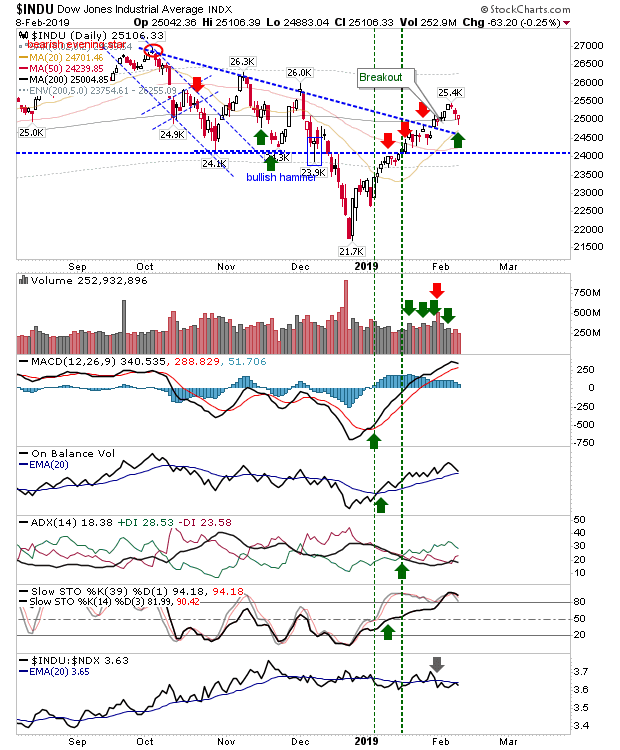

Market reversals off 200-day MAs were stalled by Friday's low key buying. The Dow Jones Industrial Average was the one index which was above its 200-day MA heading into Friday and ended the week with a bullish hammer right on its 200-day MA.

The Dow Jones Index had already cleared declining resistance at the end of January prior to breaking through its 200-day MA. To help with 200-day MA support there is the fast approaching 20-day MA. Collectively, there is a potential buying opportunity for a push to 26,300 (the last October swing high), stops on a loss of Friday's low.

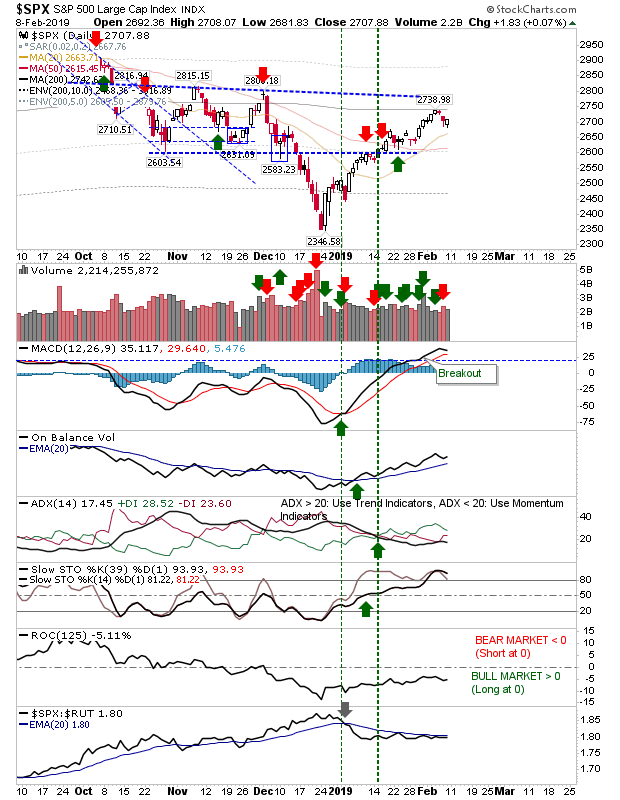

Other indices still have work to get too, before they can move beyond their 200-day MAs. The S&P should be the most favored given action in the Dow Jones Index. Relative performance (vs the Russell 2000) is slowly improving, the MACD has breached resistance and On-Balance-Volume enjoys a strong accumulation trend. While not an ideal long play, stops can go on a loss of the 20-day MA.

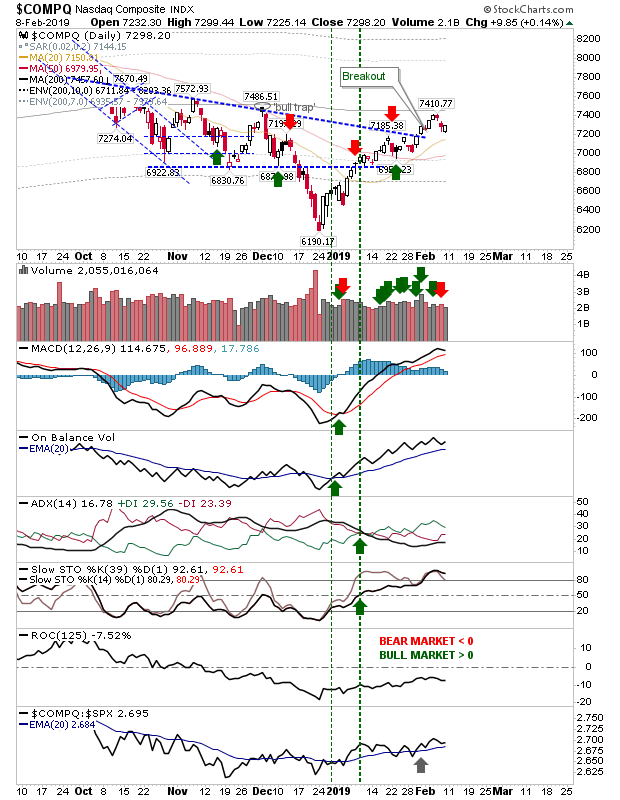

The NASDAQ cleared declining resistance in a breakout at the start of February but hasn't yet risen to fully challenge its 200-day MA. Like the S&P it's enjoying excellent technical strength and strong accumulation.

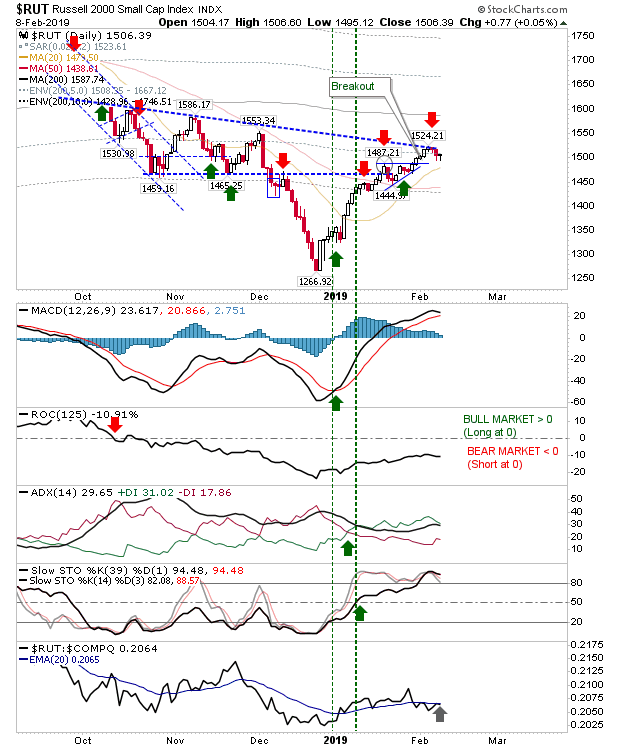

The Russell 2000 is a small step behind the NASDAQ as it has yet to breach declining resistance but its nestled right against it. The Short position is still 'active' but the mini-tweezer bottom generated by Friday's close suggest higher prices lay ahead.

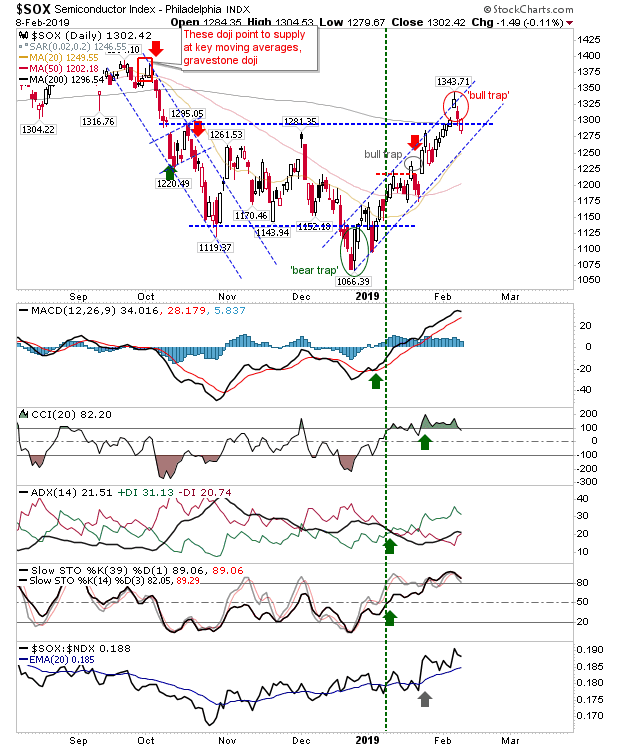

The one index to flash a bearish reversal was the Semiconductor Index; Friday's close registered as a possible 'bull trap' but there was enough gain for this to be quickly negated if there is a higher close on Monday.

For today, shorts can look to the Semiconductor Index and possibly the Russell 2000. Longs can focus on the Dow Jones Index.