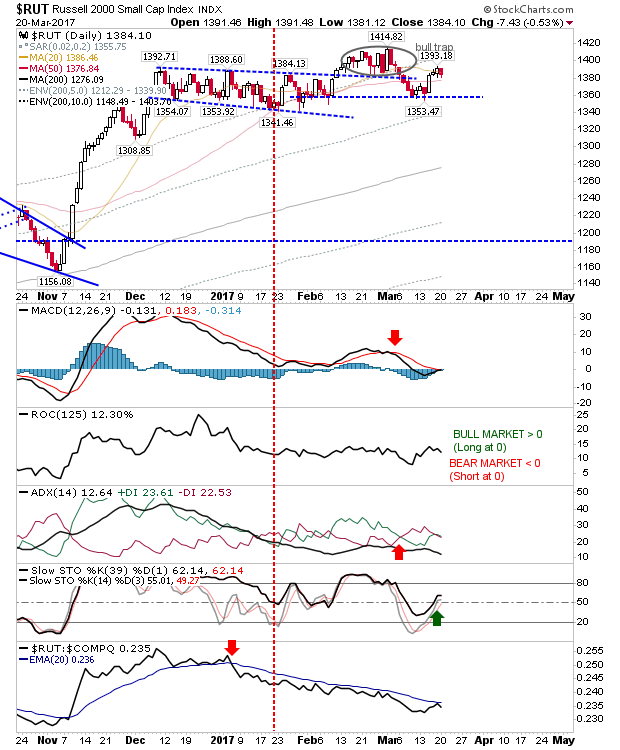

Further indecision in the markets yesterday, as a lack of participation kept volume and intraday price changes to a minimum. The biggest hit came to the Russell 2000. It lost just over 0.5% as profit taking struck the index more so than the NASDAQ and S&P. It wasn't a significant reversal, but it keeps dip buyers on their toes.

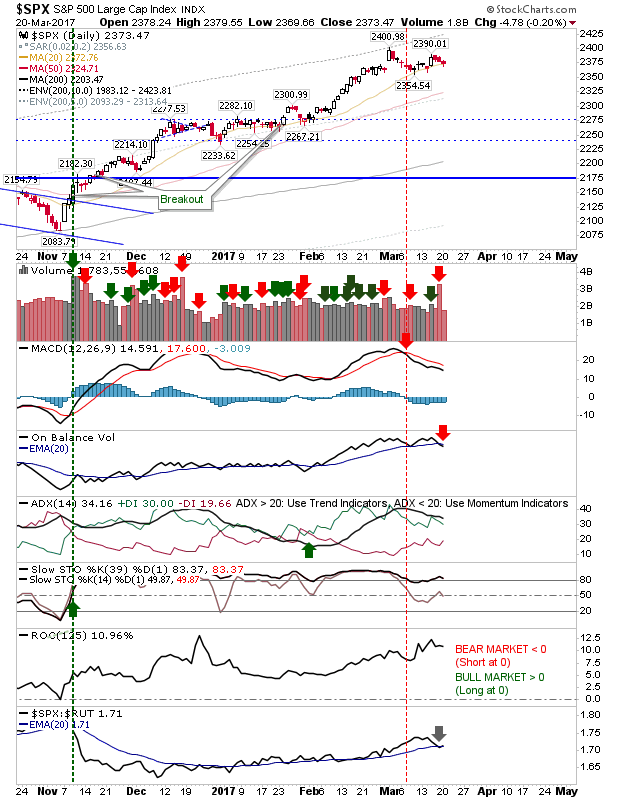

The S&P did little. Small losses on light volume with little change in technicals. Not much more to say.

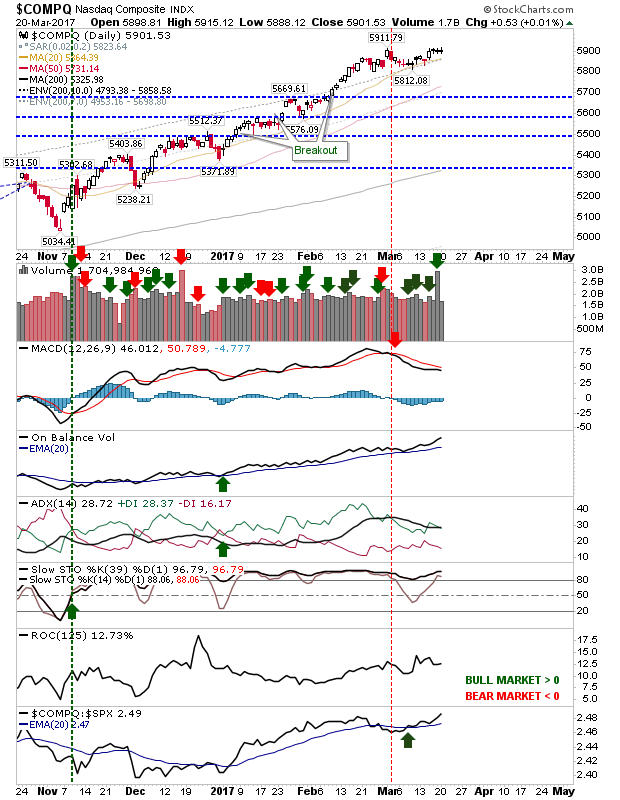

The NASDAQ experienced small gains and volume was a little heavier than experienced in the S&P, but like the S&P, there was no technical change. The impact of yesterday's action on the broader NASDAQ picture was minimal.

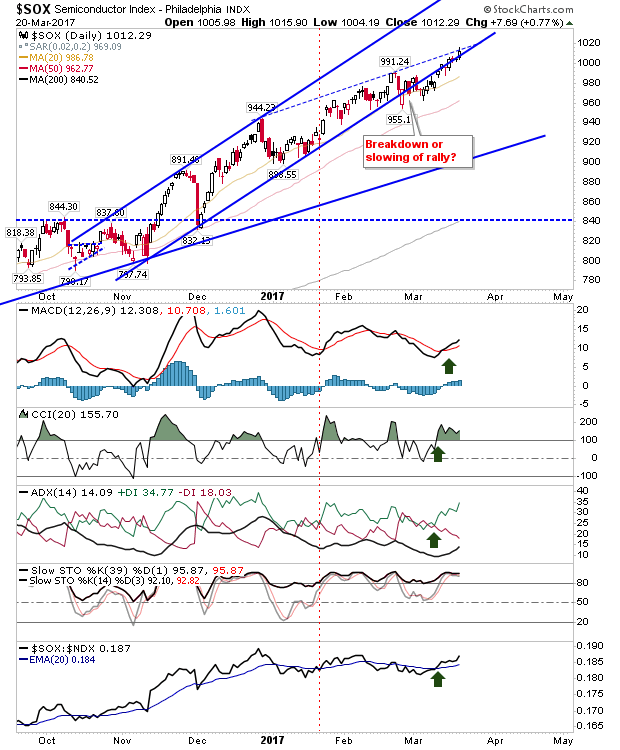

The only index to post a decent gain was the Semiconductor Index. Aggressive shorts may start looking at this today, but if it breaks the hashed blue line it could push on to the upper rising channel resistance (currently out of the displayed chart range).

For today, eyes will be on the Semiconductor Index. If the latter can break higher it will suggest the NASDAQ could follow suit and break higher. The tight intraday range over the last few days makes setting stops relatively easy, but note that once this range breaks there is likely to be run on the stops - irrespective of which side of this range the NASDAQ breaks - making the whipsaw risk high.