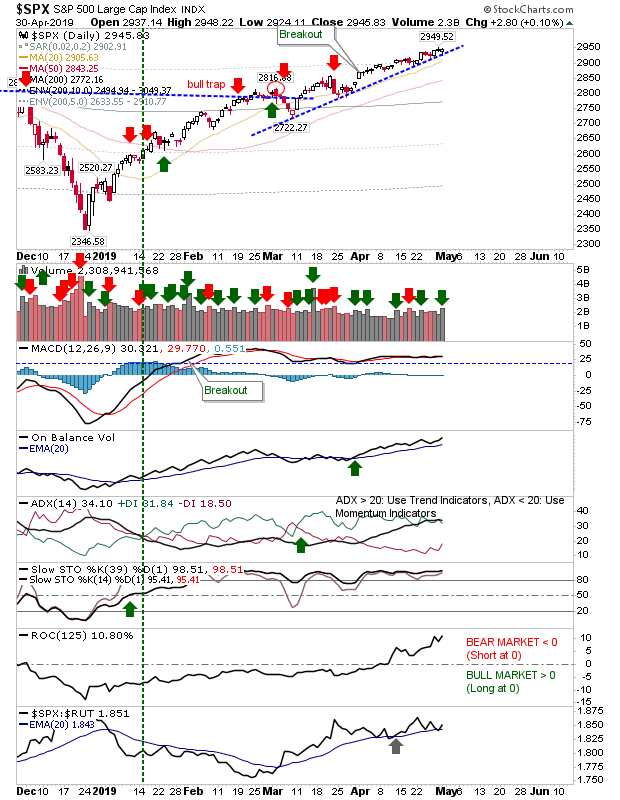

There wasn't much to yesterday's action but for what there was, it was positive—better again in the face of Google's (NASDAQ:GOOGL) disappointing earnings (revenue miss). The S&P barely registered a gain but with the index a couple of points shy of all-time highs it can be forgiven. Volume was sufficient to register as accumulation.

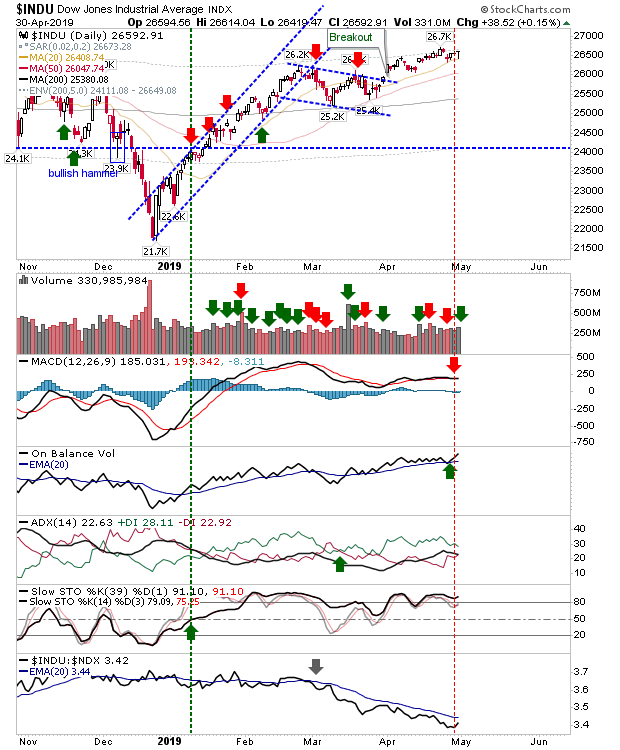

The Dow Jones Index was similar to the S&P and finished with a nice doji on the 20-day MA. Volume marked accumulation although the MACD edged a 'sell' trigger, although this is more a flat-lined indicator than a decisive swing to bears.

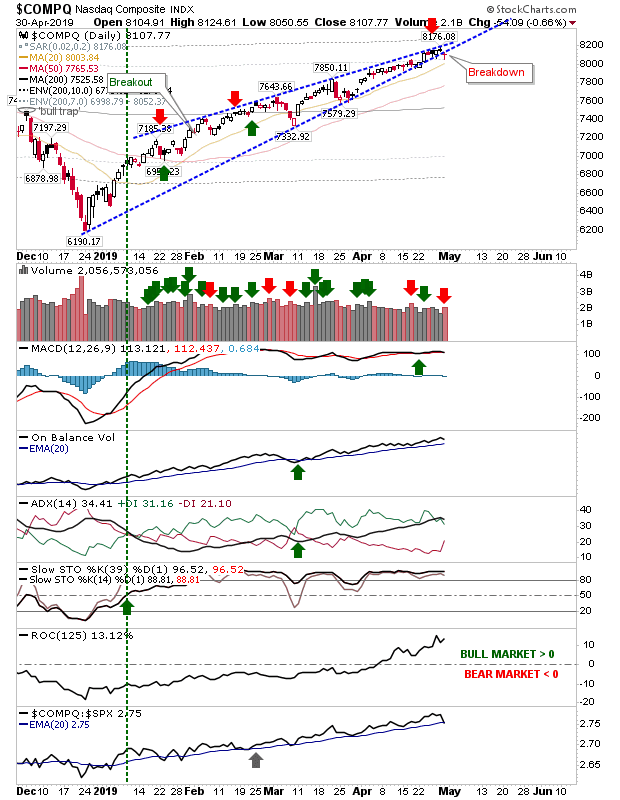

The NASDAQ did well to hold up against the earnings miss of Google, although an argument could be made for an edge breakdown of the bearish rising wedge but I wouldn't be shorting off it. Technicals are still bullish.

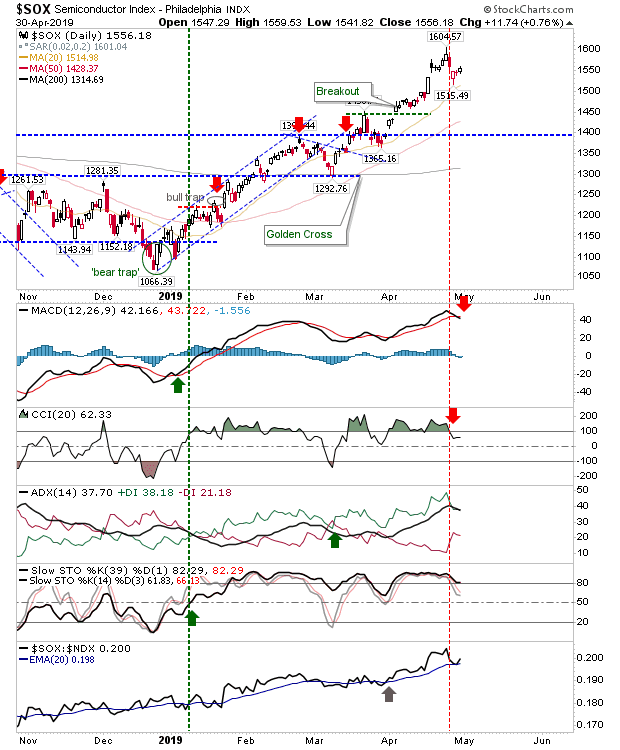

What may hurt the NASDAQ is the weak bounce in the Semiconductor Index; while the latter is doing very well it has a growing bearish technical picture

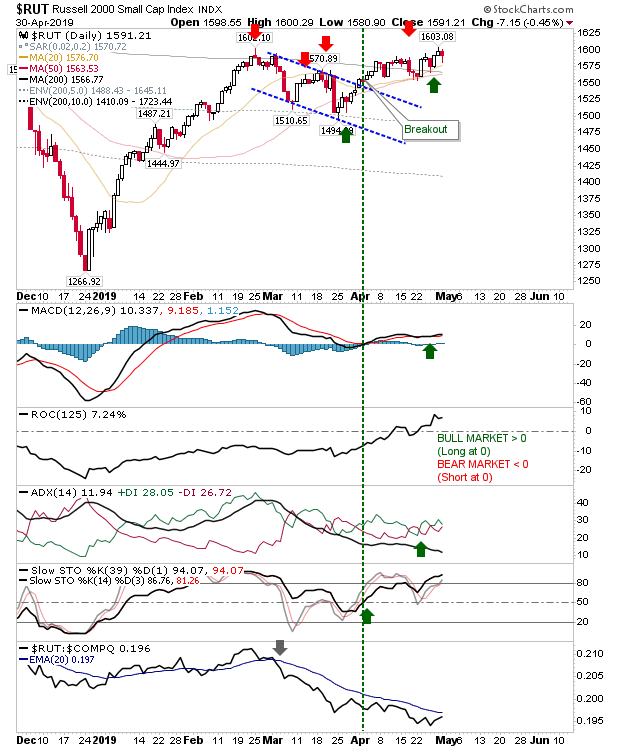

The Russell 2000 may have been the only index to close lower yesterday, but it probably did better by finishing with a bullish 'hammer' (weak, because technicals are not oversold) above a rare convergence of 20-day, 50-day and 200-day MAs. I'm still liking this for bulls and what it means for broader indices.

For today, I'll have my eye clued in on the Russell 2000 and looking for this to retake its leadership role after two months of underperformance.