The U.S. economy is in trouble. After expanding at a modest 2.2% in the 4th quarter, economic growth dimmed to a scant 0.2% in Q1 of 2015. Yet privately, many are acknowledging the likelihood that revisions to first quarter gross domestic product (GDP) will indicate a trend toward contraction.

Should investors actually concern themselves with economic uncertainty? If recessions are the primary reason for bear markets in stocks, then the answer is obvious: Yes. Still, U.S. stocks have thrived throughout six years of a sub-standard recovery. Unless recent weakness is anything more than a soft patch, market participants have little reason to fret.

Unfortunately, economic softness may not be as transitory as many would like to believe. For one thing, the Atlanta Federal Reserve anticipates 0.8% Q2 growth for the U.S. economy. Those expectations continue to drift lower. Secondly, stock enthusiasts do not have the U.S. Federal Reserve’s bond-buying stimulus (a.k.a. quantitative easing or “QE”) to fall back on anymore. In fact, voting members of the Fed publicly express a desire to raise overnight lending rates – a tightening measure that could further dampen growth prospects.

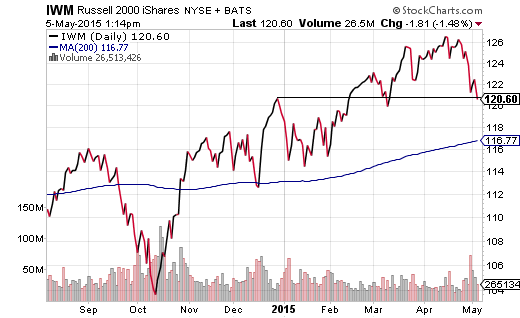

Risk may already be heading for the exits. According to FactSet, $16 billion left U.S. stock ETFs in April, with the lion’s share ($13 billion) leaving the S&P 500 SPDR Trust (SPY). Additionally, owners of more risky equity prospects – social media, biotech, small caps – have been liquidating. Russell 2000 iShares (IWM) is down nearly 5% from its mid-April pinnacle and now rests near its 2014 high from December.

Another reason for caution? The euro carry trade may be unwinding. Specifically, leveraged money managers have been borrowing the “sure-to-depreciate” euro to invest in “sure-to-appreciate” U.S. dollar-denominated assets (e.g., U.S. stocks, U.S. bonds, the U.S. dollar, etc.). However, CurrencyShares Euro Trust (FXE) has climbed above a 50-day moving average and has stayed above its 50-day for the first time in twelve months. This may be a sign that traders are being forced to liquidate dollar-denominated assets to pay back their euro loans.

Granted, U.S. multinational corporations might actually benefit from a depreciating buck. Exports might swell; revenue generated in foreign currencies might improve profitability prospects. Regrettably, U.S. stocks are already overvalued by traditional valuation metrics. It follows that waning enthusiasm for U.S. dollar-denominated assets may not be temporary. Rather, U.S. stocks may require a health-restoring correction coupled with comments by voting members of the Fed indicating the unlikelihood of any meaningful hike in borrowing costs.

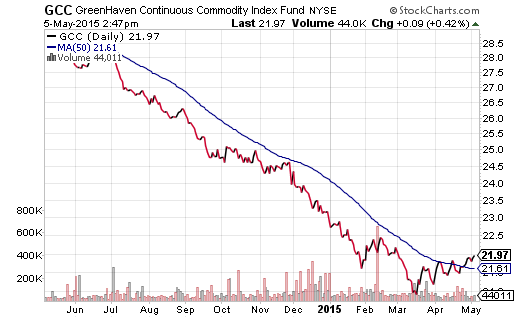

Raising one’s allocation to cash may be a regal alternative while waiting for brighter opportunities out on the horizon. That said, someone who wishes to hedge dollar risk today may wish to investigate the much-maligned commodity space. Since the mid-March highs in the dollar as well as the broader equity market, SPDR Gold Trust (GLD) and the United States Oil Fund (USO) have gained ground. Similarly, Greenhaven Continuous Commodity (GCC) has reclaimed a near-term uptrend with its recent move above a 50-day moving average.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.