Investing.com’s stocks of the week

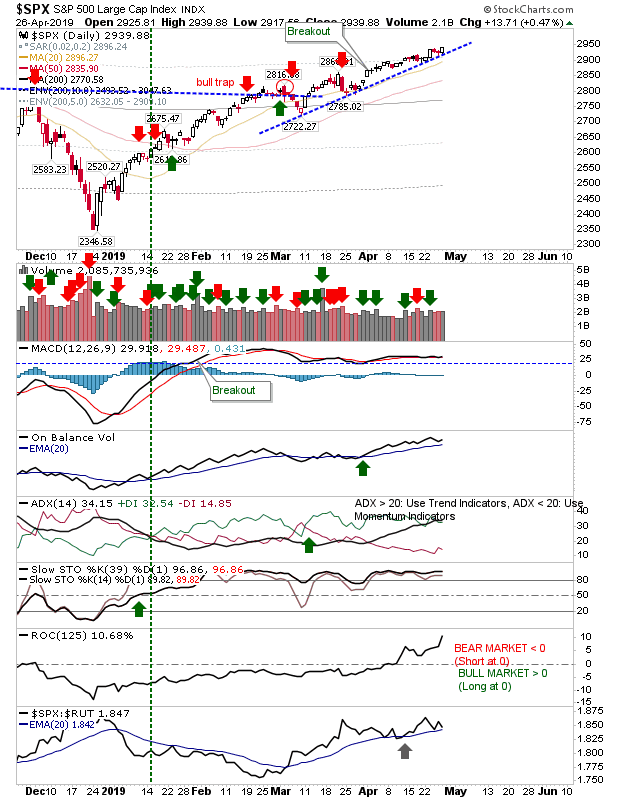

The S&P maintained bullish pressure on Friday with a small gain, sufficient to mark a new closing high. Technicals are generally bullish, although the MACD has flat-lined.

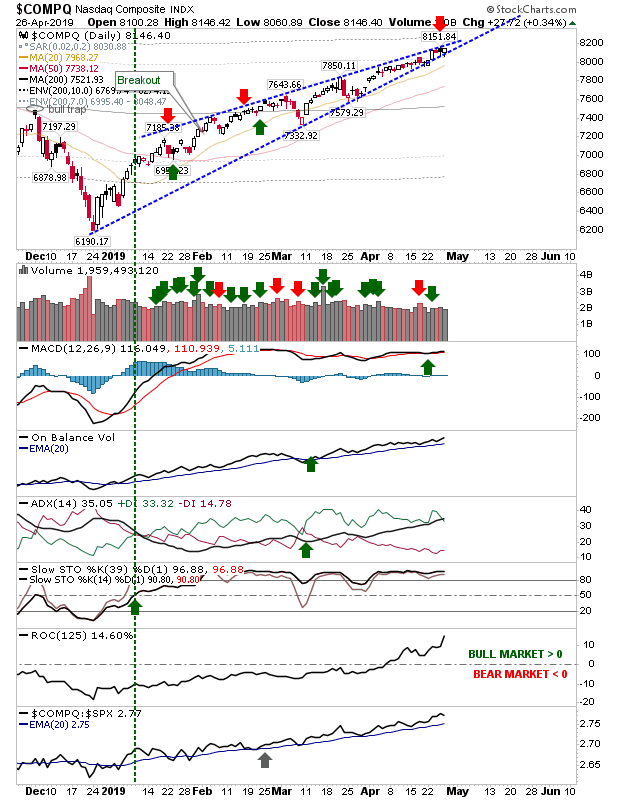

The NASDAQ is similarly trading into a tight congestion and while Friday's finish suggests higher prices ahead I have marked a possible short, based on the convergence of support and resistance. A closing break above 8,150 resistance would negate the short.

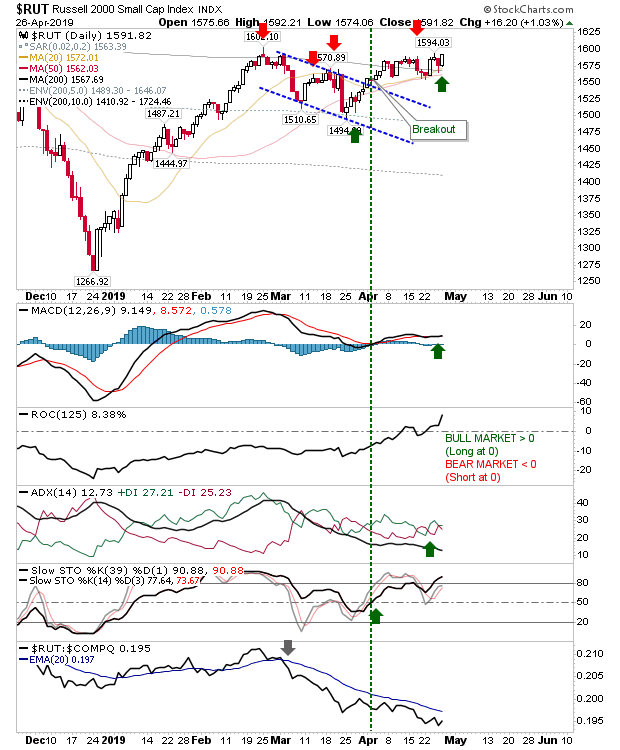

The Russell 2000 had the best of the action as it pushed a 1% gain off converged 20-day, 50-day and 200-day MAs. The index is nicely primed to gain today or Tuesday but for this to be sustainable it's going to take a few days of strong buying to reverse the relative underperformance of this index to the NASDAQ and S&P.

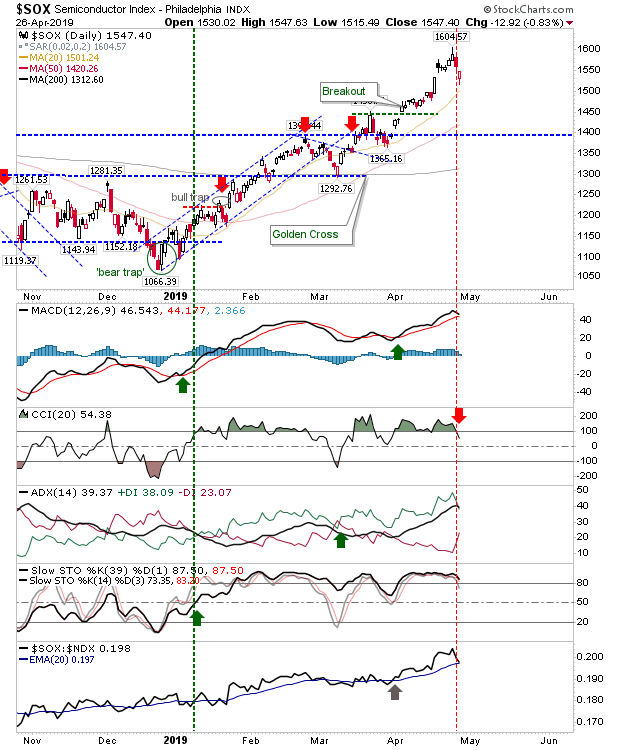

The Semiconductor Index had engaged in a reversal but Friday's higher finish relative to the open has offered a stronger picture than might have been expected after the breakout.

For today, look for Small Caps to lead broader markets higher.