Not a whole lot offered by indices yesterday, but what was offered had more bullish overtones than negative.

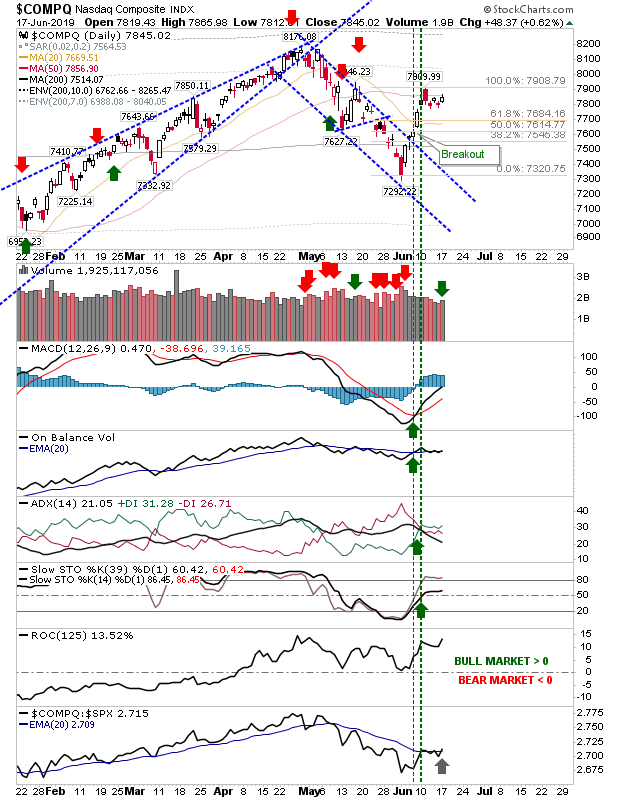

The NASDAQ continued with its shaping of a bullish handle. Volume climbed a little in registering an accumulation day. The index still has to put some distance from its 50-day MA but once it does and mounts a challenge on April highs it could really pick up momentum. On a more subtle note, there was an uptick in relative performance.

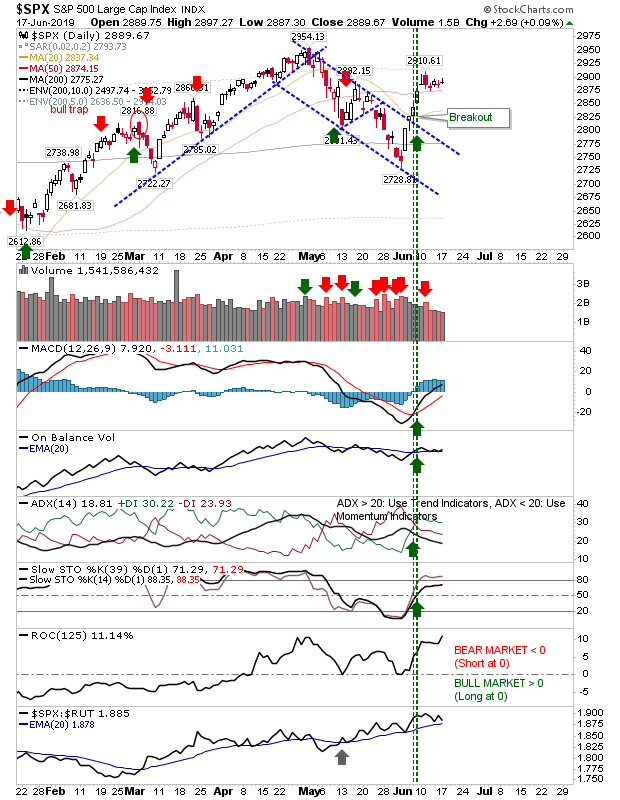

The S&P traded in a very narrow range but relative performance versus the Russell 2000 is still good.

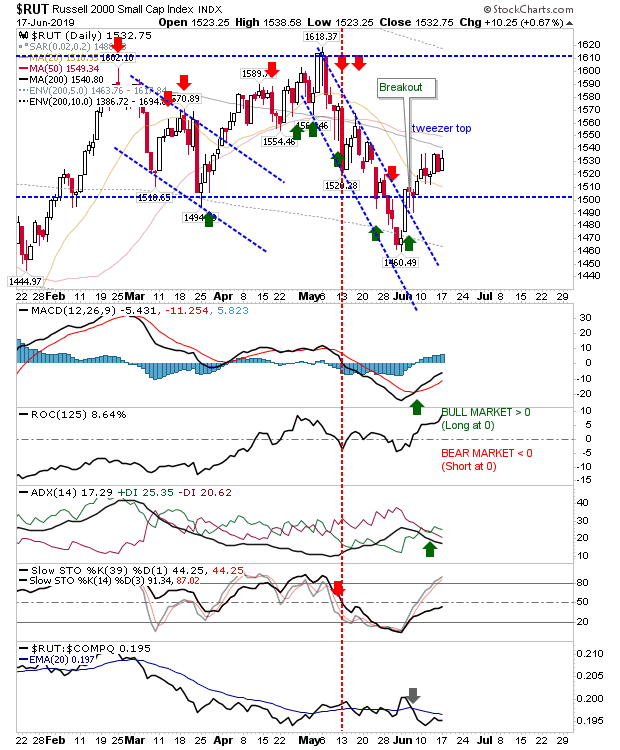

The Russell 2000 continued its back-and-forth; it's the only index not to trade a narrow range day yesterday, but neither has it managed to break out of its consolidation. It does have considerable resistance to clear with converged 50-day and 200-day MAs to navigate. Technicals are mixed, but Rate-of-Change posted a new reaction high—a bullish development.

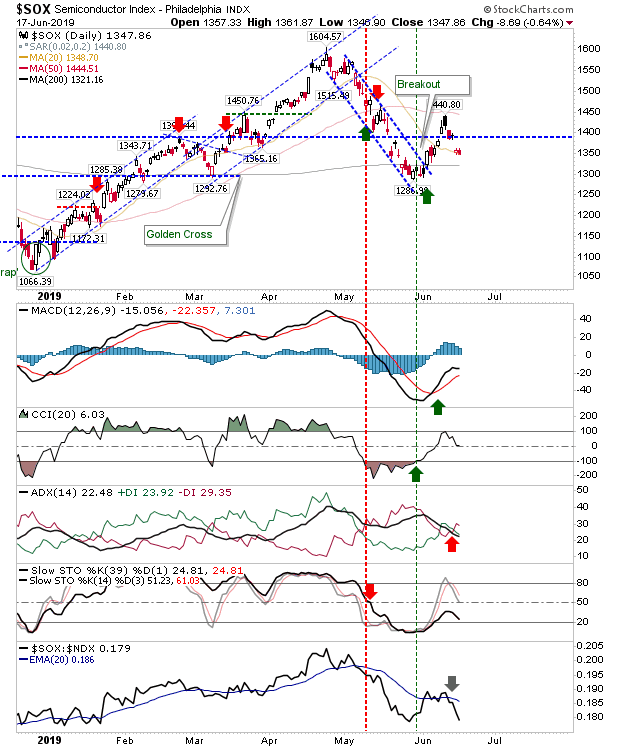

The Semiconductor Index, which had suffered a gap down on Friday, was able to hold its ground yesterday with no further loss. The 200-day MA continues to be available as support.

For Tuesday, we will want to see some sign consolidations are going to break to the upside. The lack of interest on the part of buyers and sellers tends to run in longs' favor but we need follow the lead of price.