Investing.com’s stocks of the week

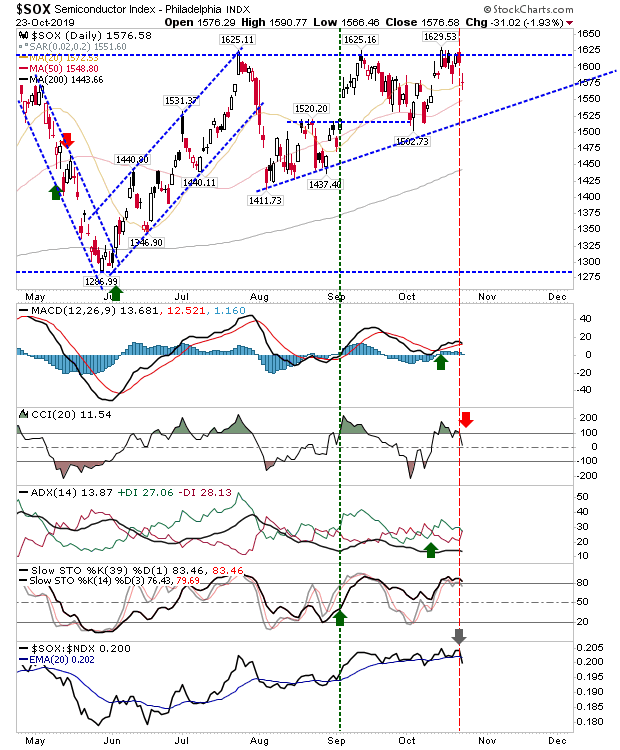

There wasn't a whole lot attached to yeserday's action except for the Semiconductor Index. It fell back inside its prior consolidation, falling below 1,620 in a near 2% loss.

The Index was able to hold on to support of its 20-day MA on a neutral doji. Relative performance turned negative but the breakout is not killed yet.

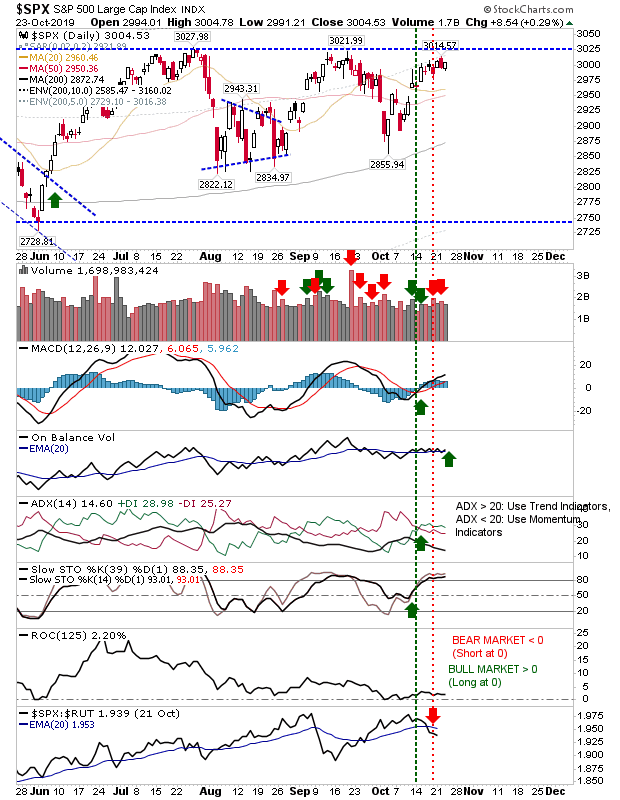

The S&P saw a gain which keeps the index primed for a breakdout. On-Balance-Volume returned to a 'buy' trigger but relative performance against the Russell 2000 took another step lower.

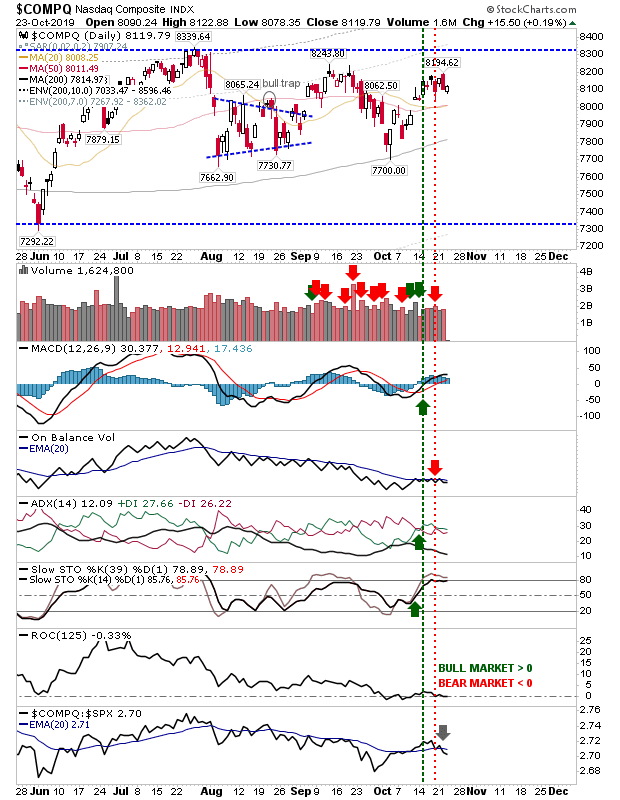

The NASDAQ also enjoyed a small gain and while further away from resistance it's also well placed for a breakout. Unlike the S&P, the NASDAQ still has a 'sell' trigger in On-Balance-Volume to reverse. It's also underperforming against the Russell 2000.

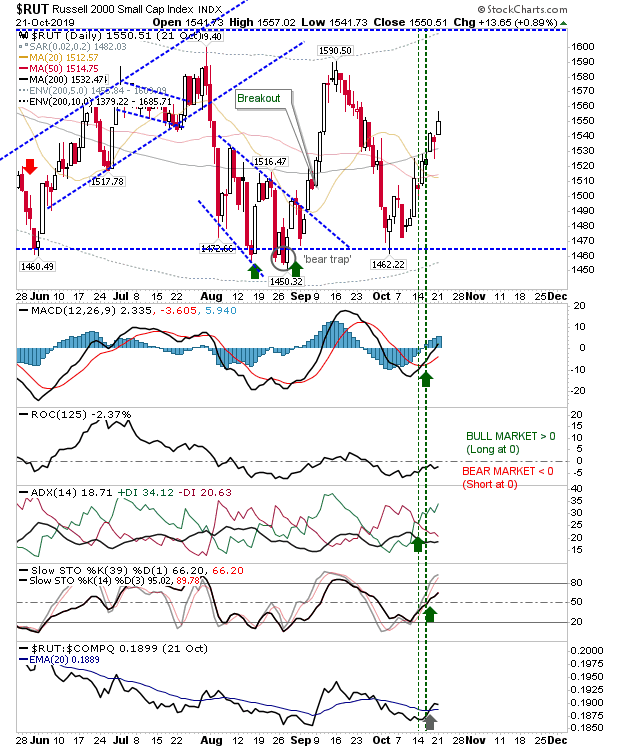

The Russell 2000 made the biggest gain on the day yesterday, which contributed to the relative performance gain against the NASDAQ and S&P. Nevertheless, it's still in the process of making up for lost ground on these indices and remains some way from new all-time highs.

With the Semiconductor Index falling back, attention can now shift to the S&P and NASDAQ. Both of these indices are well set to deliver breakouts of their own, even if they are underperforming against the current favorite, the Russell 2000.