While it was good day yesterday for Tech and Large Cap Indices it was a more muddled day for the Russell 2000 and Semiconductor Index.

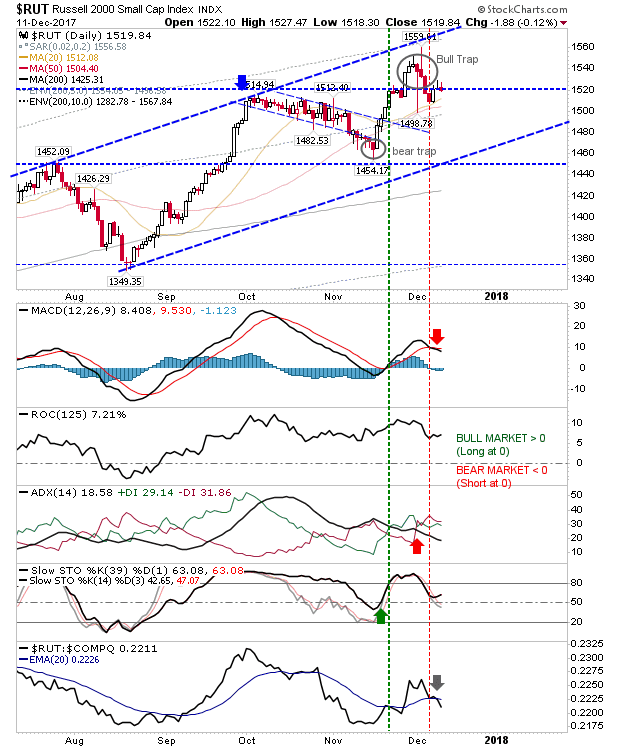

The Russell 2000 wasn't able to enjoy the fruits of what was low key buying experienced in other indices. A second doji in a row gives shorts something to work with as the 'Bull Trap' continues to influence buyers' behavior.

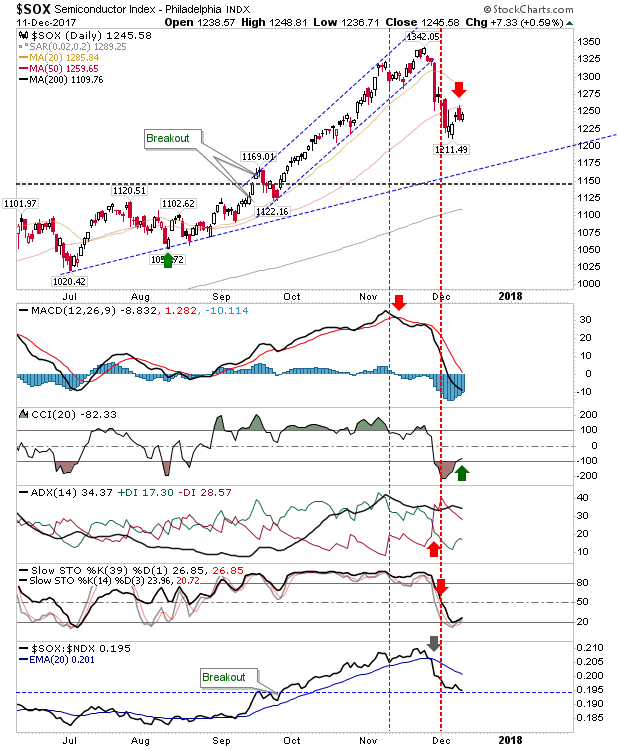

The Semiconductor Index was able to post similar gains as other lead indices but hasn't yet done enough to challenge its 50-day MA. However, it's a good shorting rally which can be attacked unless the 50-day MA is breached decisively.

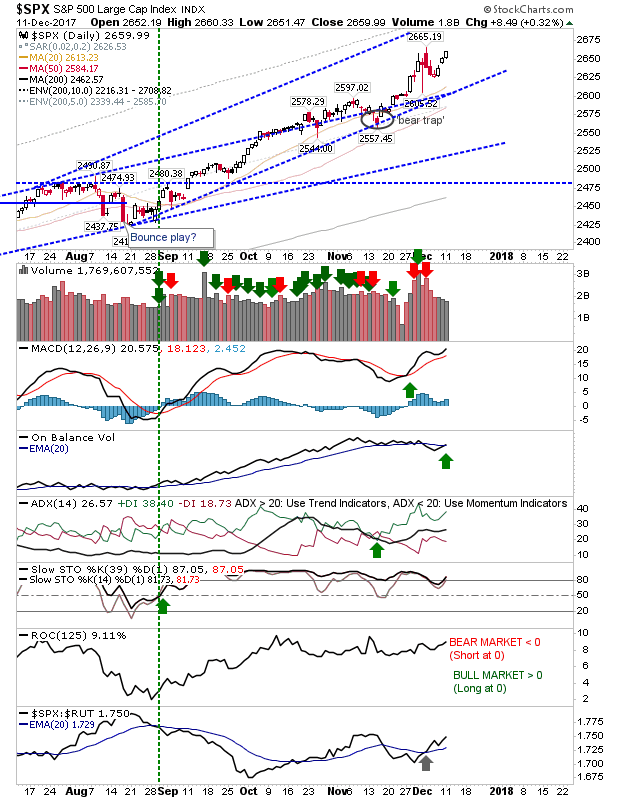

The S&P managed to post new all-time closing high on low volume. It sets up for a move to channel resistance. Existing longs have little reason to sell and shorts require something to attack, so look for more upside to follow. Technicals are back net bullish.

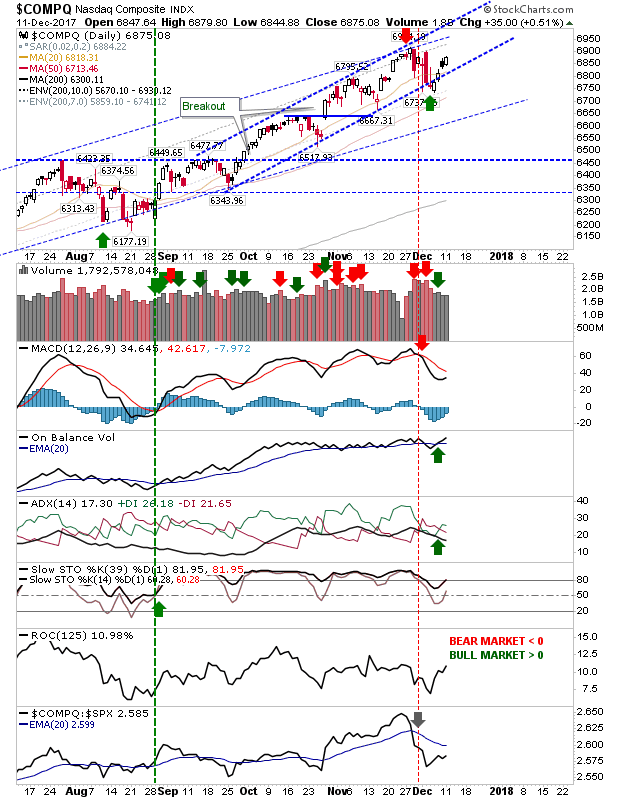

The NASDAQ managed to reverse the bearish black candlestick from Friday, reason enough to push any shorts entering yesterday out of their position.

For today, Tuesday, shorts should keep focus on the Semiconductor Index and may be able to find joy in the Russell 2000 using a relatively tight stop. Longs could look to the NASDAQ and S&P to continue their runs to channel resistance.