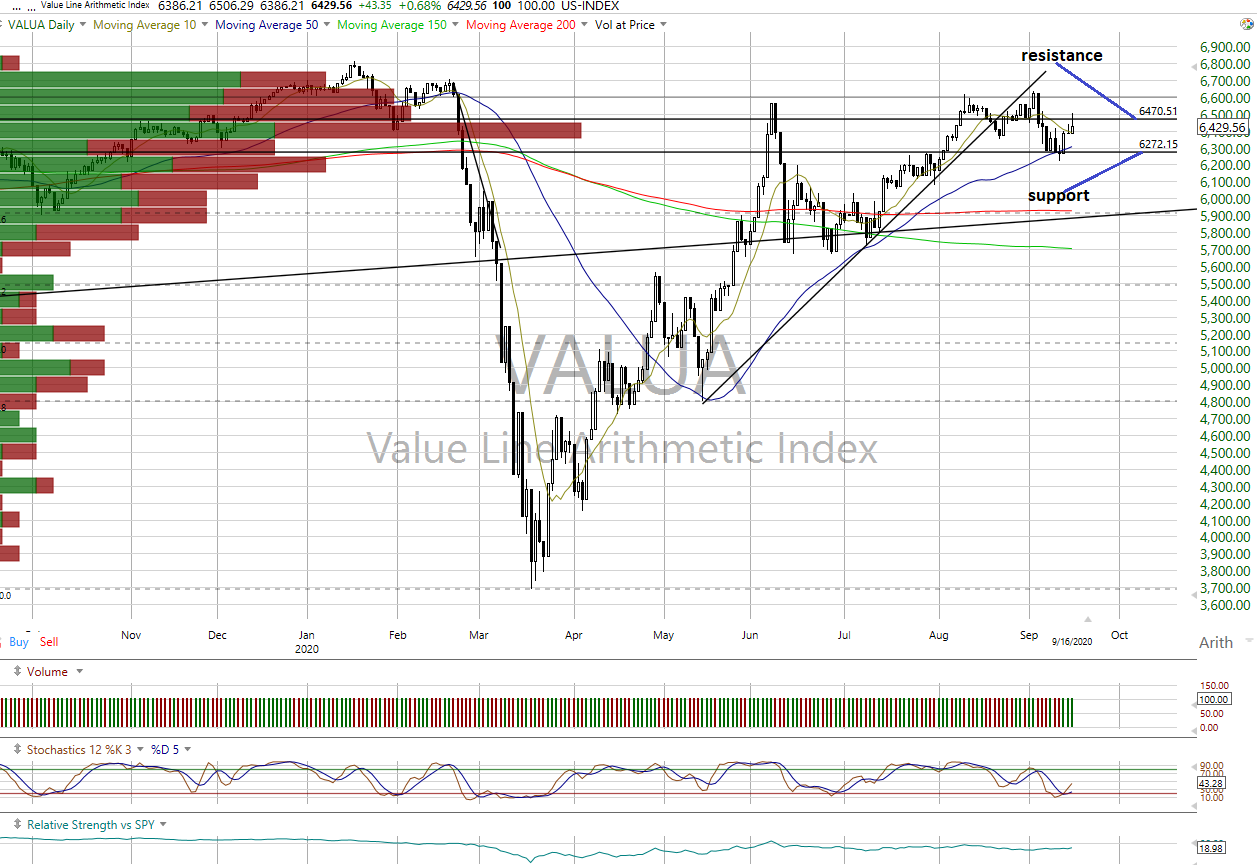

So, while we are keeping our near-term outlook at “negative”, we now suspect some sectors will emerge as new leaders while their smaller market capitalization may have less impact on the index charts.

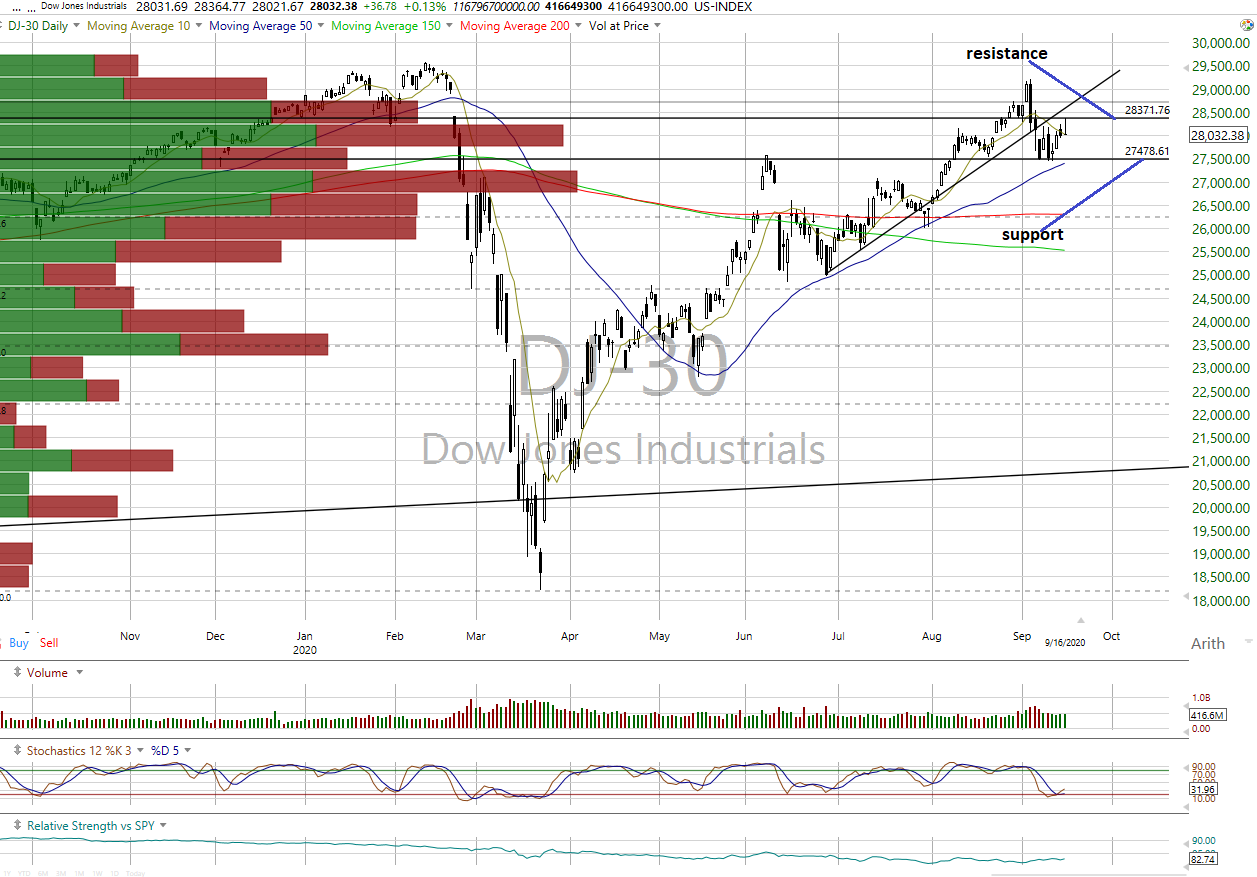

On the charts, the indexes closed mixed yesterday with the S&P 500, COMPQX and NDX posting losses as late day selling pressure took control. The rest posted gains with no technical events of import being generated other than the DJT closing above resistance.

- What we find interesting is yesterday’s action was the opposite of what had been happening as the indexes were rising while breadth was deteriorating.

- In our view, yesterday suggests we may be seeing a shift in leadership away from the large cap techs that have held sway since the March lows.

- All the index near-term trends remain neutral except for the DJT staying positive.

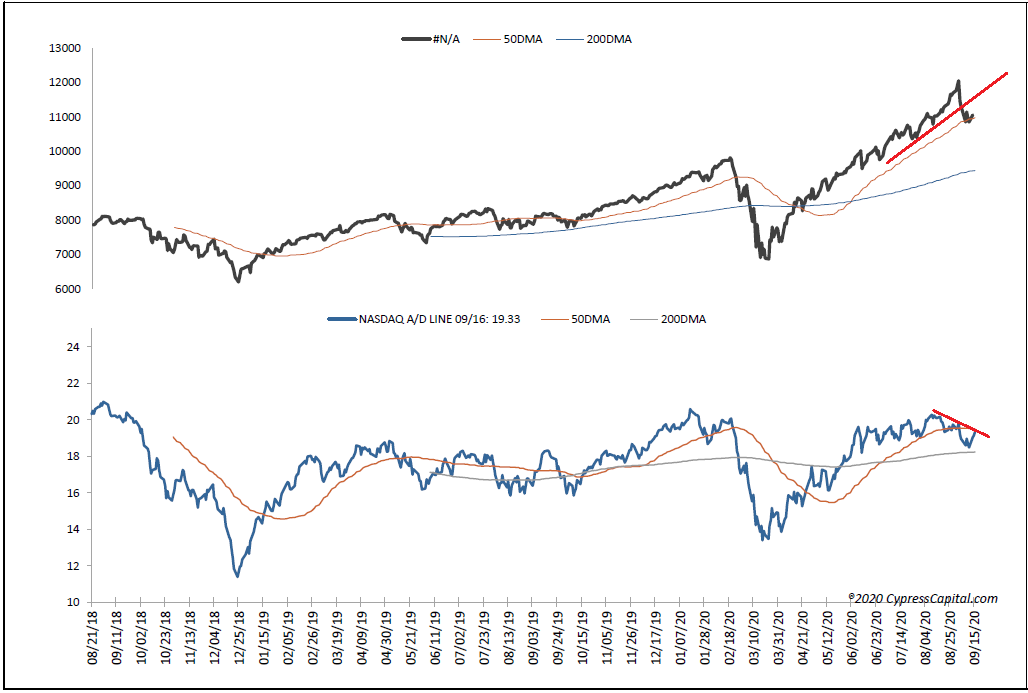

- Meanwhile cumulative breadth improved with the All Exchange, NYSE and NASDAQ cumulative advance/decline lines turning positive with only the NASDAQ’s below its 50 DMA.

The data remains mixed.

- The 1-day McClellan OB/OS Oscillators are neutral (All Exchange: +11.34 NYSE: +6.46 NASDAQ: +15.27).

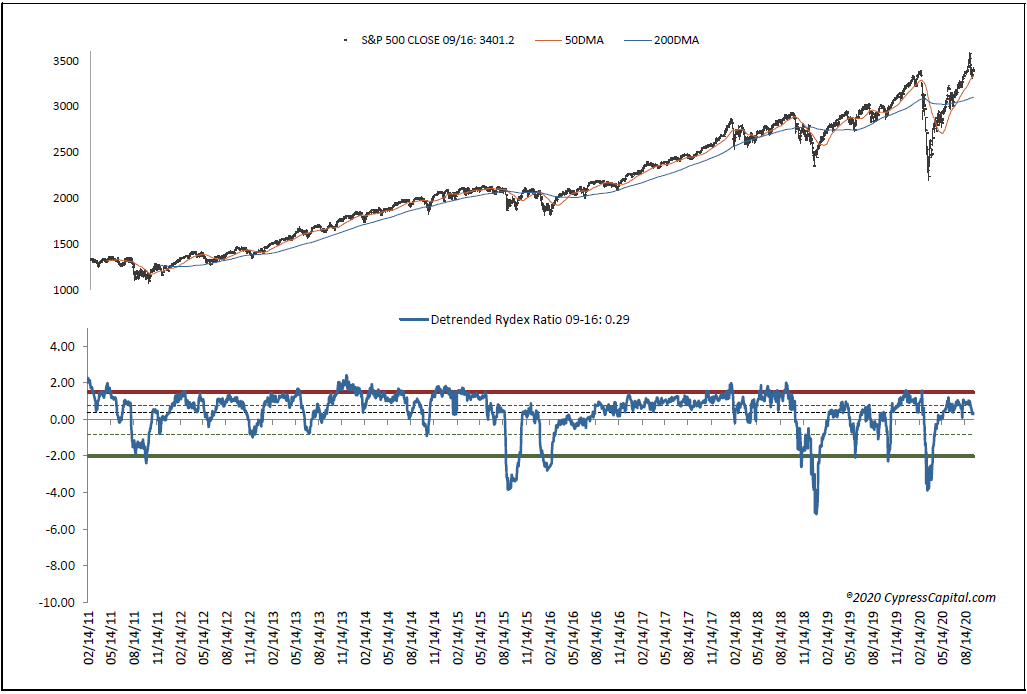

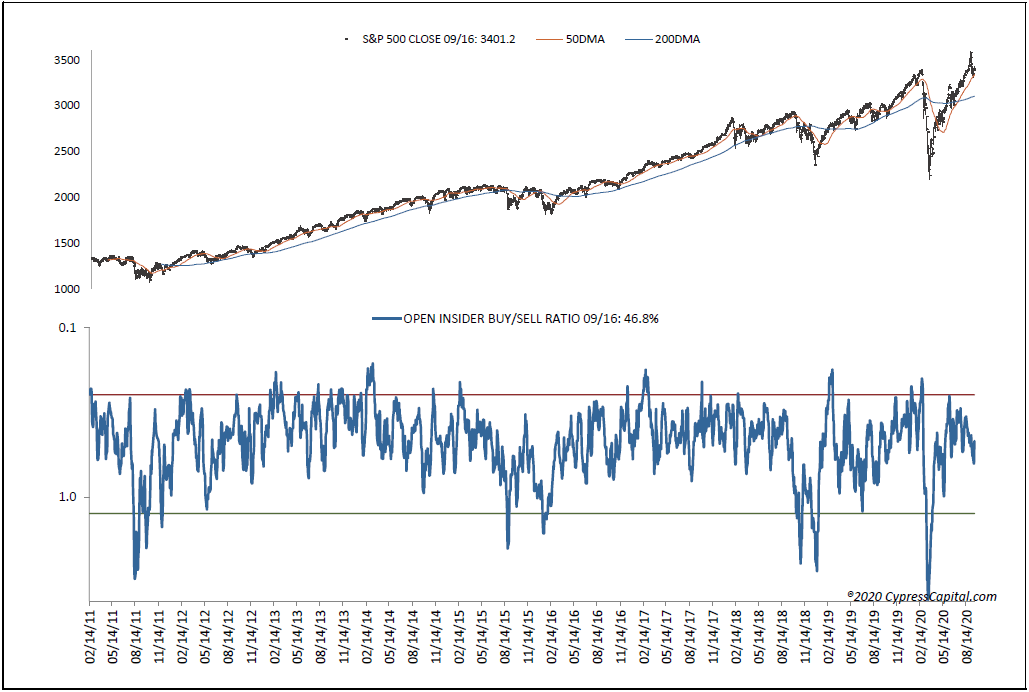

- The Open Insider Buy/Sell Ratio (page 9) is also neutral but dipped again to 46.8 while the detrended Rydex Ratio (contrary indicator page 8) remains neutral at 0.29 with the leveraged ETF traders slightly decreasing their leveraged long exposure.

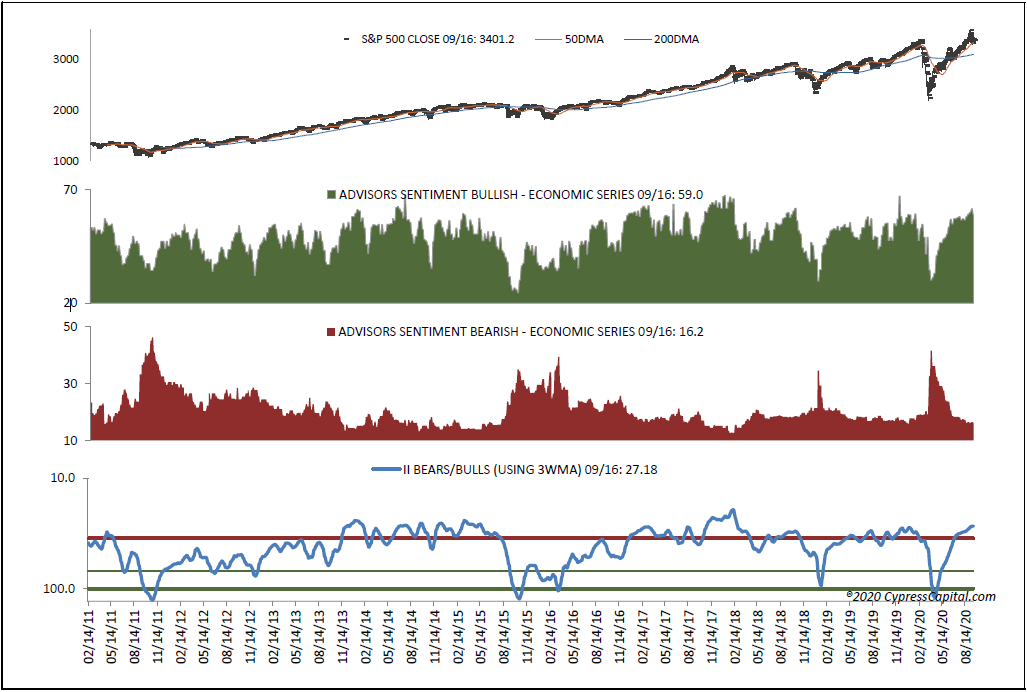

- This week’s Investors Intelligence Bear/Bull Ratio (contrary indicator page 9) remains bearish at 16.2/59.0 after hitting a 2-year high last week at 61. We reiterate the lopsided bullish sentiment on the part of investment advisors implies a potential shift in their outlooks that could be meaningful for the markets should such a move be generated.

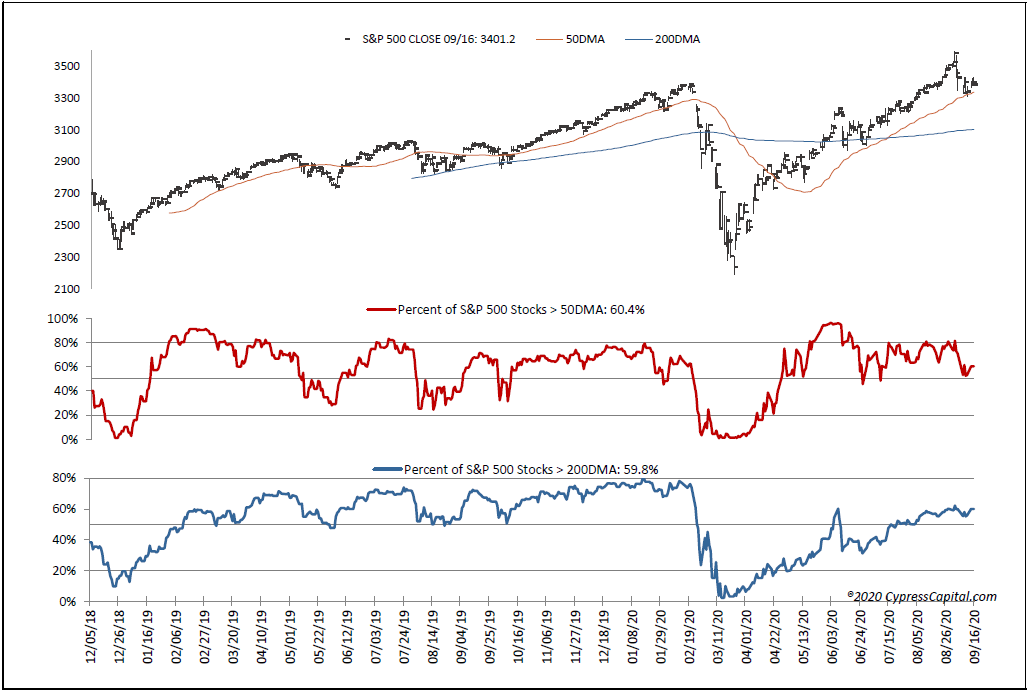

- The counterintuitive % of SPX issues trading above their 50 DMAs is neutral at 60.4%.

- The valuation gap remains extended with the SPX forward multiple of 23.2 via consensus forward 12-month earnings estimates from Bloomberg of $146.18 while the “rule of 20” finds fair value at 19.3.

- The SPX forward earnings yield is 4.32% with the 10-year Treasury yield at 0.69%.

In conclusion, while we are maintaining our near-term “negative “outlook foe the equity markets due to psychology and valuation, we now suspect the source of weakness may possibly come largely from the prior market leaders that appear extended while other sectors may come to the fore.

SPX: 3,328/3,448 DJI: 27,479/28,371 COMPQX: 10,830/11,519

NDX: 11,057/11,763 DJT: 11,114/11,526 MID: 1,849/1,925

RTY: 1,500/1,595 VALUA: 6,272/6,470

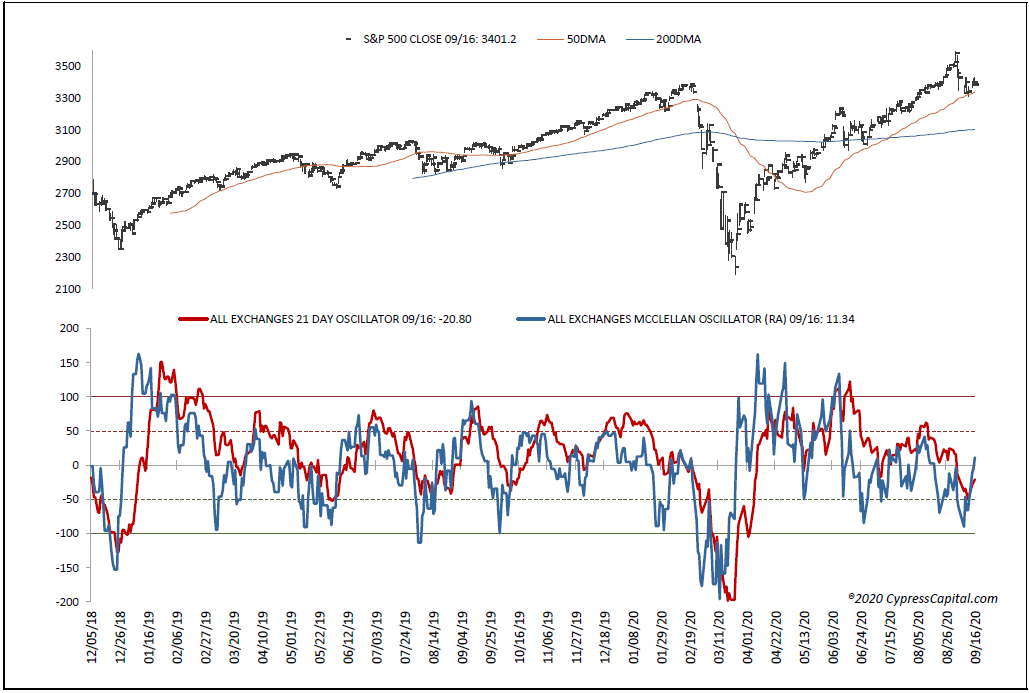

The All Exchange McClellan ratio adjusted 1-day OB/OS Oscillator is +11.34 (neutral) and 21 day -20.8 (neutral).

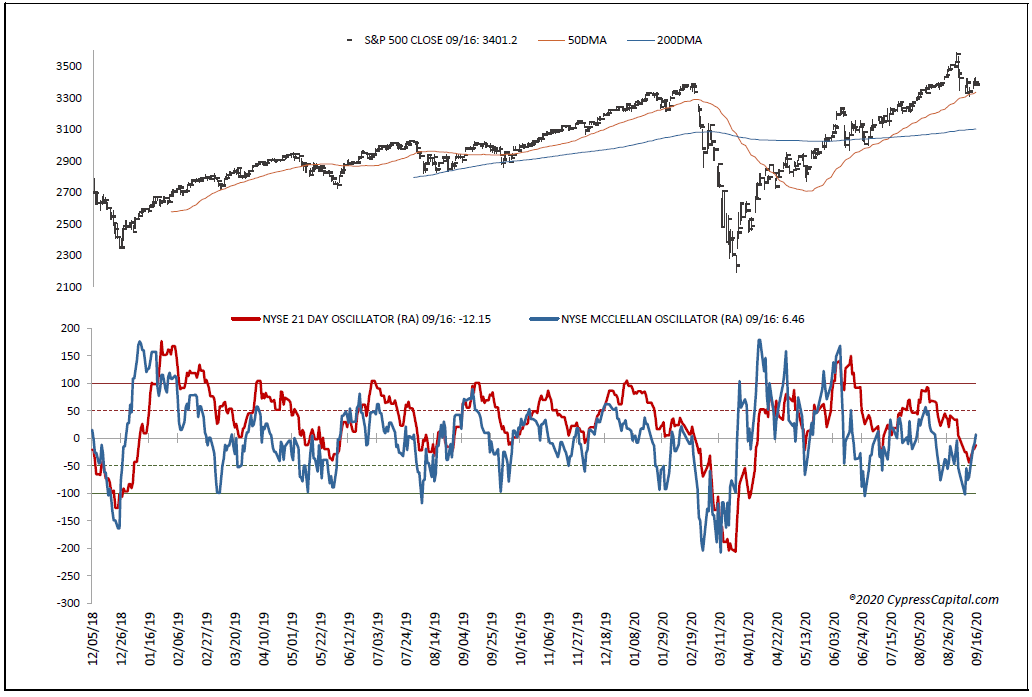

The NYSE ratio adjusted 1-day McClellan OB/OS is +6.46 (neutral) and -12.15 (neutral) on the 21 day.

The NASDAQ cumulative advance/decline line is positive and below its 50 DMA

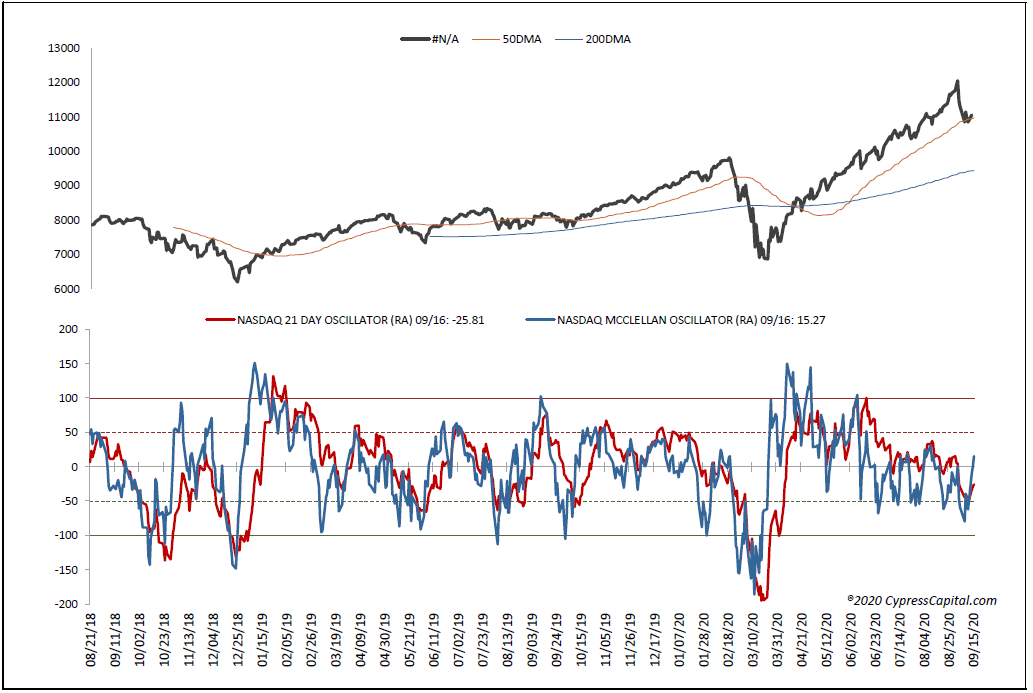

The NASDAQ ratio adjusted 1-day McClellan OB/OS Oscillator is +15.27 (neutral) and -25.81 (neutral) on the 21-day.

The detrended Rydex Ratio is 0.29 (neutral)

The Investors Intelligence Bear/Bull Ratio is 16.2/59.0 (bearish) as of 9.16.20

The Total and Equity put/call ratios are 0.81 (bearish) and 0.51 (bearish) on the 1day. The 15 DMAs are 0.8 (bearish) and 0.5 (bearish) respectfully. The OEX put/call Ratio is 1-day is 1.52 (very bearish) and 2.69 (very bearish) on the 15 DMA.

% of SPC stocks trading above their 50 DMAs is 60.4 (neutral)

The Open Insider buy/sell ratio is 46.8 (neutral)

Data:

• The All Exchange McClellan OB/OS ratio adjusted is +11.34 (neutral) 3-week average is -20.8 (neutral).

• The All Exchange A/D line is positive and above its 50 DMA.

• NYSE McClellan OB/OS ratio adjusted is +6.46 (neutral) 3-week average is -12.15 (neutral).

• The NYSE A/D line closed above its 50 DMA and is short term positive.

• NASDAQ McClellan OB/OS ratio adjusted is +15.27 (neutral) 3-week average is -25.81 (neutral).

• The NASDAQ A/D line is short term positive and below its 50 DMA.

• % of SPX stocks > 50 DMA is 60.4% (neutral).

• AAII bear/bull ratio is 43.28/28.86 (neutral) as of 9/14.

• Investors Intelligence Bear/Bull Ratio 16.2/59.0 (bearish) as of 9/14.

• The detrended Rydex Ratio is +0.37 (neutral).

• Open Insider Buy/Sell Ratio is 54.5 (neutral).

• Total and Equity put/call ratio 1-day readings are 0.81 (bearish) and 0.51 (bearish) respectively. The 15-day averages for the total and equity p/c are 0.8 (bearish) and .5 (bearish) respectively.

• OEX put/call one day is 1.52 (very bearish) the 15 DMA 2.69 (very bearish).

• ISEE call/put Sentiment Index is 119 (neutral).

• The SPX, DJI, DJT COMPQX, NDX, MID, VALUA and RTY closed above their 50 DMAs.

• The DAX and NIKKEI close above their 50 DMAs.

• The Hang Seng and FTSE closed below their 50 DMAs

• The U.S. dollar as measured by the UUP ETF closed higher at 25.17. Support is 24.90. Resistance is 25.27.

Commodities in up trends:

Gold (closed below its 50 DMA)

Silver (closed above its 50 DMA)

CRB Spot Raw Industrials (closed above its 50 DMA)

Copper (closed above its 50 DMA)22222222

Stainless Steel (closed above its 50 DMA

Aluminum (closed above its 50 DMA)

Commodities in down trends:

Oil (closed below its 50 DMA)

Commodities trading sideways:

Baltic Dry Bulk Rate (closed above its 50 DMA)

Market Internals:

The major equity indexes closed mixed Wednesday.

Internals were positive on the NYSE and NASDAQ.

Volumes were above prior day’s levels on the NYSE and below on the NASDAQ.

NYSE: A/D:1852/1152 U/D Volume:3.4B/1.26B Total Volume:4.74B

NASDAQ: A/D:2020/1383 U/D Volume:2.33B/1.41B Total Volume:3.8B