Market Brief

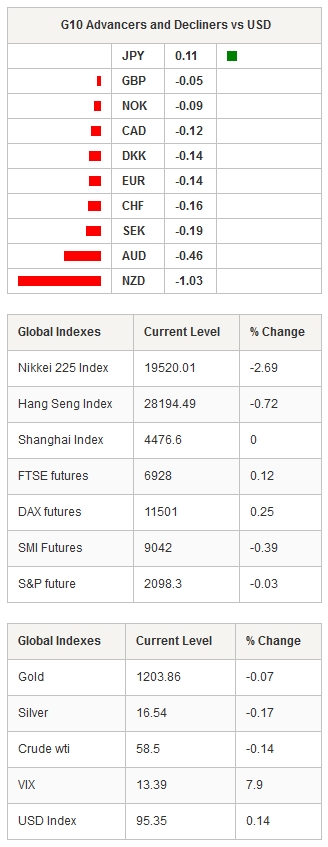

The USD was heavily sold-off yesterday amid poor US GDP data. Preliminary results indicate that the US economy grew at an annual pace of just 0.2% during the first three month of 2015 while analysts were looking for 1%. US equities were trading lower with the S&P 500 down -0.37%, NASDAQ -0.63%; small and mid caps suffered the most with the Russell 2000 down -0.99%. The yield on the 10-Year US Treasury rose by 10bps as government bonds were on sell; the yield stabilized around 2.02 afterwards. The dollar lost more than 1% and fell at 95.24, the lowest since early March.

Unsurprisingly the FOMC released a relatively dovish statement, a few hours after the disappointing growth figures. As expected, the committee acknowledges that the US economy grew at a slower pace during Q1 and added that recent weakness was partly due to transitory factors. However, Fed officials seem to remain confident that economic growth and inflation will rebound in the coming months, paving the road toward rate tightening. The probability of a rate hike in June has decreased significantly as the Fed added that “economic activity will expand at a moderate pace”. However, the fact that Fed officials remain confident in the economy means that a rate hike can happen as soon as September.

The dollar didn’t react affect the release of the statement as sellers have already been very active during the previous hours. EUR/USD reached a 10-week high at 1.1188 before consolidating during the Asian session around 1.11. The euro broke the strong 1.1043 resistance (multi highs).

In Asia, it was a tough day for Japanese equities after a first holiday. The Nikkei opened below 20,000 and ends the day losing 2.60%. In Shanghai, stocks are flat while in Hong Kong, the Hang Seng retreated by -0.71%. Australian equities are also trading lower and lost -0.83% as S&P/ASX 200 falls to 5,790. USD/JPY is getting closer and closer to the low from March 26 at 188.33. The next key support stands at 117 (psychological level and low from early February). On the upside, resistance are still at 119.74 and 120.18 (Fib 38.2% and 50% on March sell-off).

AUD/USD is running out of steam and is back from its previous high of 0.8076. The Aussie should find some support at 0.7938 (high from March 24th) and lower around the 0.7846/84 area.

As broadly expected, the BCB raised the Selic rate by 50bps to 13.75%, the highest level since January 2009. The central bank unanimous decision is more than necessary as the country has difficulty tackling rising inflation (inflation accelerated to 8.13%y/y in March) while the central bank wants to bring back inflation to 4.5 throughout 2016. USD/BRL is still in a decline channel but couldn’t break the 2.7913 support (low from March 3). We still see the BRL lower but a small correction in the short-term is not excluded.

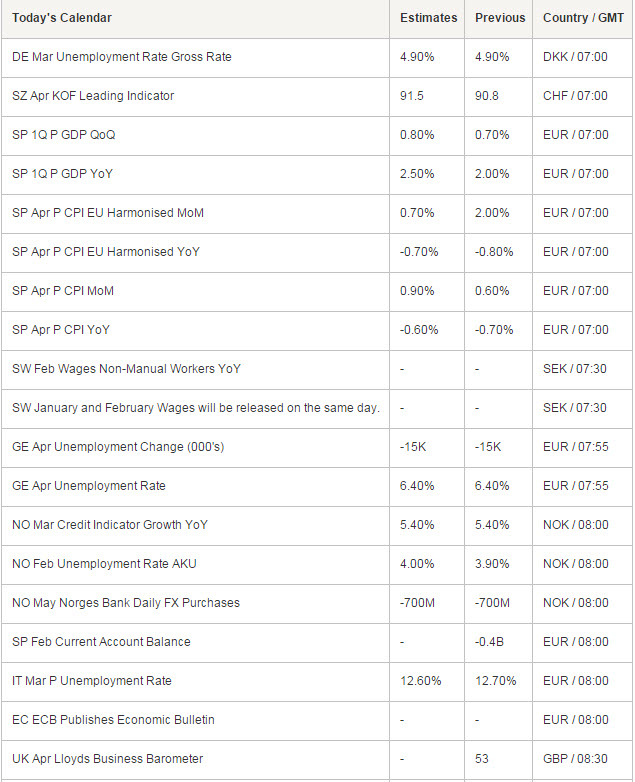

Today traders will watch Spain GDP, unemployment change in Germany and EU, Canadian GDP, personal income and spending and initial jobless claims from the US. The Chicago Purchasing Manager will also be released this afternoon. In Brazil, net debt % GDP is due as well as the nominal budget balance.

Currency Tech

EUR/USD

R 2: 1.1241

R 1: 1.1188

CURRENT: 1.1119

S 1: 1.0740

S 2: 1.0504

GBP/USD

R 2: 1.5600

R 1: 1.5560

CURRENT: 1.5431

S 1: 1.4943

S 2: 1.4750

USD/JPY

R 2: 121.52

R 1: 120.18

CURRENT: 118.87

S 1: 118.33

S 2: 117.95

USD/CHF

R 2: 0.9948

R 1: 0.9754

CURRENT: 0.9400

S 1: 0.9481

S 2: 0.9450