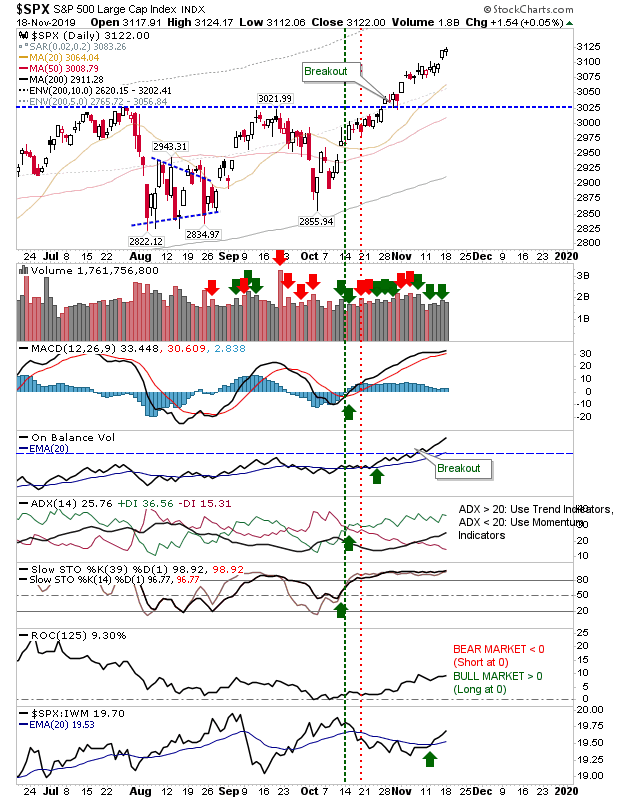

Very little to say about yesterday. Small gains keep things positive although volume was light. We are coming to a point when rallies in the S&P and NASDAQ need to develop a consolidation which at the very least moves things sideways—if not, down.

The rally in the S&P hasn't stopped since October and a test of the 20-day MA would be welcome at this stage. However, On-Balance-Volume does have a breakout in support of price action—so the rally is not concurring in isolation.

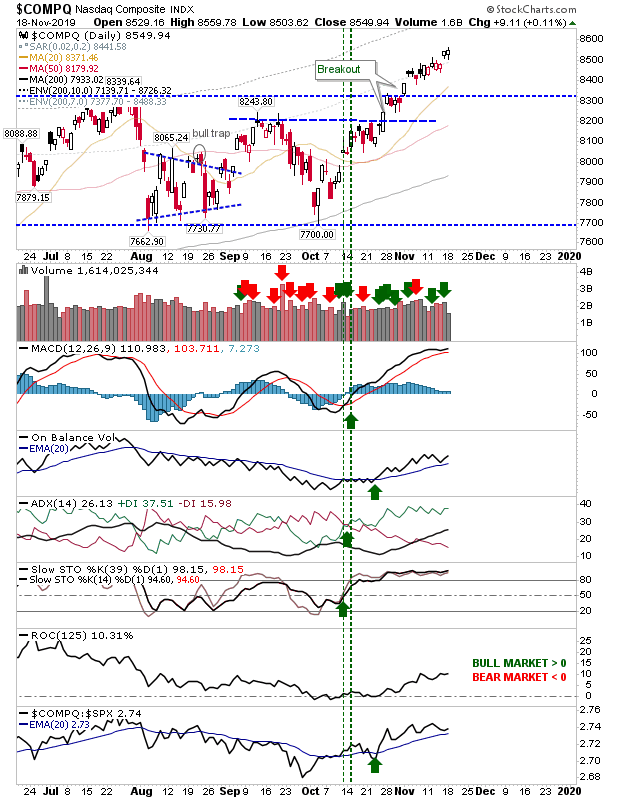

The NASDAQ is in similar need for a consolidation but at least technicals are strong

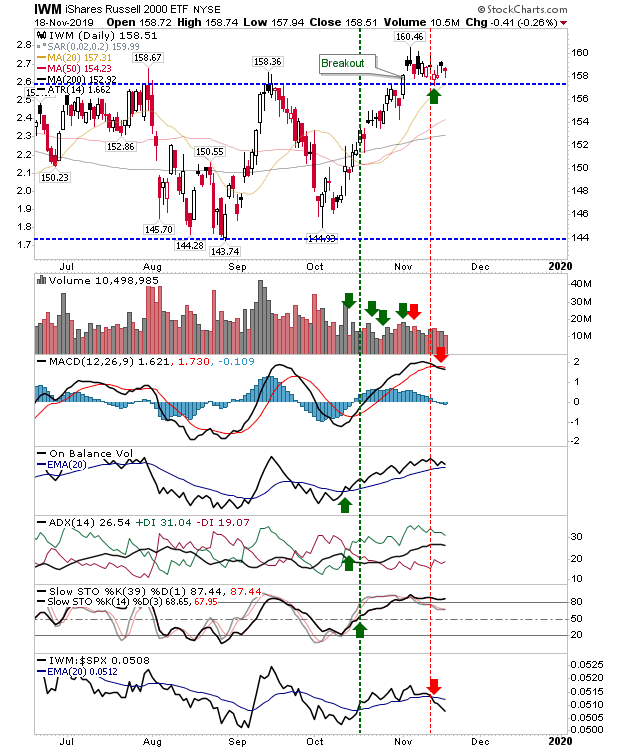

The Russell 2000 (via iShares Russell 2000 (NYSE:IWM)) has stalled a little on its push off support, succumbing to a 'sell' trigger in the MACD along with an earlier such trigger in relative performance.

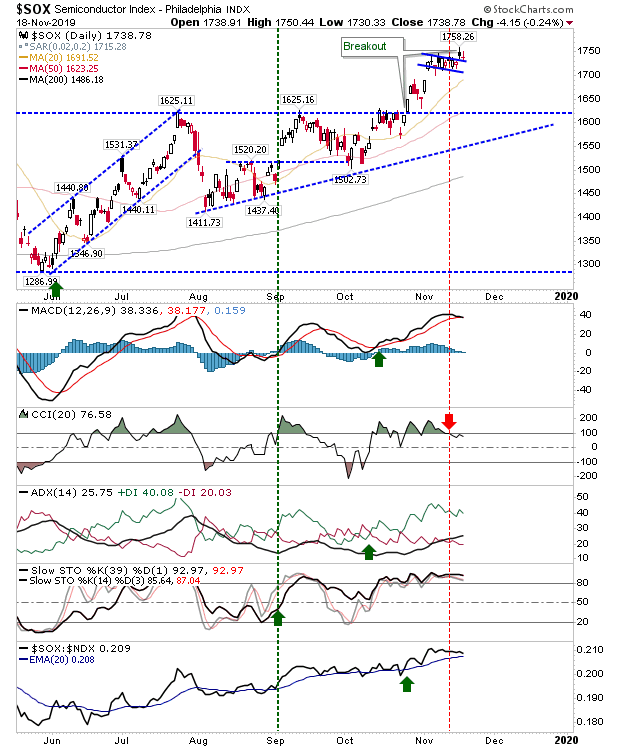

The Semiconductor Index has to follow on from a 'bull flag' breakout, but despite not showing a candlestick, which would mark a resumption of the rally, it has at the same time, not reversed the breakout.

At this stage, we want to see some solid 1% moves. Even if these result in losses, it will be important that consolidations emerge which keep longs onside, but offer an opportunity for sideline money to get involved, and trap shorts in the process. Aside from that, yesterday was a good day.