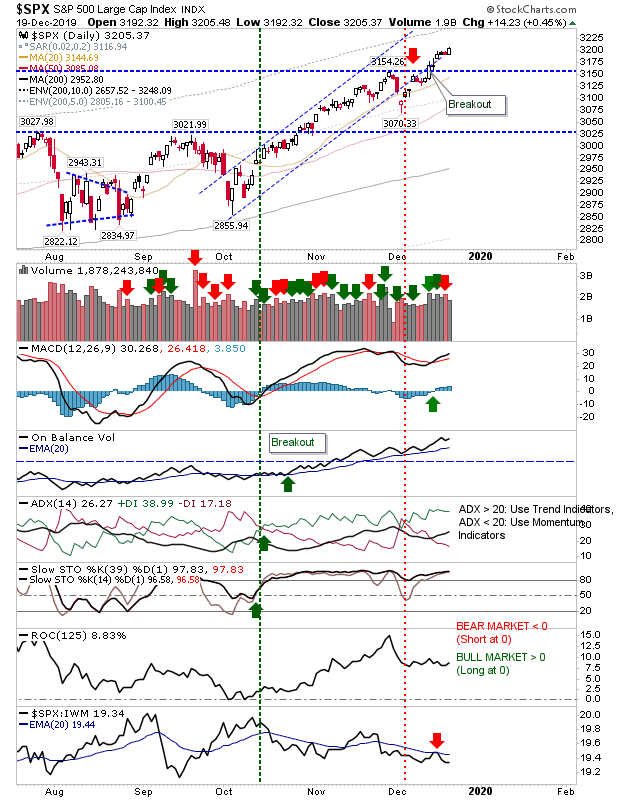

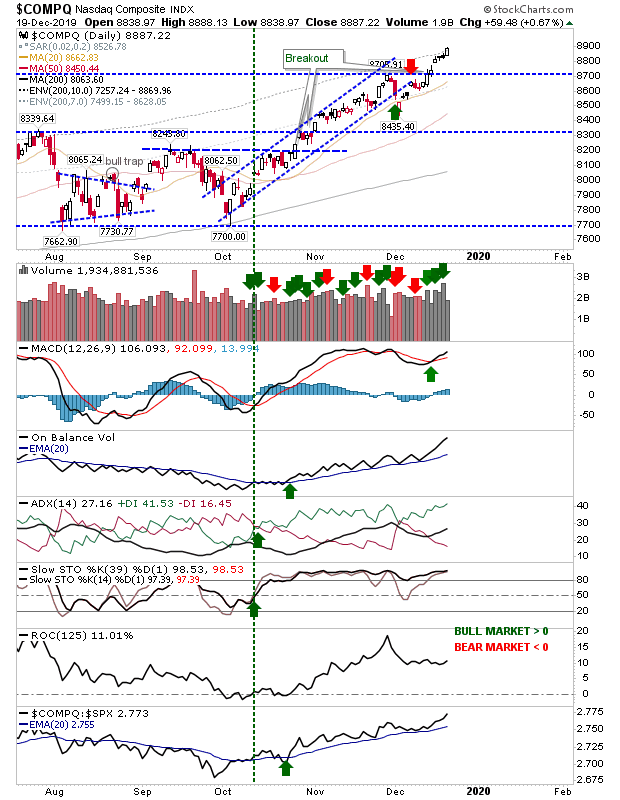

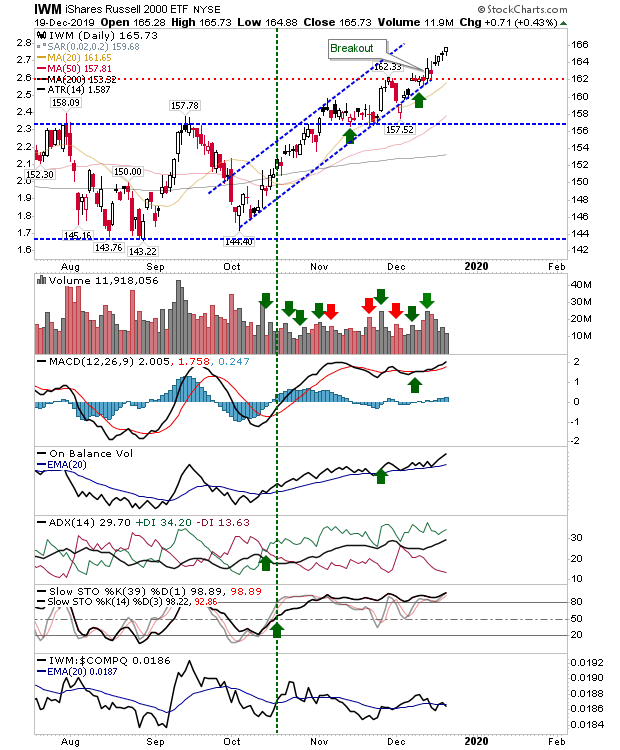

Volume will lighten as Christmas approaches, making it easier to push larger than normal gains or losses. Now that indices have moved past 2018 highs (with the exception of the Russell 2000), stockholders who are holding long positions will be largely in profit—and those with shorts, holding loses. This makes it easier for markets to push more gains and allow value buyers to fish around the Russell 2000.

The S&P posted a small gain with technicals pointing in the right direction. The index is still losing ground against the Russell 2000 but this is no bad thing for the broader market.

The NASDAQ is leading the pack on all fronts, including in relative performance. Semiconductors are helping in a large way and traders should look for this to continue into 2020.

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) also tagged on a gain as it slowly makes its way back to 2018 highs. Relative volume was much lighter than for Tech or Large Cap stocks but this should change once the 2018 high is breached.

Not expecting too much more heading into the end of year but holding the breakouts will be important as we move into 2020.