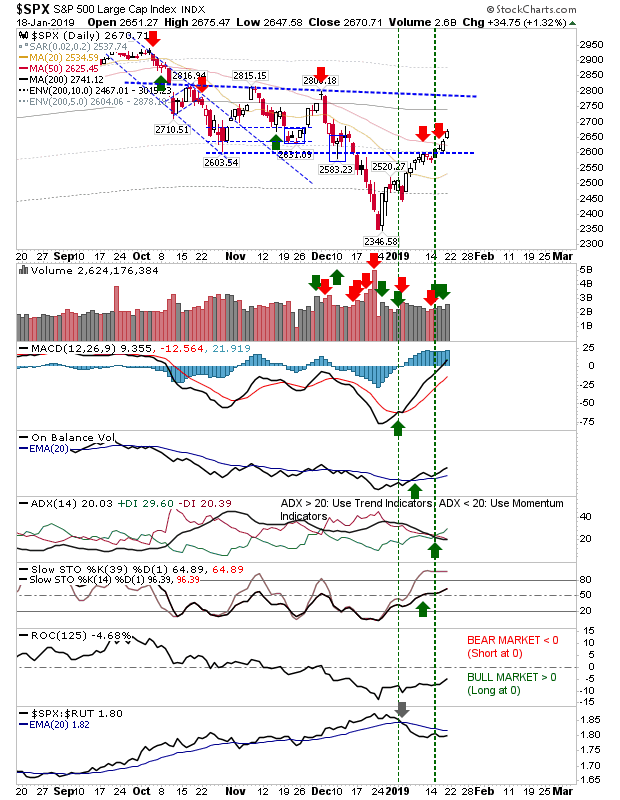

Friday's second day of gains put another squeeze on shorts. Resistance was handily broken on higher volume accumulation, leaving markets in an area of indecision with neither shorts nor longs holding a clear advantage. However, each advance strengthens the December swing low as a major low—opening up the next retest as a buying opportunity.

The S&P pulled away from congestion on net bullish technicals. Next upside target is the 200-day MA but the index is underperforming against the Russell 2000.

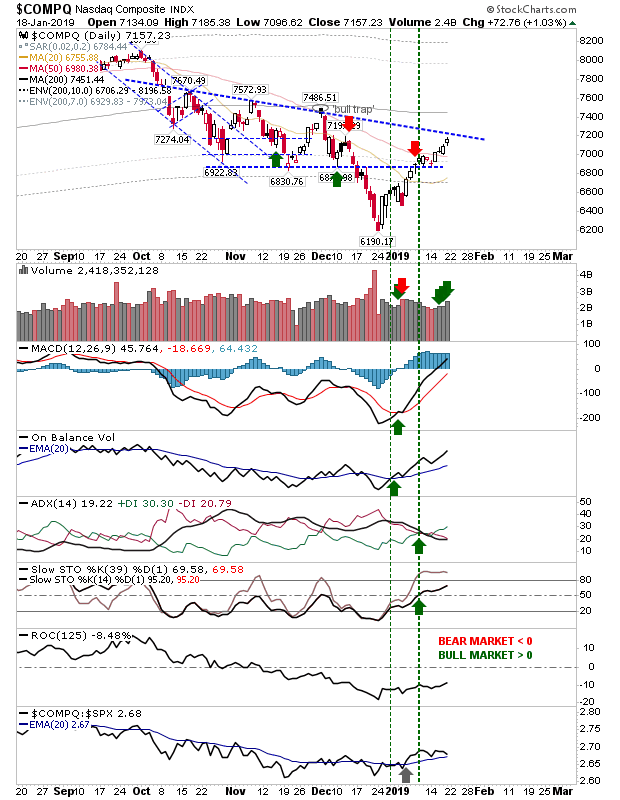

The NASDAQ is approaching declining resistance and a second shorting opportunity. The relative advantage (vs the S&P) is slowing but not reversed.

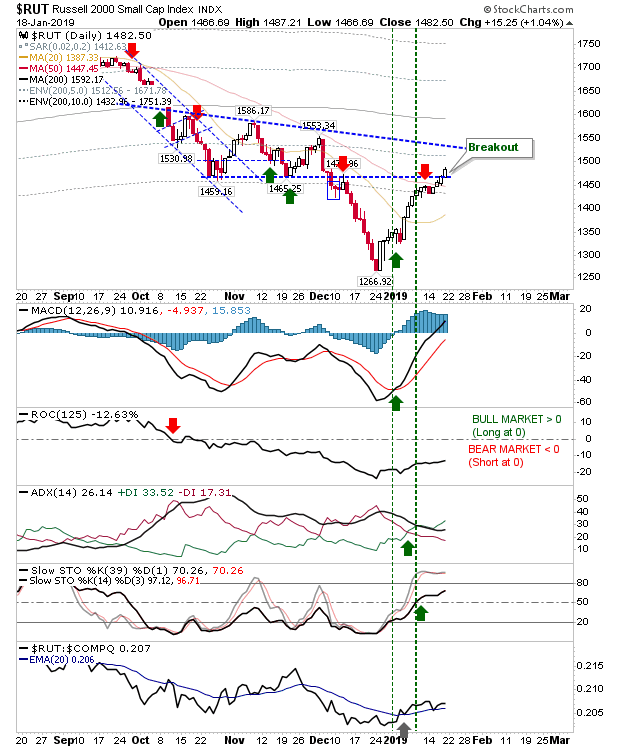

The Russell 2000 breached resistance as declining resistance and 200-day MA become the next upward targets. There is a little bit of wiggle room for bulls who want to trade the breakout to the aforementioned targets.

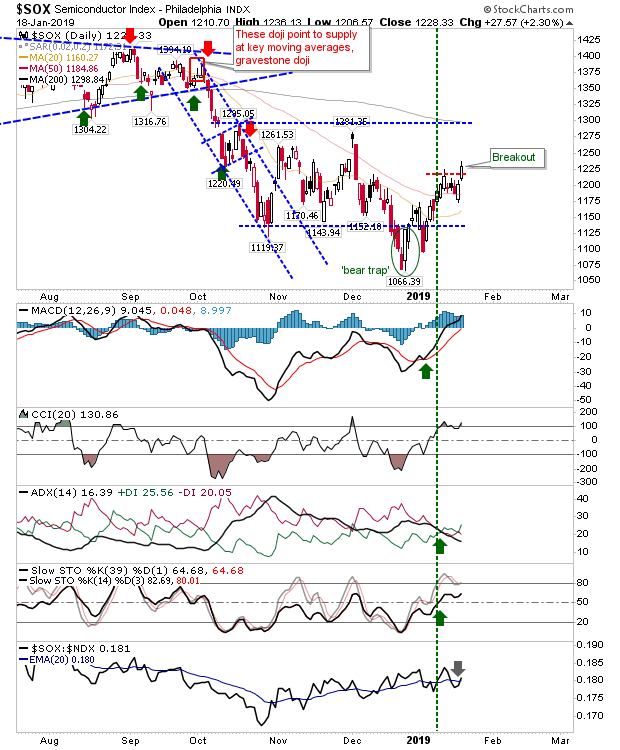

The Semiconductor Index had the clearest in-play short (with no whipsaw) but this was neatly undone by Friday's gain. Of the potential long trades, it looks best with a target of 1,295.

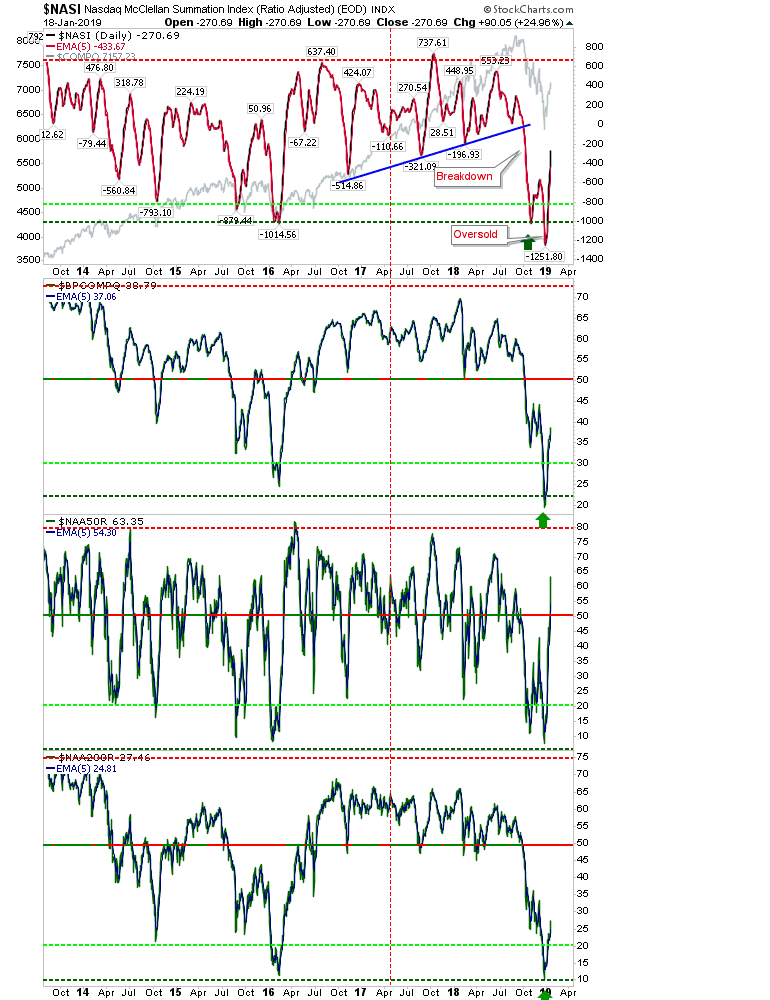

Breadth metrics have recovered strongly but you can still see plenty of room for upside; this is a scenario similar to what we had in 2016.

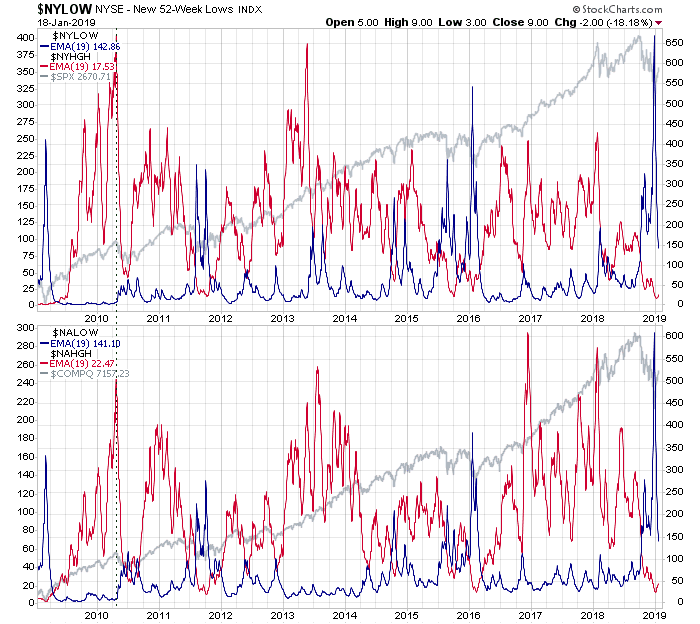

The 52-week lows also had a major spike (well beyond the spike of 52-week lows in 2016); another reason for bullish optimism.

For tomorrow, bulls can look to the Semiconductor Index and Russell 2000 for new long trades. Shorts are out of the picture for now.