The U.S. government spent $7.50 trillion above the country’s budget over the last six years to encourage economic growth as well as fulfill pre-existing obligations (e.g., defense/military, agriculture, Medicare/health, Social Security, education, transportation, interest on the federal debt, etc.). Yet the economy still only grew at annualized 2.1% in the period – a growth rate that is far lower than the expected average of 3.0%.

Similarly, the U.S. Federal Reserve created electronic dollars in the neighborhood of $3.75 trillion, encouraging investment in automobiles, equities and real estate at artificially low interest rates. People did buy cars, shares of stock and homes; prices did move higher, making homeowners and 401k plan participants feel wealthier. Nevertheless, public corporations primarily borrowed money at ultra-low rates so that they might repurchase their own stock shares, largely avoiding more productive avenues for the cash (i.e., research, development, mergers, acquisitions, marketing, human resources, training, product/service roll-out, technological upgrades, etc.). Financial engineering does little, if nothing, to help an economy grow.

In the end, there’s simply no avoiding a number of unfortunate realities. First, the U.S. economy has not been able to grow at its historical rate of 3.0% since the Great Recession’s official farewell, even after $7.5 trillion in excess government spending and $3.75 trillion in Federal Reserve interest rate manipulation. Second, the U.S. economy is nearing the possibility of contraction, practically stagnating since the Fed ended a third round of emergency level bond buying (”QE3″) at the tail end of October. Third, the U.S. economy – from the individual to the household, from the business to the government entity – is now addicted to debt. Consumption is driven by debt; entitlement fulfillment is dependent on the borrowed buck as well.

There’s enough blame to go around. Politicians do not get elected without making promises, many of which they cannot keep due to insufficient funding. Meanwhile, Fed policy makers do not have a goal of fortifying a house made of straw. They only have a predisposition to fueling credit expansion in the hopes that it might maintain an illusion of prosperity; if the mirage lasts long enough, employers might offer real positions with real wage growth. Sadly, a mirage is fleeting by nature.

Ask yourself a few basic questions. If the economy were genuinely humming, then why haven’t policy makers been able to move overnight borrowing costs back up to historical levels of 4.0%? The former Fed chairman, Ben Bernanke, has already acknowledged that we will not see “normalized” rates in his lifetime. Why has it taken six-plus years to get to a point where the world agonizes over how and when the Fed will move the overnight target rate up a measly quarter of one percentage point? The answer is obvious: the #1 economy in the world is addicted to borrowing at insanely cheap levels. It follows that even the most modest gesture to tighten the reins can have a “Big Gulp” impact on investor psyche.

If you see the forest for the redwoods, rather than a lake surrounded by a wall of palm trees, you recognize that our economy is a function of debt addiction at every conceivable turn. At first, business and consumer borrowers celebrate bargain-basement rates for accessing capital. The longer the rates stay low, the less pressure many feel to pay back the debts, choosing to pay back the interest alone and/or even take on more debt. A person or family or business or government would be stupid not to borrow with the cost of capital so low, right? Unfortunately, other people’s money often moves from solution to a problem, to a problem without a solution. Either the debt balloons to a place where even the interest on the borrowed money has become too difficult to pay back. Or, equally burdensome, higher borrowing costs and/or more onerous terms displace the easy access to low rates, stunting a debt-driven economic expansion in its tracks.

What are the investment implications of living in the late stages of a debt-driven economic expansion? First, investors need to recognize that an irrational rush for the exit doors by the overwhelming majority of market-based participants is inevitable. The depth and length of the panic period may be unknowable, but its occurrence is guaranteed. It typically starts with the breach of an unwritten code; some call it a “moral hazard.” For instance, in 1998, a nuclear superpower in Russia defaulted on its sovereign debt. Once the “too-important-to-fail” moment transpired, it caused a chain reaction in the selling of virtually every risk asset — foreign sovereign debt, emerging market currencies, stocks, high yield bonds, even investment grade U.S. bonds from the Wal-Marts of the world. No matter what the premium for ownership, no mater how silly it might look in terms of yield spreads, the only desirable assets were the perceived safety of long-term U.S. treasuries. In the end, only an orchestrated bailout of the highly leveraged hedge fund, Long-Term Capital Management, and Federal Reserve market intervention, quelled the collapse.

What about 2008? The Fed-orchestrated bailout of Bear Stearns kept market-based investors from abandoning hope in the early months of the year. Unfortunately, the unwillingness to bailout Lehman brothers later in the year kicked off a six-month period (9/15/08-3/9/09) of unprecedented volatility and despair. The “code” had been violated. The problem was with the banks, of course. Toxic debt.

How about 2011? Until the European Central Bank assured the world that it would do whatever it takes to protect hopelessly indebted borrowers like Greece, Portugal and Spain – until the U.S. Fed served up its third round of controversial quantitative easing (QE3) without a stated end date – investors refused to take any risks. Instead, they paid astronomical premiums to own U.S. treasuries, gold and/or the greenback to avoid exposure to the possibility that over-indebted countries would be allowed to default.

In essence, the crises of 1998, 2008 and 2011 shared a common element of borrowed money. The depth and length of the ensuing investment panics differ based on the responses by the parties in charge of the bailouts.

It should be noted, however, that the ability of central banks to ride to the rescue was much greater in previous years than it is today. This brings up the second implication for investors in this late-stage, debt-fueled economic expansion. With the U.S. economy showing unfriendly indications of eroding strength, and the Fed still angling to maintain credibility with an attempt to push overnight lending rates a “smidge” in the direction of tightening, how long before the central bank of the United States will find itself needing to reverse course? Will they be able to do it fast enough to maintain record levels of margin debt betting on ever-pricier stocks continuing to appreciate in value? Or, as history suggests about over-borrowing by governments and financial institutions, when a perceived “moral hazard” eventually happens, will the rush to sell risk assets trigger margin calls. Throughout history, record margin debt eventually turns such that those involved are forced to sell positions. That reduces the value of the collateral, setting off more margin calls and triggering more selling and more margin calls until, eventually, the entire market-based universe is battling to get out a tiny exit hatch.

The final implication for investors is, “What should I do now?” Plainly, you need to invest for your goals, but plan for the worst. This is achieved by pruning winners, dumping losers and raising cash for future opportunity. For example, maybe you have held Health Care Select Sector SPDR (ARCA:XLV) for the last five years. And maybe it represented 7% of your portfolio when you began, but now it represents 12%. As much as it may pain you to reduce exposure on a long-time winner with few signs of slowing down, rebalancing back to the original 7% is the sensible move in a latter stage-bull market.

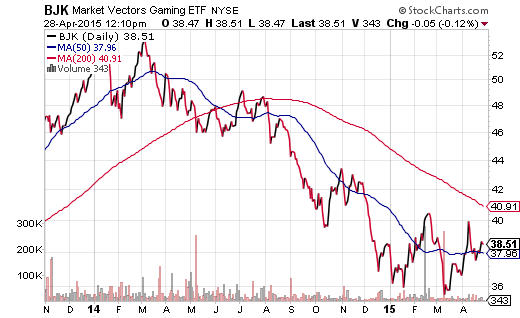

By the same token, you may have a few losers in your portfolio that you had tremendously high hopes for when you bought them a year or two earlier. For instance, let’s say that you went into 2014 with the well-researched belief that consumer discretionary spending would benefit the gaming sector more than any other. So you purchased the sub-sector investment, Market Vectors Gaming (NYSE:BJK). After all, a massive increase in tourism to Macau in Asia had already led to the island generating more than 5x the revenue of Las Vegas. Other countries and other states were in the process of loosening regulations on casino development. And even the casino operators in Las Vegas has been expected to report fabulous growth. Nevertheless, BJK has been disappointing enough for an investor to take his/her lumps and raise cash for a better allocation down the road.

Finally, having cash for future investment in a late-stage bull should be looked upon as an asset. Far too often, you will hear folks complain about their money making no money in accounts with virtually no interest. On the other hand, there is a reason that Warren Buffett has $65 billion sidelined in non-productive cash. One of the most famous investors on the planet is patiently waiting for the next panic, crisis, crash or sell-off before redeploying into a growth or income champion.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.