Investing.com’s stocks of the week

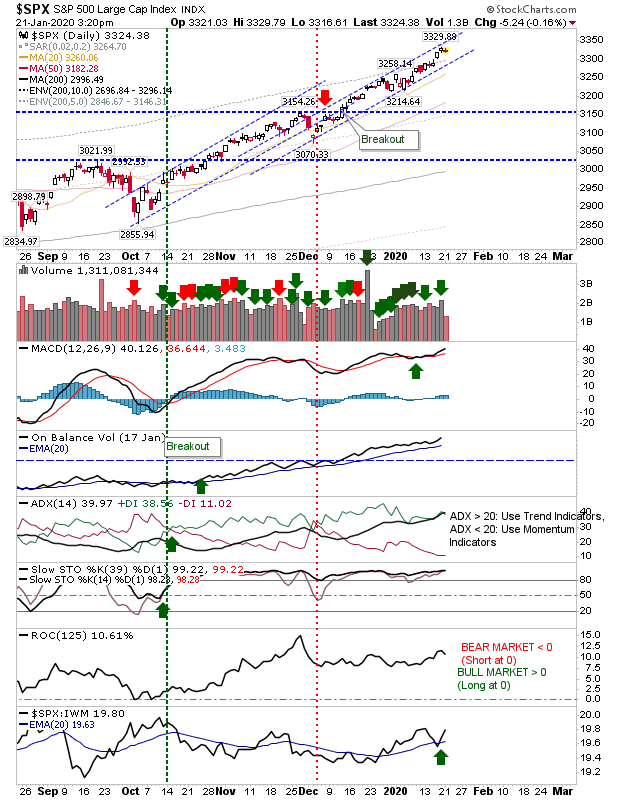

A slow start after the MLK holiday yesterday led to minor losses for markets. Technicals remain positive with the S&P enjoying a sharp uptick against Small Caps which experienced a loss (although not a great loss). Indices remain defined inside existing rising channels, or in the case of the NASDAQ, just above.

The lack of a significant loss in the S&P helped keep the indices inside their narrow channel.

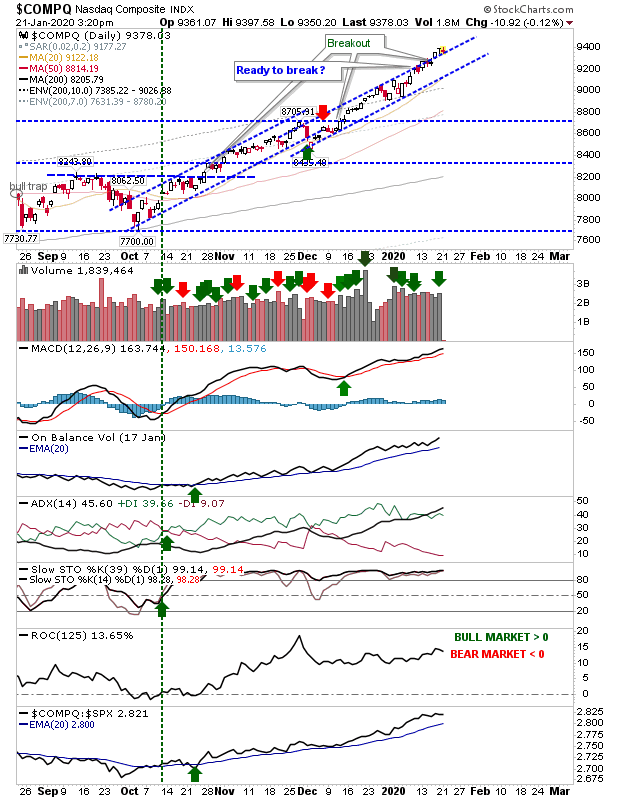

The NASDAQ is running along former channel resistance—now support—in what is a nascent breakout. Technical strength remains excellent. No reason for concern here.

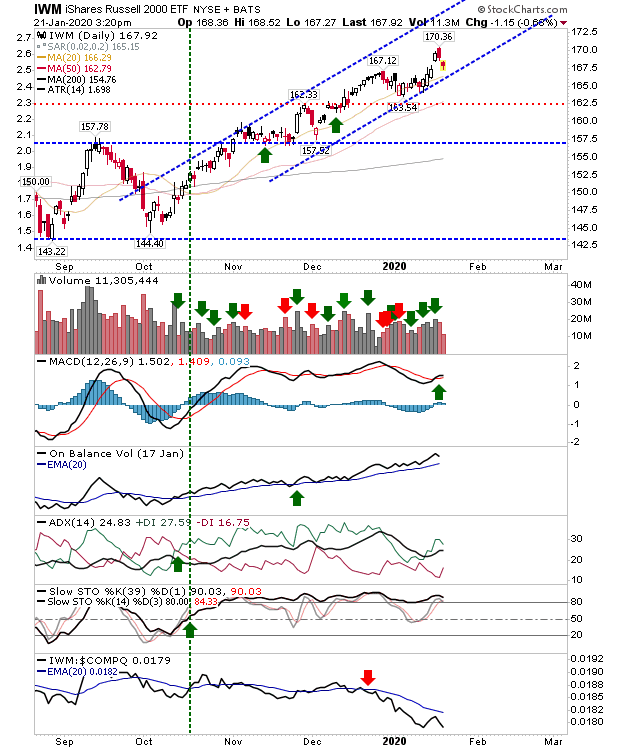

Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) took a small hit but not enough to violate channel support and selling volume was light. While it took the biggest loss on the day, there was no violation of support and no negation of the MACD trigger 'buy.' Yesterday's action should be considered just noise as part of the broader rally.

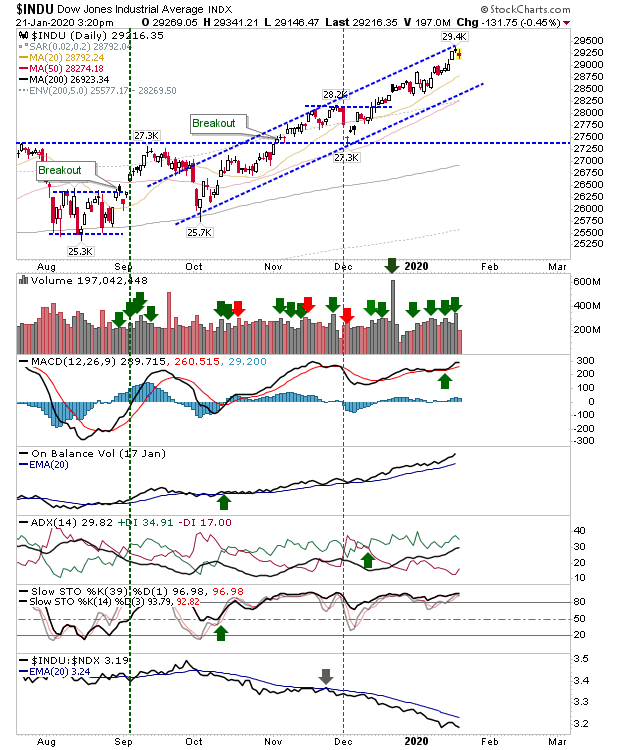

The Dow Jones Index fell back off channel resistance on light volume. The rising channel from October is well defined so yesterday's losses were not entirely unexpected given the reversal off resistance.

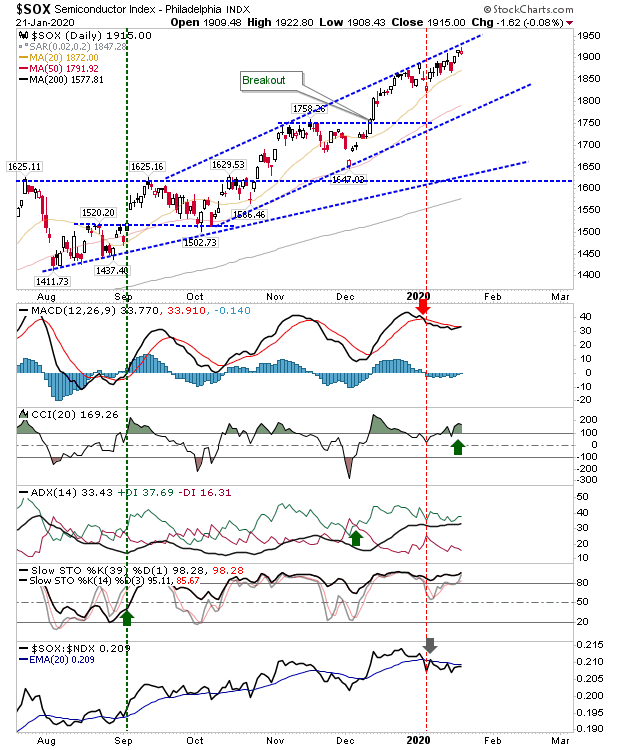

Semiconductors are also riding along channel resistance with the MACD on the verge of a new 'buy' signal. Relative performance looks ready for a new 'buy' signal which could coincide with a breakout of the channel.

In summary, there was no significant damage done despite yesterday's losses. Look to the NASDAQ to accelerate from its channel breakout.