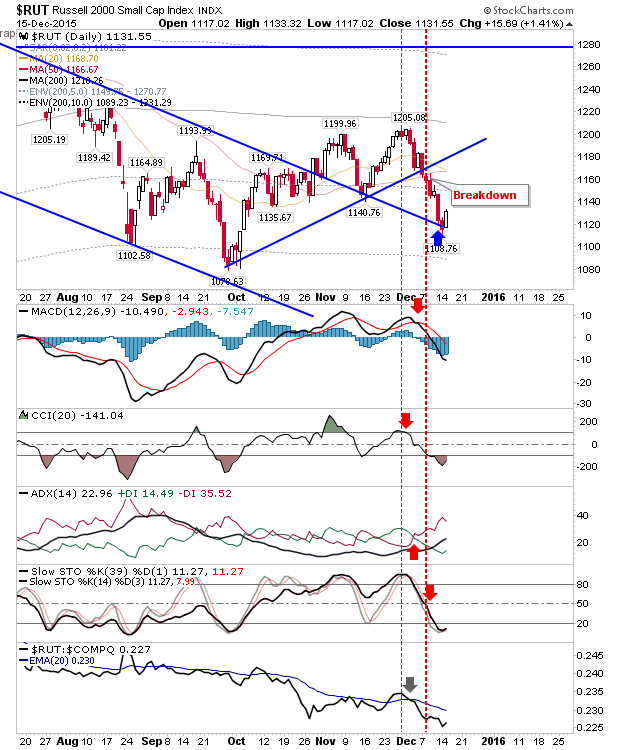

After an extended period of under performance for the Russell 2000, yesterday saw it gain over a percentage point and close near the day's high. It's a positive response to the test of former channel resistance turned support, but it will have to watch supply as it approaches the moving averages.

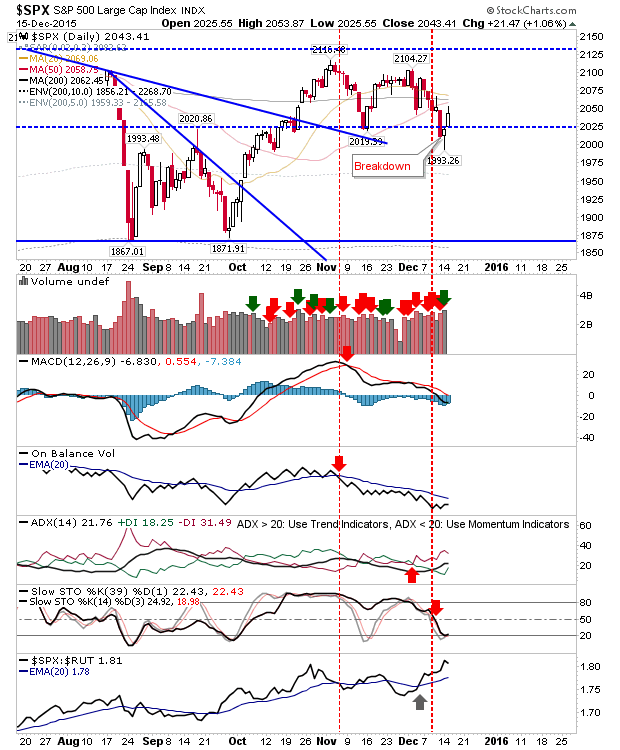

The S&P was next on the performance charts. It started to struggle when it approached overhead moving averages. Despite higher volume accumulation, other indicators remained bearish. Today will see how much supply there is at converging moving averages.

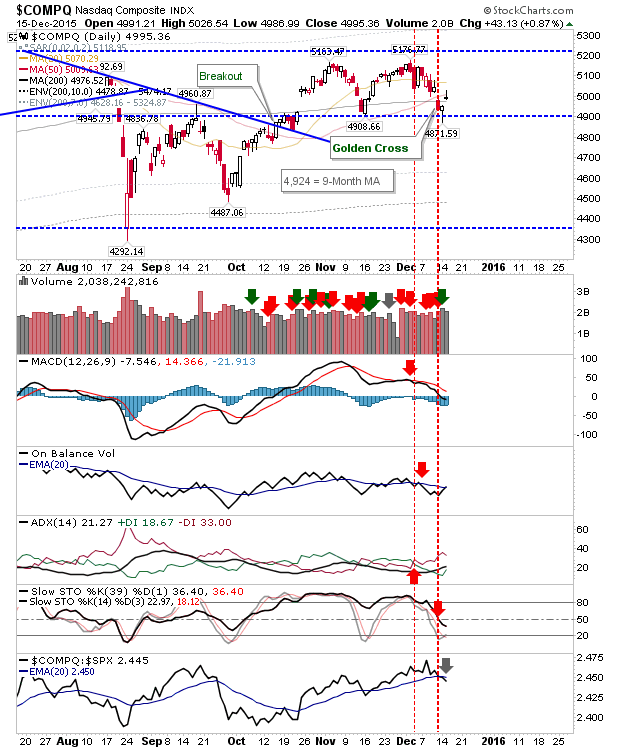

The NASDAQ was the one disappointing index. It finished near the lows of the day with an indecisive doji. It does have the benefit of closing above its 200-day MA, but it will need to hold on to encourage buyers. Technicals are bearish, but On-Balance-Volume is close to a 'buy signal.

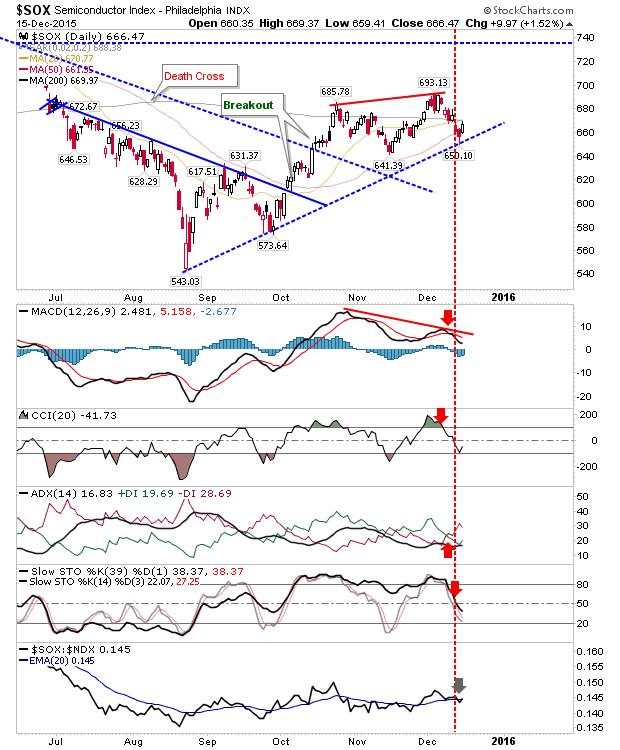

Today is a chance for bulls to add to yesterday's gains. The Russell 2000 perhaps remains the value play for bulls looking for value, while the Semiconductor Index also has merit. Note how it has rallied off the rising trendline.