On Wednesday, the S&P 500 logged in as the 3rd longest bull market in the benchmark’s history. Yes, yes… bull market’s don’t die of old age. Yet, what about health-restoring corrections of 10%? Shouldn’t they appear more regularly than 45 months (1371 days)? The current period of equanimity now registers as the 3rd longest without a 10% pullback.

In my recent article on the debt-driven economic expansion, I focused on the Federal Reserve’s acquisition of $3.75 trillion of the public Treasury debt with electronic dollars (a.k.a. “credits”). Naturally, record-low yields enticed families to borrow more money; they bought real estate and stocks through their 401ks, pushing prices higher and making households feel wealthier. More critically, however, corporations borrowed by the boat-load to finance similar acquisitions. In fact, non-financial companies currently owe 37% of their net worth. That’s greater than the 34% leverage witnessed back in 2007.

Some folks might argue that 37% really isn’t that big a deal. After all, it represents an improvement over a 45% debt-to-net-worth ratio in 2009, doesn’t it? Not exactly. When asset prices inevitably decline – perhaps by an average bear of 29%-30% – net worth will drop dramatically while the debt will remain the same. In this manner, the typical corporation may be a bit like an emperor wearing little more than his undergarments.

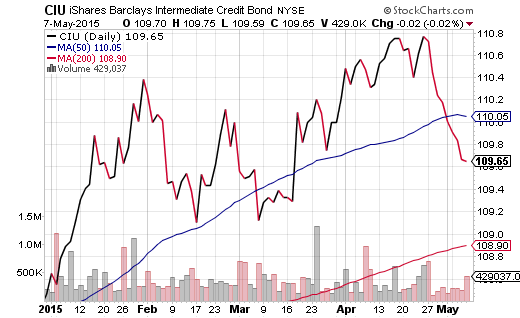

Corporate debt yields have skyrocketed as of late. The iShares Intermediate Credit Bond Fund (NYSE:CIU) sits at the farthest point below its 50-Day moving average than at any other moment in 2015.

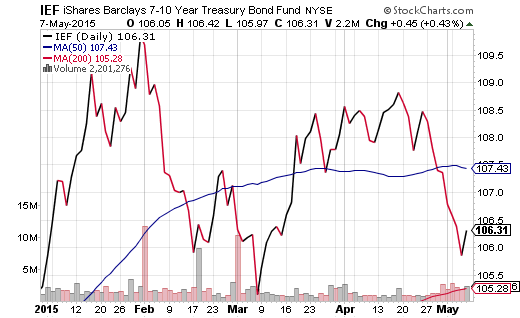

Does the near-term direction have anything to do with a lack of faith in the ability of investment grade companies to service their obligations? Not likely. Panic selling of sovereign debt, primarily in German bunds, but also with U.S. treasuries, contributed to the bond repricing. Add in a reversal of the euro carry trade, and owning U.S. dollar denominated Treasuries became hazardous. Year-to-date gains for the iShares 7-10 Year Treasury ETF (ARCA:IEF) have been nearly wiped out.

Bond investors should not anticipate the beginning of a bond bear, however. The economy’s weak data do not support tightening and Federal Open Market Committee (FOMC) members like Chicago’s Charles Evans know it. That is why he is now suggesting that rate hikes can wait until 2016. In fact, it might not be long before other voting members express a similar sentiment. Job growth is slowing, oil prices are rising and earnings growth is flatlining.

It gets worse. Remember, nearly every economist on the planet expressed that lower oil prices would amplify consumer spending. Yet U.S. import data suggest that consumers have less punch than a boxer with one arm tied behind his back. Manufacturers? The Institute for Supply Management’s (ISM) index of factory activity only registered 51.5 in April, which served as the lowest reading since 2013. In other words, there may not be a “winter thaw.”

The biggest problem that the Fed faces now is whether or not it will be willing to push ahead on a monetary tightening course at any point in 2015. Conventional wisdom suggests that committee members are capable of saying and doing all of the right things to keep stock and bond investors from losing the faith. Unconventional wisdom? Perhaps the Fed reads the tea leaves wrong or perhaps they will be willing to let stocks slump and/or yields soar. Both would be rather traumatic for “diversified” asset allocators.

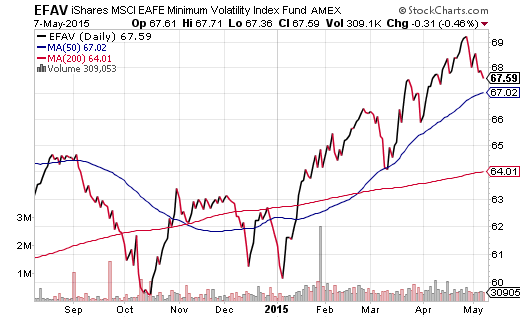

Lengthy periods without corrections are statistically uncommon, particularly when an economy is struggling and the Fed is tightening. Having some extras cash on the sidelines is prudent. Today, I’d be a buyer of 10-year Treasury proxies like IEF as well as longer duration munis in taxable accounts like Blackrock (NYSE:BLK) BlackRock Muni Assets Fund (ARCA:MUA). And if you are light on the international exposure, you might look for a bit less volatility from iShares MSCI EAFE Minimum Volatility (NYSE:EFAV). The European Central Bank’s (ECB) commitment to quantitative easing is ultra-accommodating in the world of rate lowering manipulation.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.