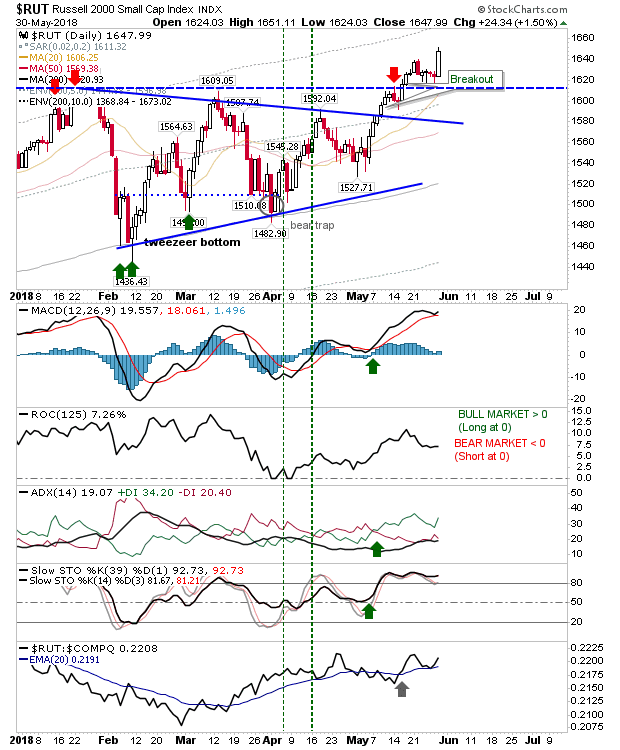

Tuesday's action opened up bearish opportunities in Large Cap Indices but it was the Russell 2000 which ultimately delivered in favor of bulls.

The Russell 2000 followed Tuesday's successful test of support with a 1.5% gain yesterday. With no overhead resistance and net bullish technicals, there isn't any clear point of weakness.

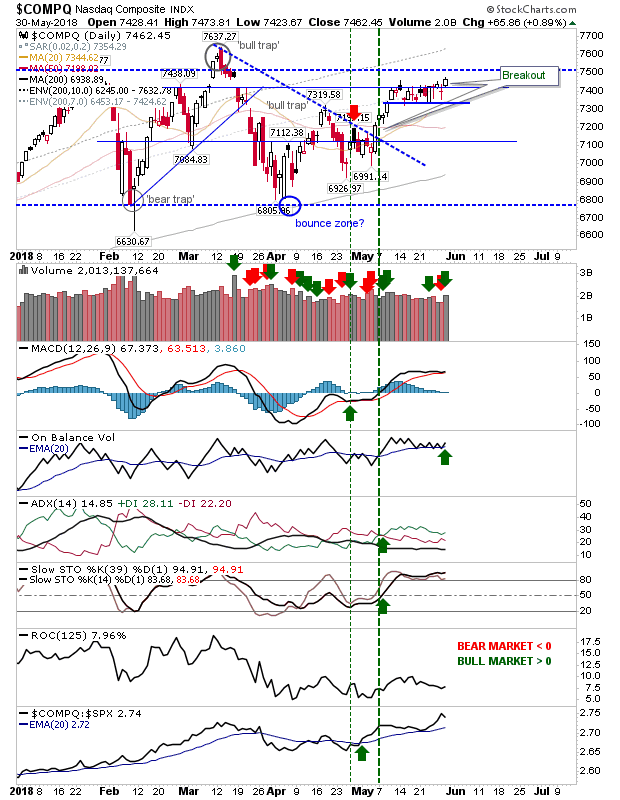

Another index which took advantage of yesterday's buying was the NASDAQ. The breakout was relatively minor and it still has to challenge the 'bull trap' but the index cleared the 3-week handle consolidation. Volume climbed to register accumulation with a fresh On-Balance-Volume 'buy' trigger to return technicals to a net bullish state.

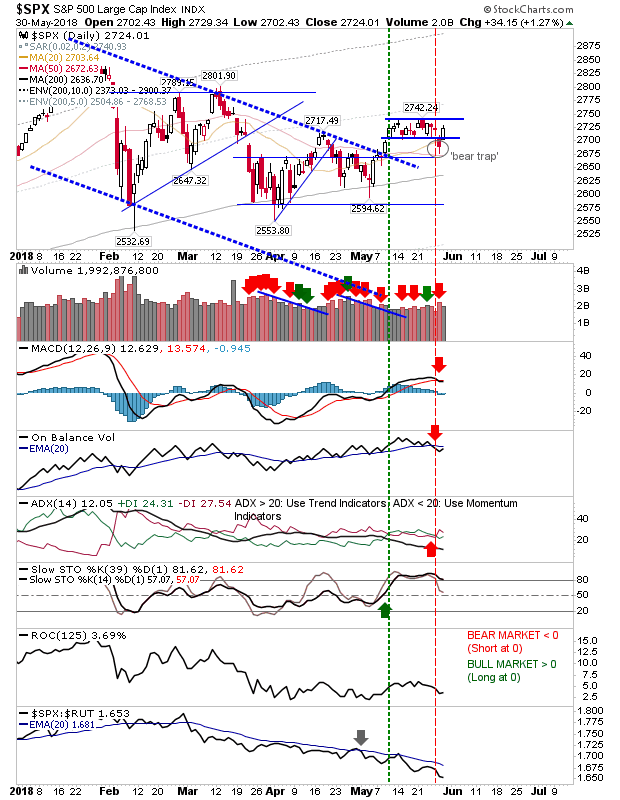

The switch trade belongs to the S&P; Tuesday's consolidation breakdown would have encouraged new short trades but these would have been whipped out yesterday. Aggressive traders could go the other way and trade long off the now new 'bear trap'; stops on loss of 2,700 with upside targets of 2,800 and 2,875. Unlike the NASDAQ, buying volume was light and technicals are still predominantly bearish.

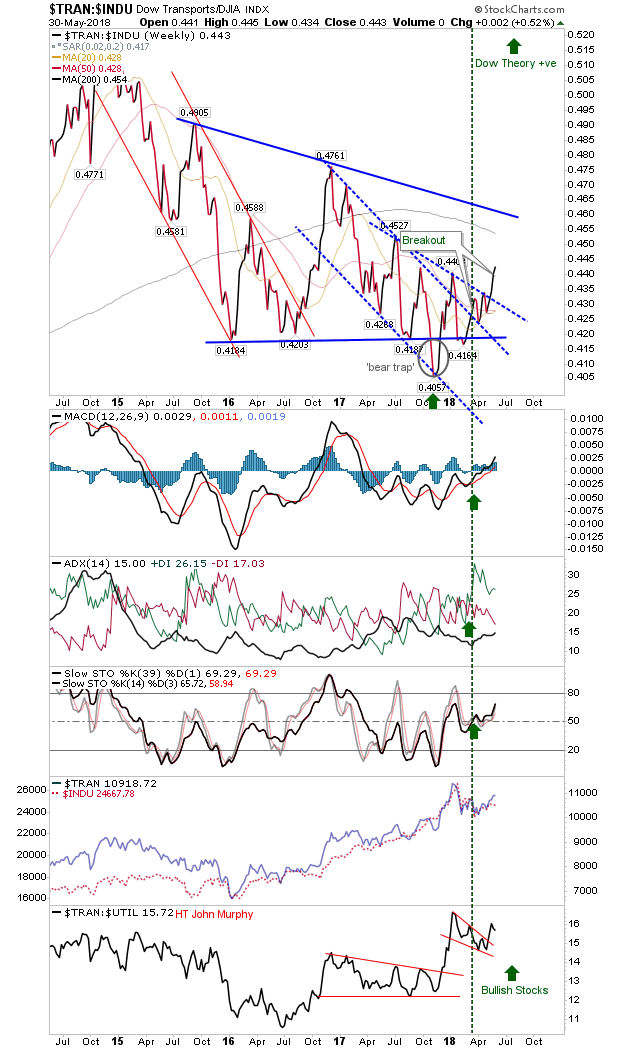

Dow Theorists will be enjoying the acceleration in the ratio between the Transports Index and the Dow Industrials. This is the second breakout this year with a new near-term high.

For today, the Russell 2000 has been the consistent player for bulls. Aggressive traders can look to buy the 'bear trap' in the S&P—although given some may have shorted on Tuesday (and have been forced to cover) they may be reluctant to switch.