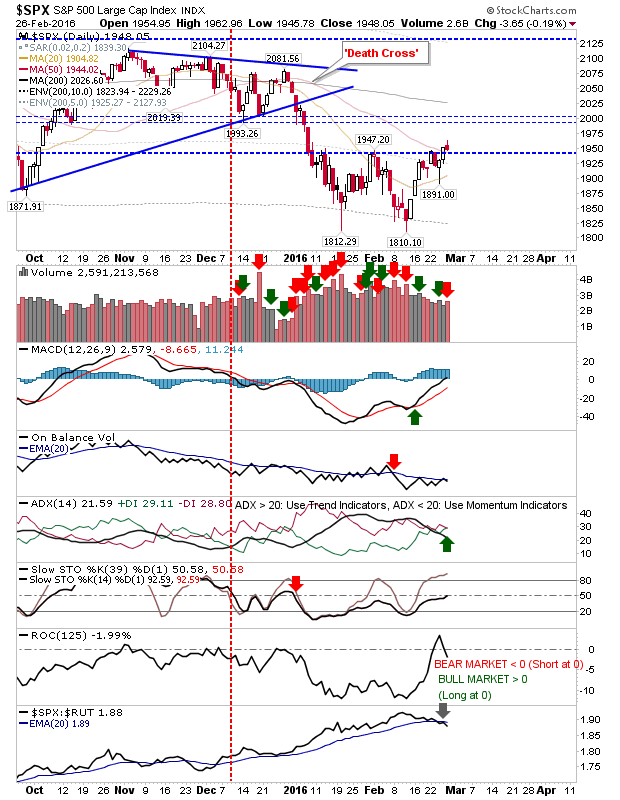

The run of 'gain some, give back a little' continued Friday with small losses after a solid Thursday.

The S&P remained above its 50-day MA as relative performance shifted towards Small Caps, and Rate of Change moved sharply lower. Volume rose to register a distribution day. Bulls will be looking to the 1,891 spike low to hold as a swing low; if not, then 1,810 is back in play.

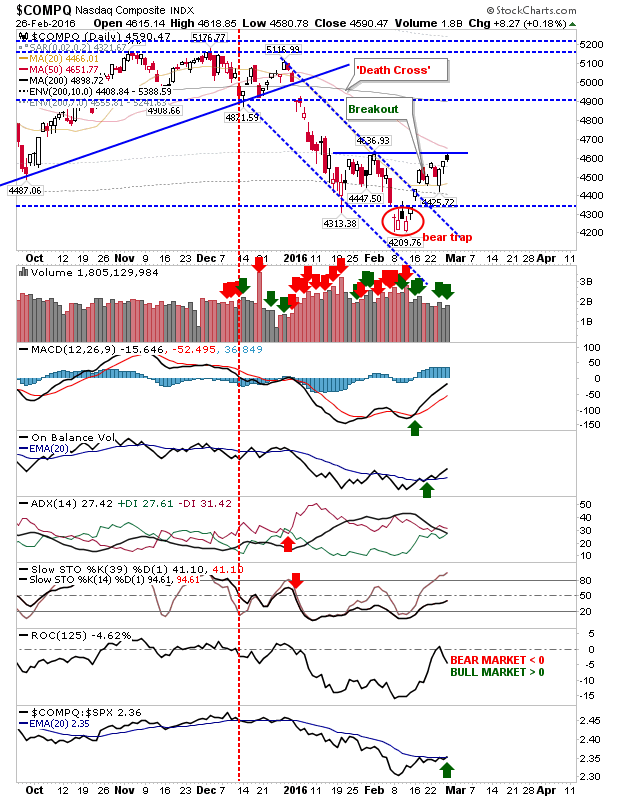

The NASDAQ finished with a bearish black candlestick just below resistance. Because it managed a higher close it registered an accumulation day. As with the S&P, this lead to a sharp reversal in Rate of Change, but did enjoy a relative performance gain against the S&P.

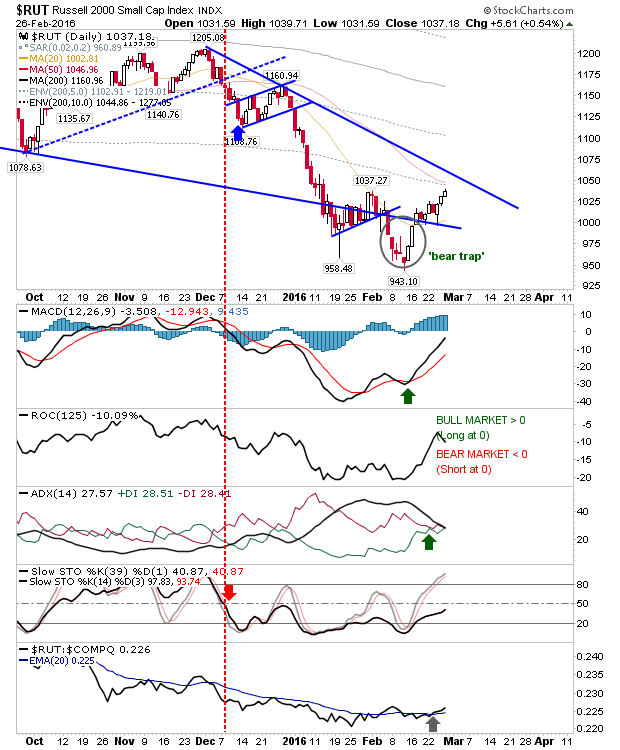

Small Caps managed to post a small gain, but the index hasn't yet tagged the 50-day MA. Not surprisingly, the index enjoyed a relative advance against the NASDAQ (which is outperforming the S&P). The long term health of this bull market will be driven by Small Cap stocks and action in this index since the February low has been very good. There is little to suggest this form can't continue.

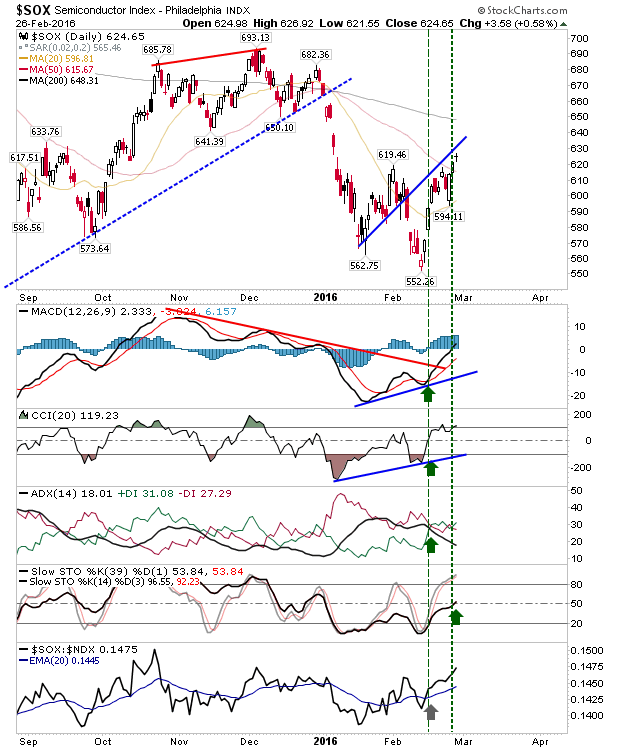

Another index to watch is the Semiconductor Index. It finished with a doji at former support turned resistance, but did manage a net bullish finish in technical strength. The easier path may be lower, but a break above rising resistance will bring the 200-day MA into play.

Friday's candles suggest today, Monday, will be a down day (except for the Russell 2000), opening up for a challenge of the swing low last week. What happens after than will be very important. Further loses would open up 2016 swing lows.