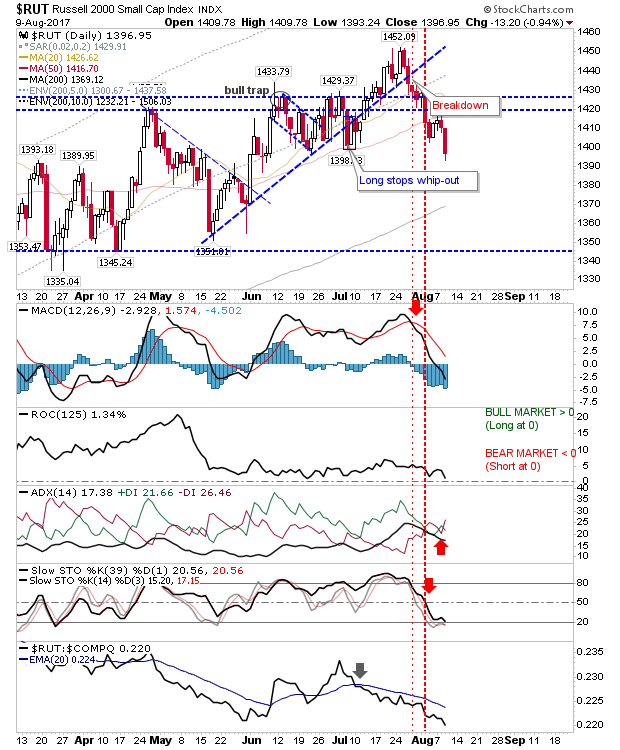

The Russell 2000 has been the index under the most pressure since peaking in July and it was the index to suffer greatest from sellers. The index is trading inside the early summer trading range and typical after a false breakout is a move back to range support, currently at 1,345. The 200-day MA will be the first port of call on the way down, which as of Wednesday's close is at 1,369.

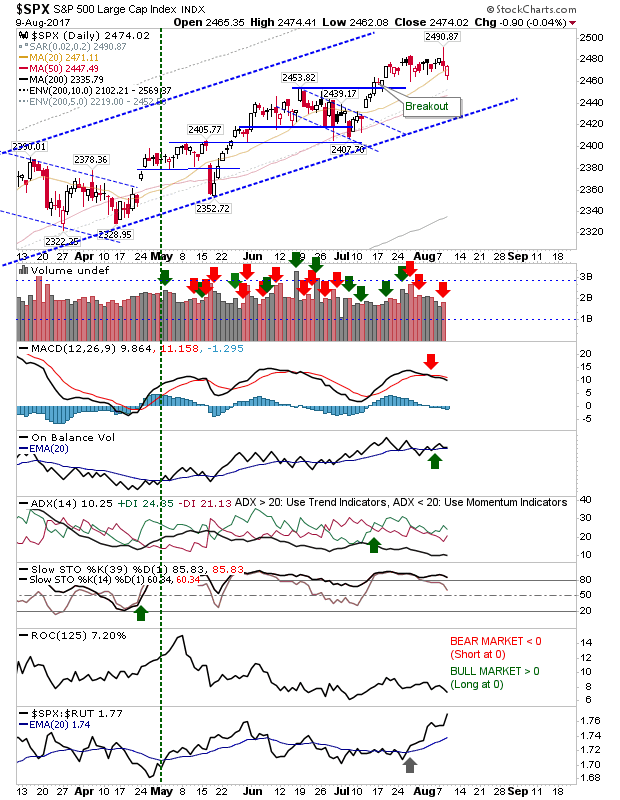

The S&P was able to post a gain after a gap down on the open – even if the net result was a flat end-of-day close. The 3-week trading range is still intact although Wednesday's lows saw the bottom of the range tagged.

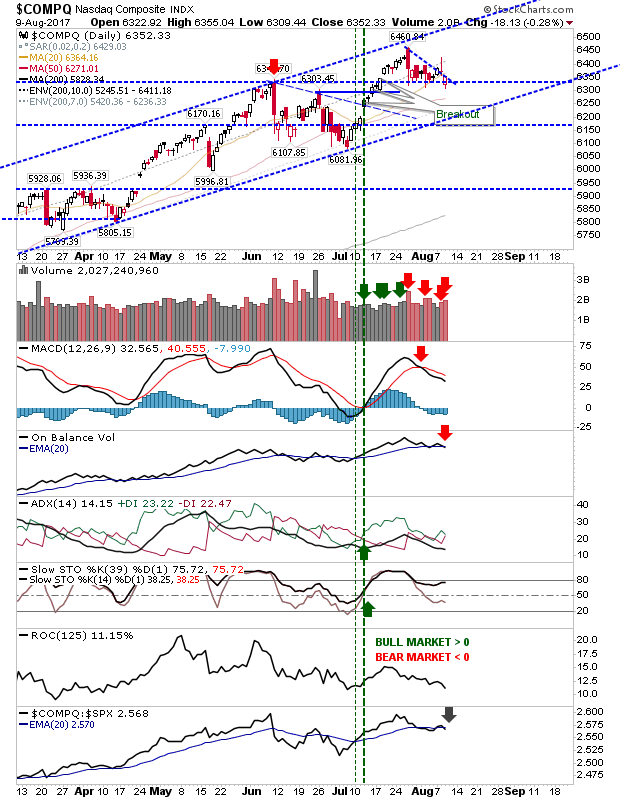

The NASDAQ is getting squeezed by 6,330 support and declining resistance generated from the July breakout. If there is going to be a false breakout then Thursday is the day it's likely to happen. Swing traders are in a position to trade with a buy above today's high of 6.355 or a short below 6,310 - stops on the flip side.

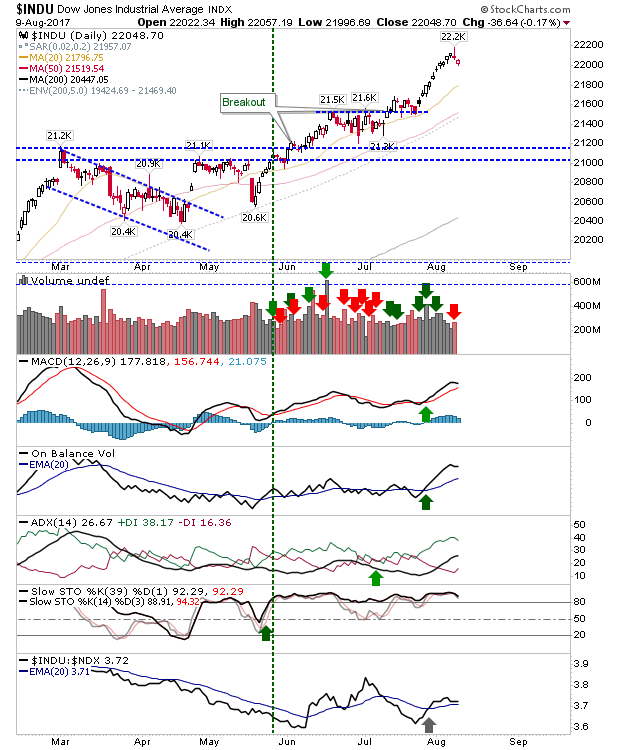

The Dow Jones may have marked a top with a gravestone doji. This will be confirmed by a retest of 22,200 which fails to take out the high. Shorts are likely to take advantage of any such test. Watch with interest.

For Thursday, watch the NASDAQ for a swing trade opportunity. The Russell 2000 may be morphing into a larger decline but after Wednesday there may be a relief bounce which will give day (bull) traders a chance to steal something. The S&P is in limbo and a breakout may be the preferred outcome. The Dow is looking vulnerable to further profit taking but shorts will need something more to enter their positions.