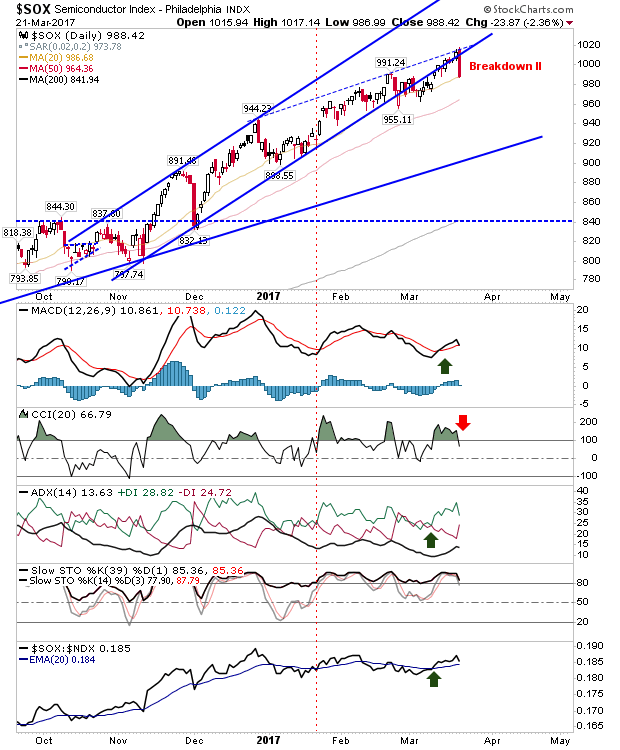

For those who took advantage of the resistance test in the Semiconductor Index, there was a picture perfect test of the hashed blue line resistance and secondary break of former rising channel support yesterday. The Semiconductor Index finished bang on the 20-day MA so there may be a little (big?) bounce later today. If buyers can't defend the 20-day MA then the 50-day MA is next.

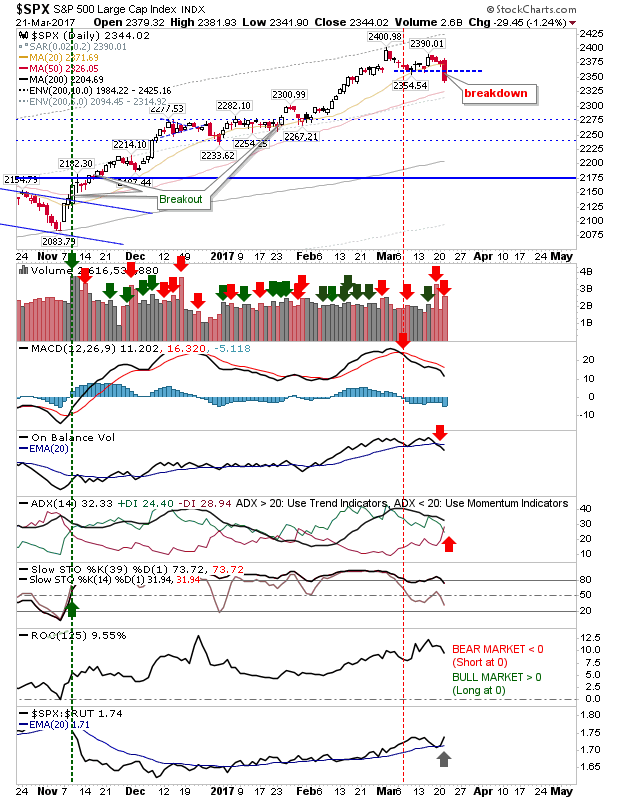

The S&P did not experience the biggest loss yesterday, but it did undercut the recent swing low. In fact, the relative performance of the index against the Russell 2000 kicked on in the S&P's favour, but it may not be enough. The next logical test is the 50-day MA at 2,326. Yesterday was also marked by significant distribution and a 'sell' trigger.

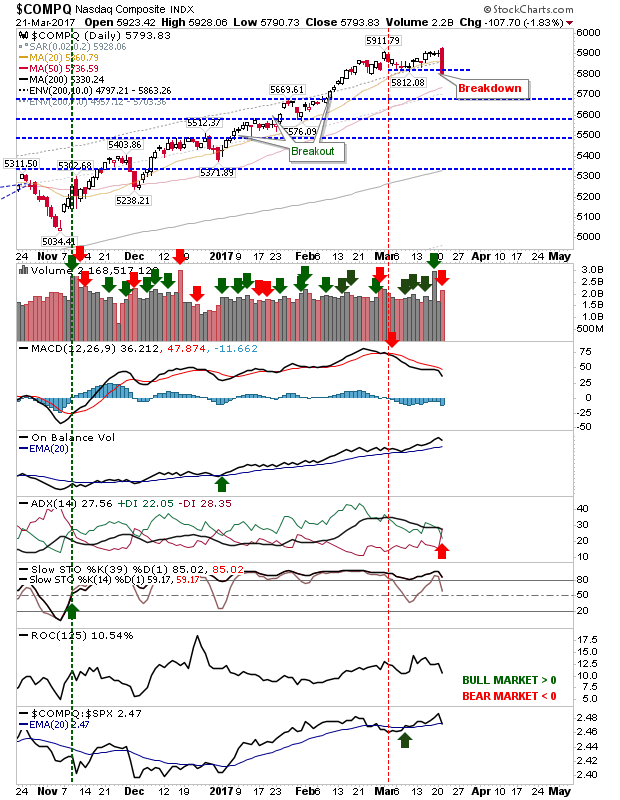

It was a similar story for the NASDAQ as it undercut the swing low. Volume climbed in distribution (as it was for other indices) with a new 'sell' trigger in +DI/-DI. The only hang-on for bulls is bullish stochastics. The 50-day MA at 5,736 is looking like a good place for buyers to return to the index.

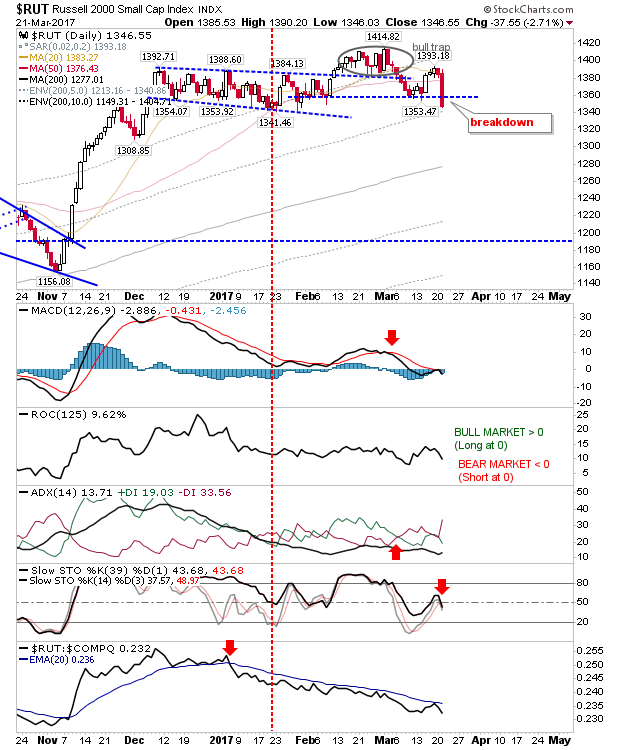

The Russell 2000 was the weakest index coming into yesterday, and indeed it gave up close to 3% as sellers swarmed the index after having long said goodbye to its 20-day and 50-day MAs. The next question is whether it can defend 1,342; if it can't, then it's about looking at the 200-day MA.

For today, given the extent of 1-day losses over the last 6-months (not many), the likelihood of a rally is quite high. The indices hardest hit - the Russell 2000 and Semiconductor Index - are most likely to post the biggest gains. However, if there is not a positive reaction in the first half-hour of market action, then these same indices will be most likely take the biggest losses.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.