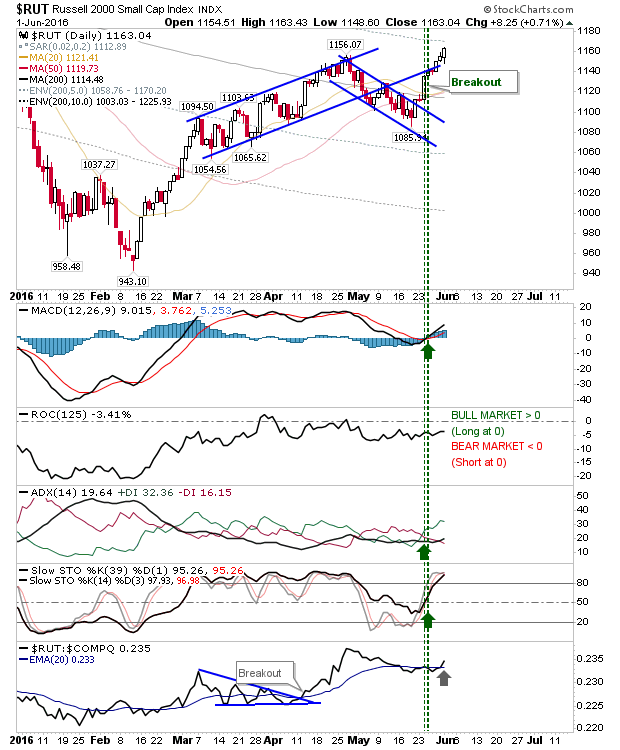

It's a slow and steady for indices as gains continued. The Russell 2000 has pushed beyond the April high and will soon be hitting the 5% boundary above its 200-day MA. This market is a long way from January and February lows and there is an opportunity for a measured move higher coming out of this.

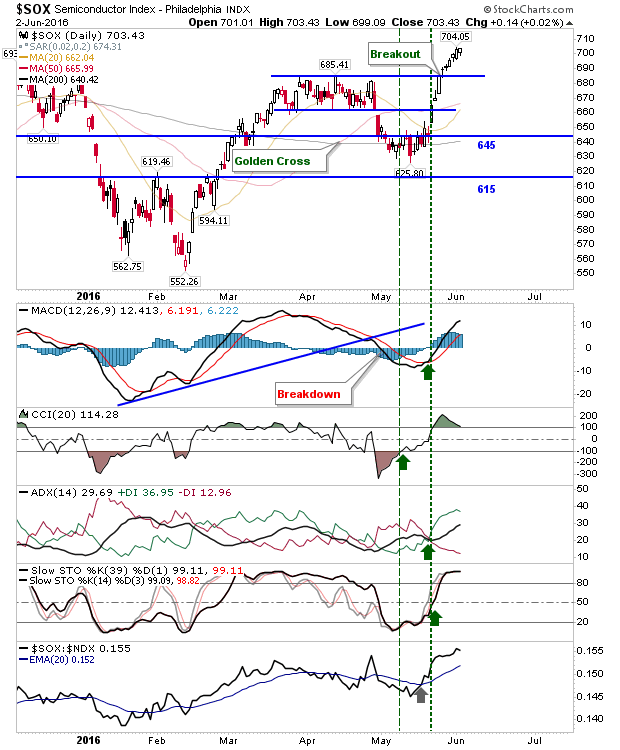

The Semiconductor Index made its seventh straight gain in a row. The index is well above 685 support and all technicals are net positive.

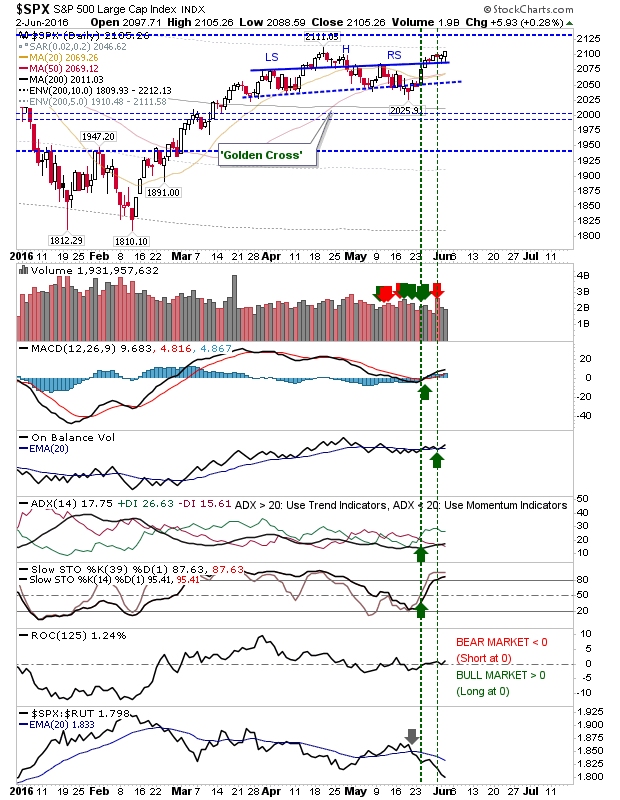

The S&P also posted a gain, but it was a relatively low key gain. It hasn't quite negated the head-and-shoulder pattern, but shorts have little room for optimism. On-Balance-Volume returned positive too.

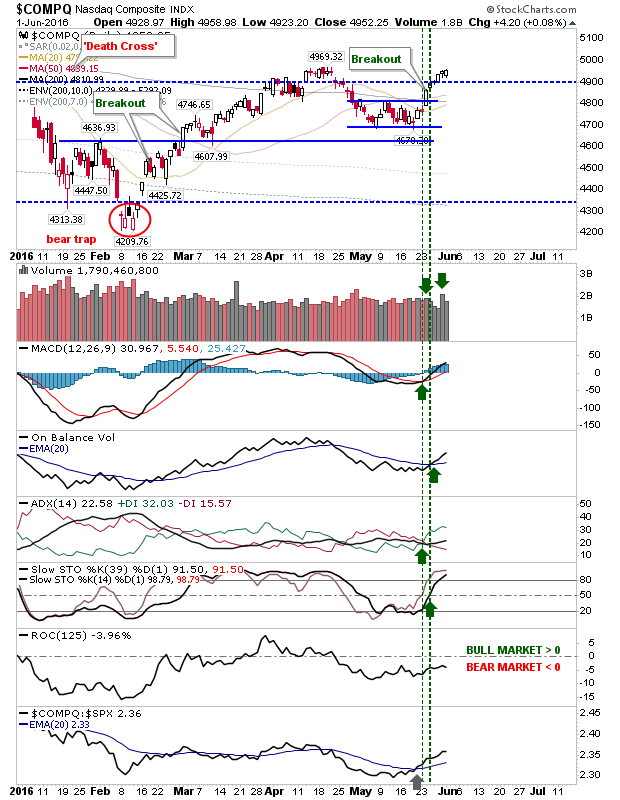

The Nasdaq is also knocking the door of new highs. It may be the last to do so, but technicals do suggest a move higher is favoured.

The short terms are looking better for bulls and the secular bull market from March 2009 may yet have another leg higher to offer. There isn't a whole lot for shorts, other than a speculative play at resistance for S&P and Nasdaq, but supporting technicals do not suggest a path to success.