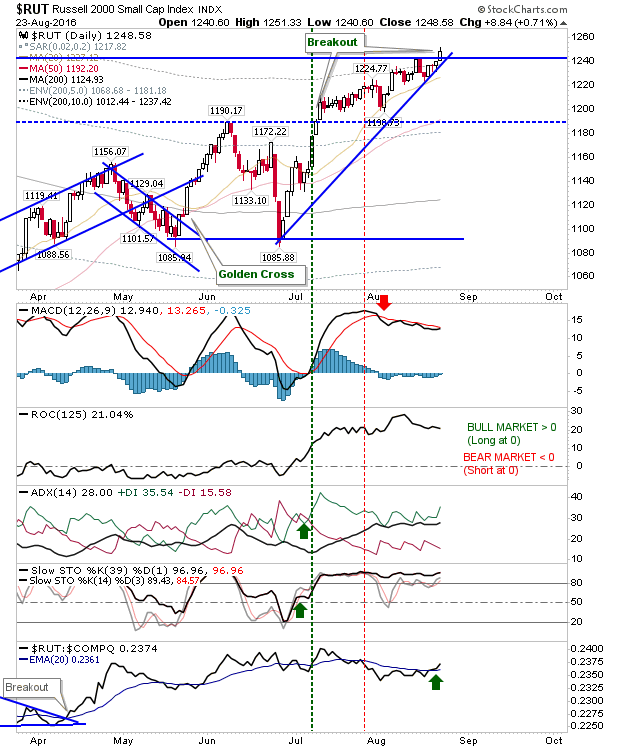

Markets made a break higher, although only the move for Small Caps stuck. The Russell 2000 managed to finish with a new closing high and is very close to a fresh MACD trigger 'buy'. There was a significant gain in relative performance of Small Caps against Large Caps and Tech.

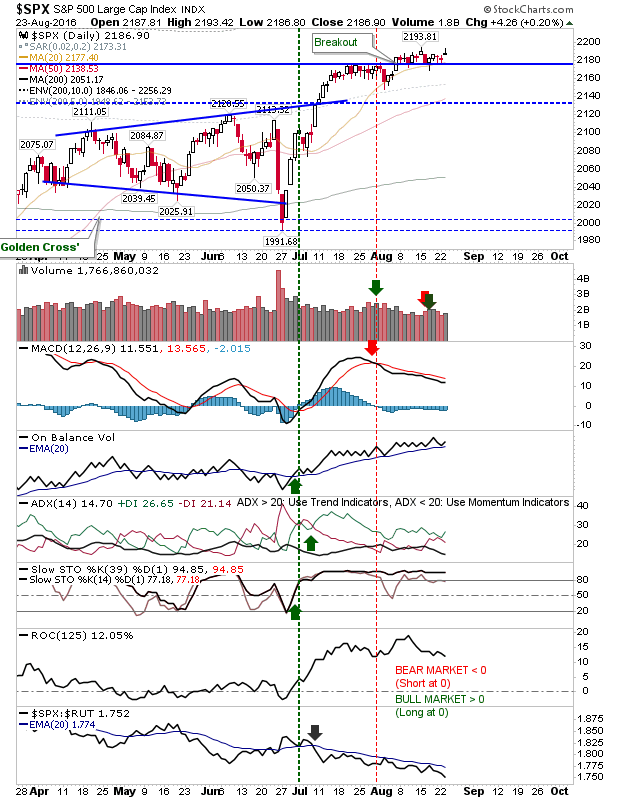

The S&P started well, but it drifted back inside its range. However, there is still a gap breakout to defend.

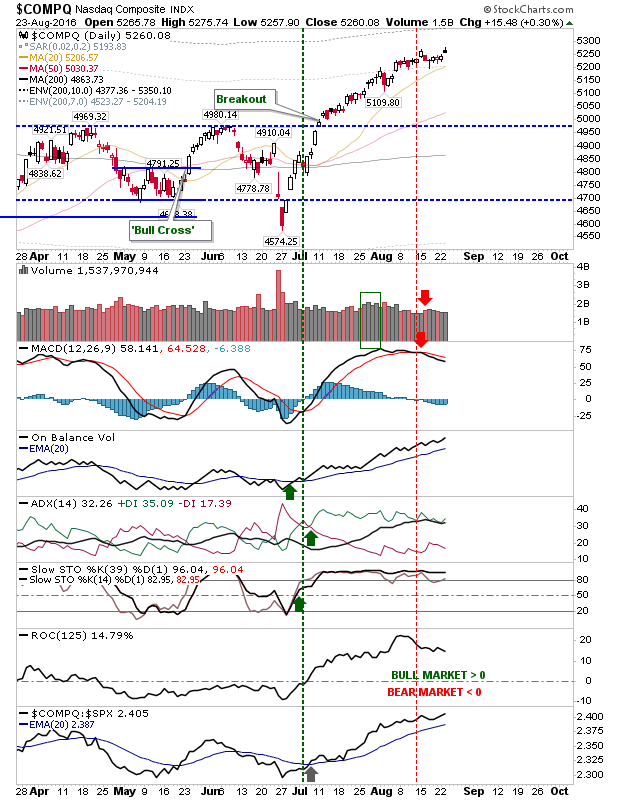

It was a similar story to the Nasdaq where early gains faded through the day. Tuesday's action registered as a neutral 'doji'.

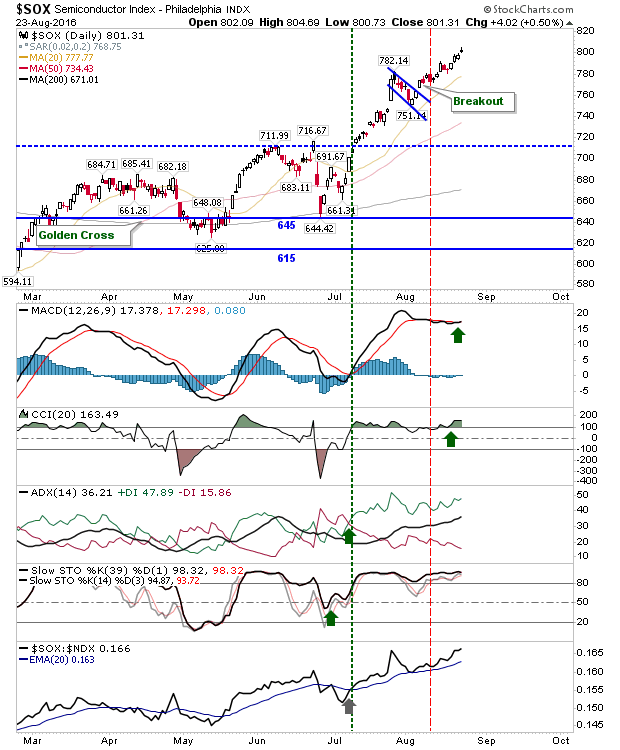

The Semiconductor Index experienced similar action as for the S&P and Nasdaq, but it managed to close the day with a MACD trigger 'buy' on new highs.

Wednesday will be about Small Caps continuing the gains kicked off on Tuesday. If these can be maintained in morning trading it will help bring the S&P and Nasdaq with them. Any shorts will be feeling the squeeze which will only add to buying pressure. With holiday trading still very much in play it's hard to see sellers making much of a mark.