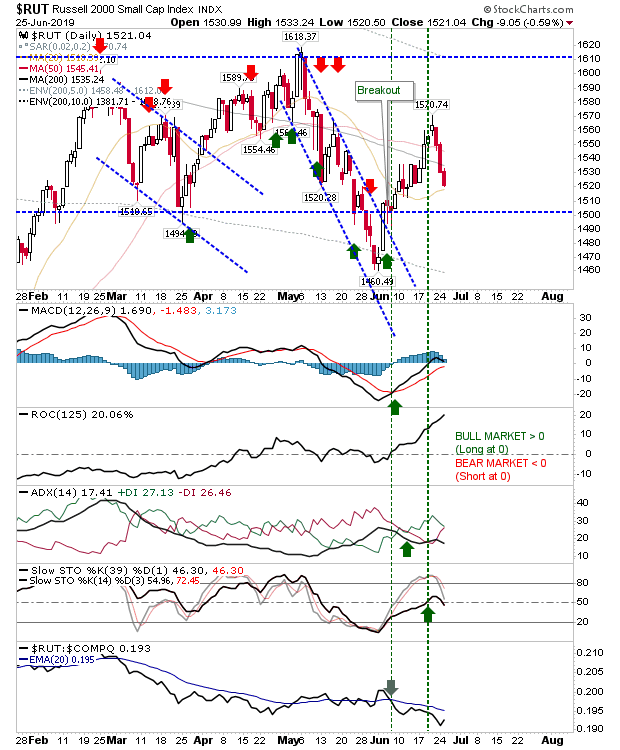

Sellers took a third day of selling out of the Russell 2000 yesterday, and this weakness made its way to the S&P and NASDAQ. The selling is more problematic for the Russell 2000 because there is a genuine lack of conviction from traders wanting to pick up an index which is trading at a deep discount to its peers.

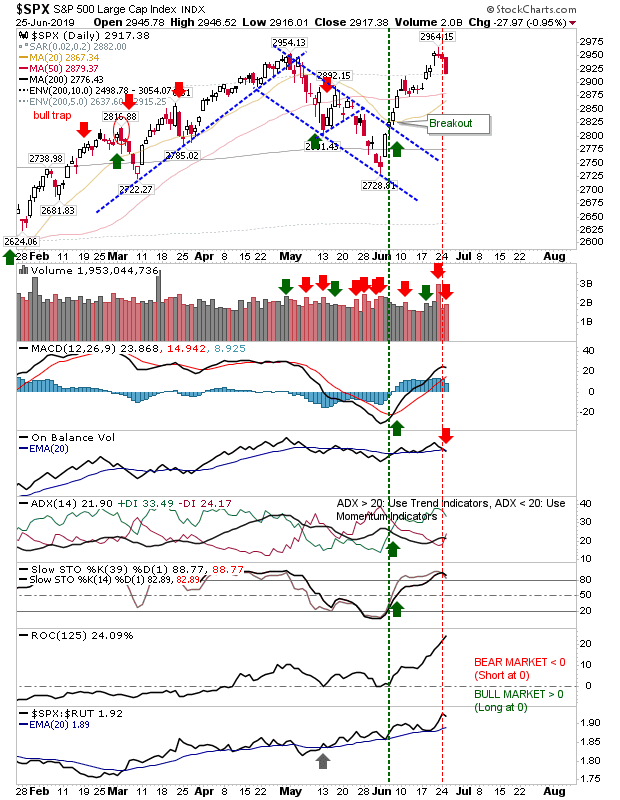

While the Russell 2000 is struggling the S&P is knocking on the door of all-time highs. Profit taking at resistance looks the most likely cause of yesterday's action but it will be important there is no acceleration into a deeper loss undercutting moving averages; 20-day and 50-day MAs to begin with.

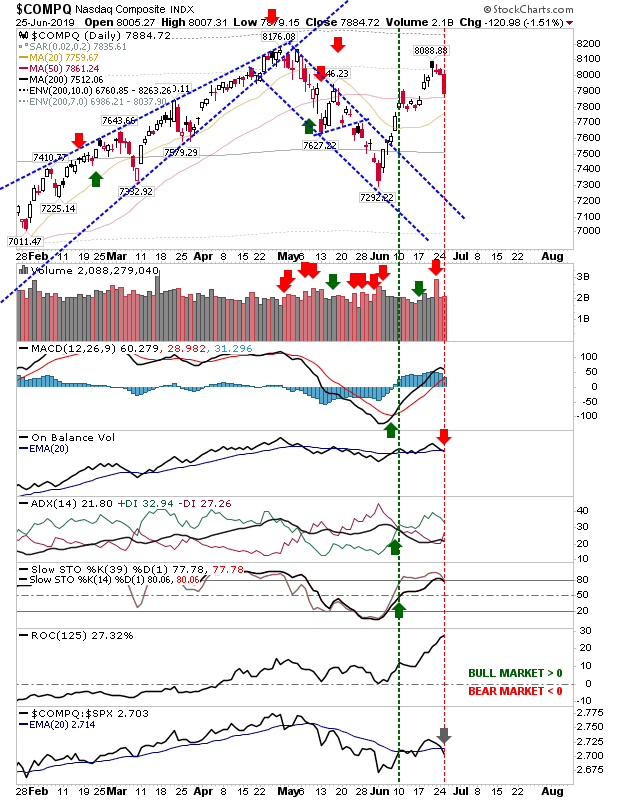

The NASDAQ is just behind the S&P but is close enough to all-time highs to mark yesterday's selling as profit taking too. The index finished on its 50-day MA, so what happens here will act as a guide for the S&P.

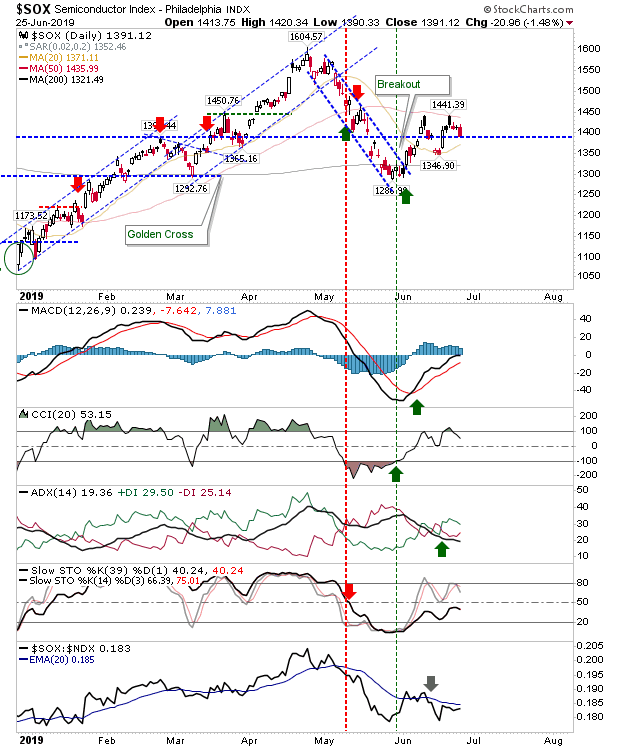

The Semiconductor Index is still caught in a bit of a no mans land with the recent consolidation bound by 20-day and 50-day MAs. If this is able to push above the 50-day MA I think it could go on a nice run, but it will need to clear the double-black-candlestick pairing at 1,441 soon enough.

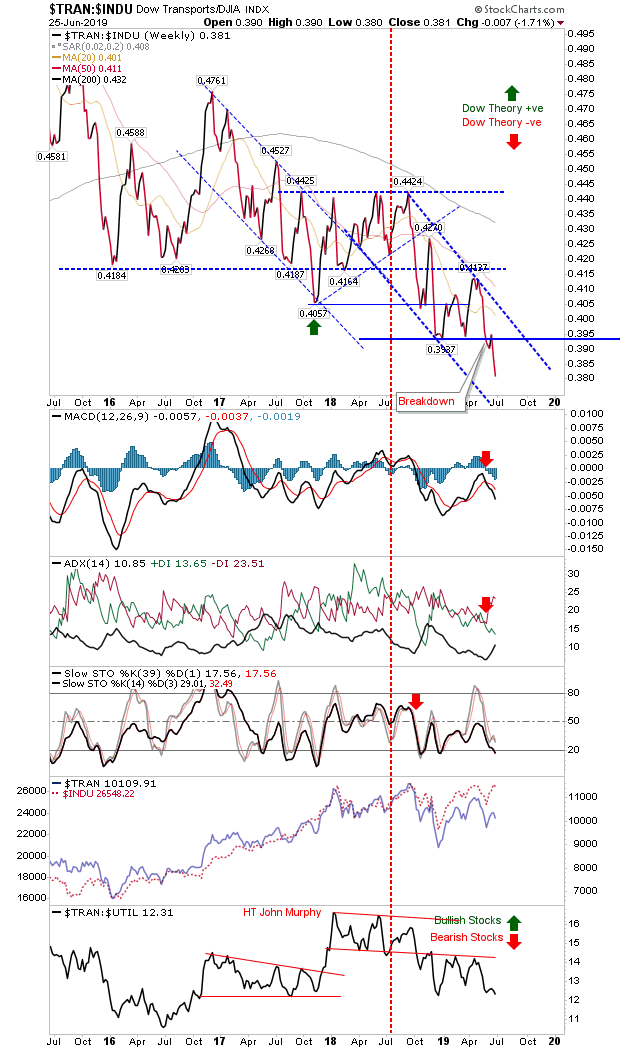

The Dow Transports and Industrial Average relationship continues to struggle with new lows in the trend. The lower Transports-to-Utilities ratio is similarly pointing to a bearish outlook for stocks.

Markets are too overbought to consider themselves at risk of a crash, but a continuation of this long standing consolidation does look a more likely outcome. Moving averages will play as a first stop for support, with May lows the last boundary for maintaining the consolidation. For now, stocks are a hold, but there is little to suggest a fresh buying opportunity is available.