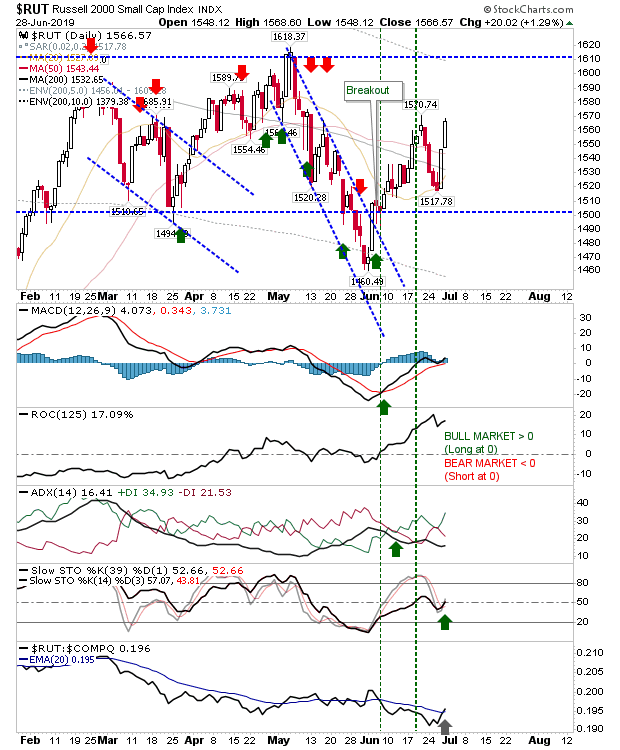

It was another good day Friday for Small Cap stocks as the Russell 2000 added over 1% to bring it into a challenge of the June swing high. Just as the declines of the early part of last week were of lesser significance because of the broader trading range between 1,500 and 1,610; the same is true for Thursday's and Friday's gains. The one aspect which is interesting is the improvement in relative performance against the S&P. With money flowing back into Small Caps, the groundwork for a larger, secular rally is been put into place.

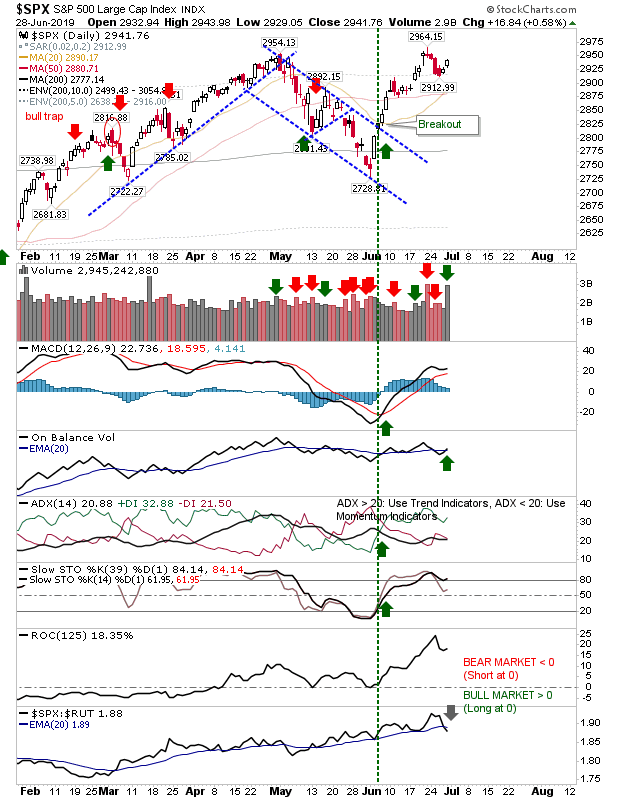

The S&P is poised to take advantage. Friday posted a small gain on confirmed accumulation which leaves things nicely set for a break of 2,955. Friday offered a 'buy' trigger in On-Balance-Volume which leaves all technicals net positive (bar the relative trigger in favor of Small Caps).

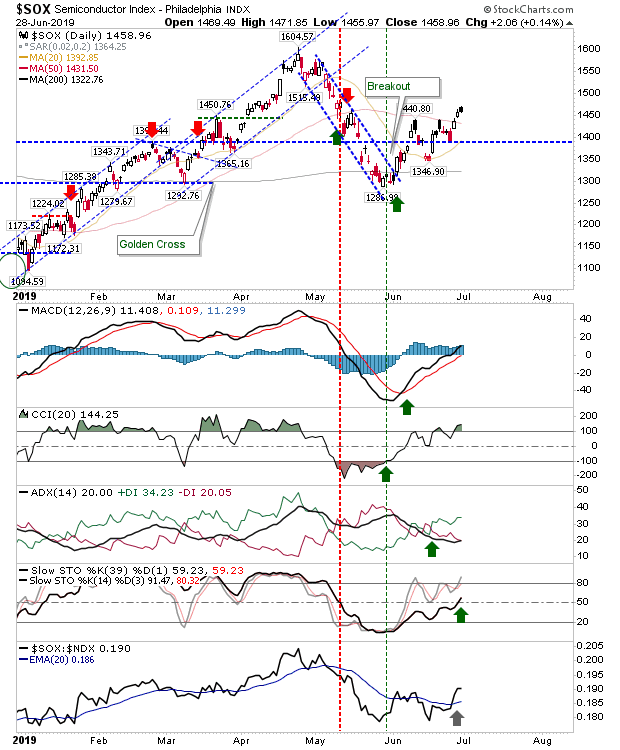

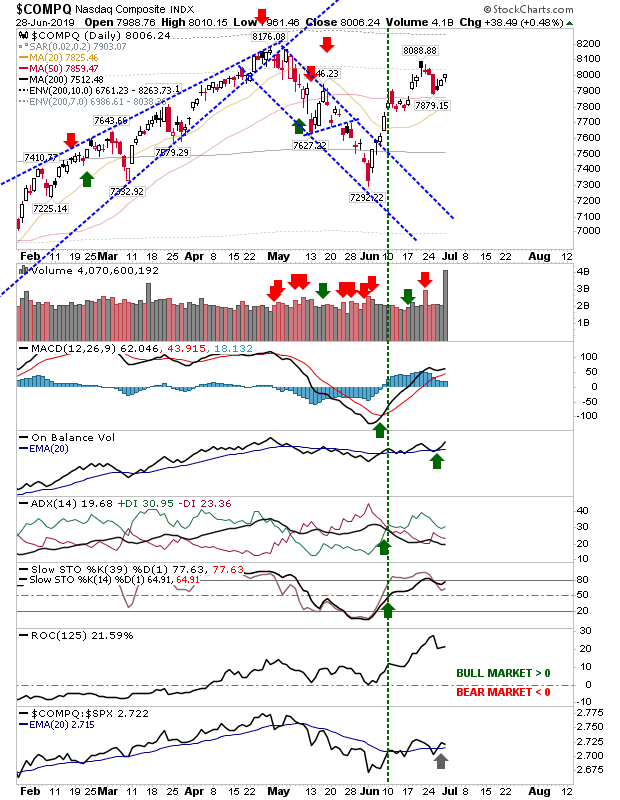

The NASDAQ has seen solid improvement since early June and Semiconductors have managed at least to post new June highs. Again, more speculative issues like Tech and Small Caps are making all the running which is another sign a major new rally is in the making.

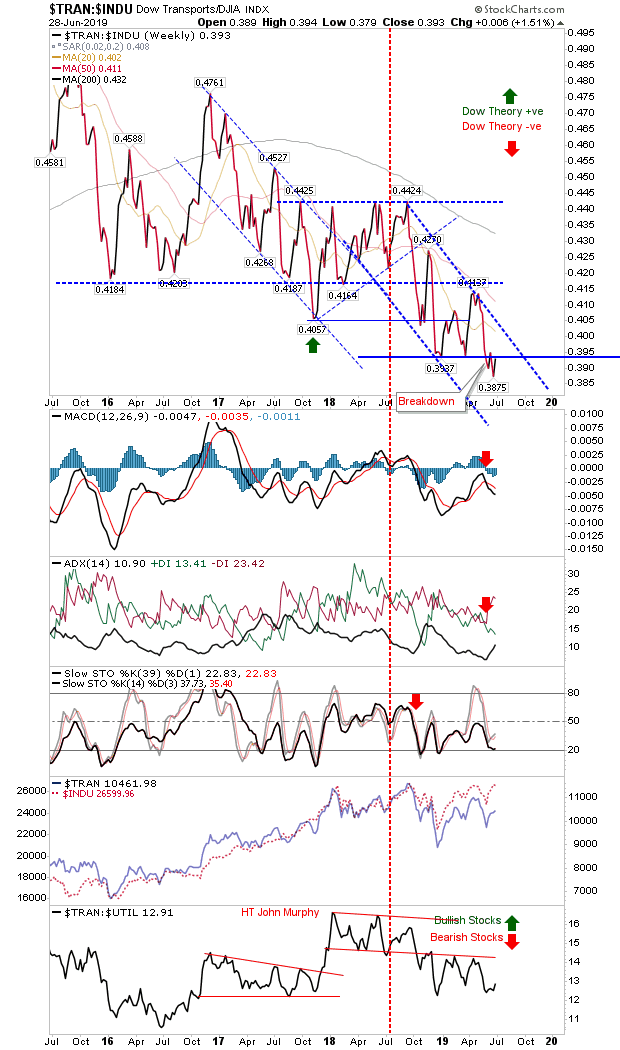

For a larger, secular rally to break out of the current consolidation, I would like to see the relationship between Dow Transports and Dow Index and Transports and Utilities mark a strong bottom and offer a supporting foundation for a rally

For today, we want to look for a consolidation of Friday's small gains which will give traders a chance to get in before the various indices breakout.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI