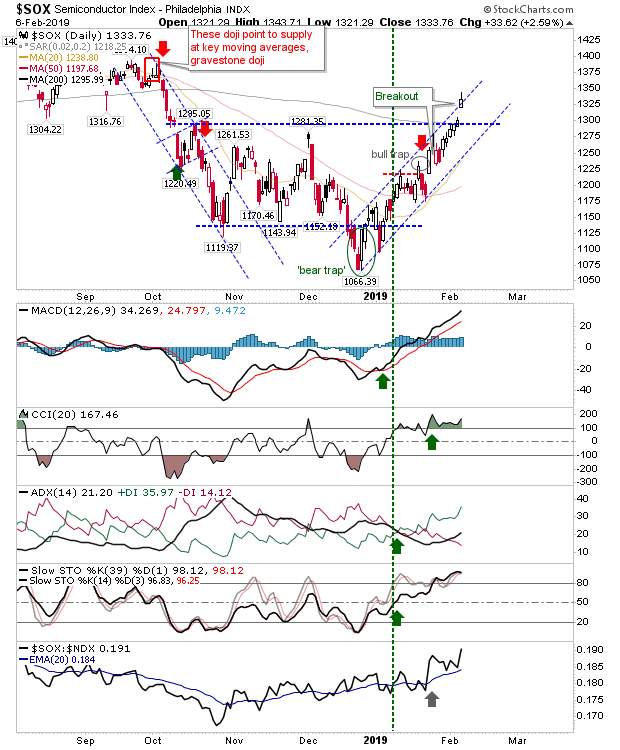

This bounce which kicked off in December has reached levels which are getting rich for many but not for the Semiconductor Index.

The Semiconductor Index gapped higher which keeps it hugging the channel resistance line but also offers a buffer down to support; yesterday's action registered as a breakout. Technicals are in good shape and relative performance is good.

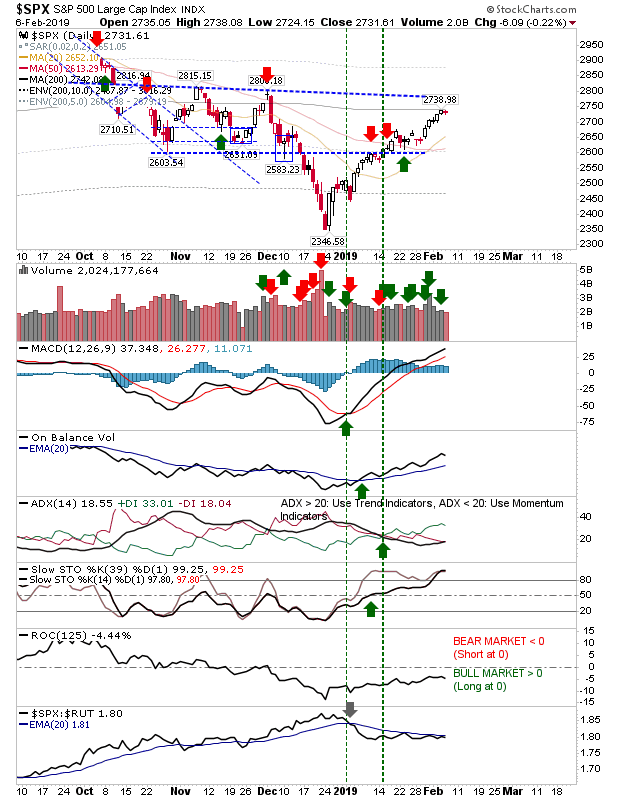

The S&P closed with a narrow doji just below its 200-day MA. The 200-day MA is looking a little obvious as resistance so watch for a gap higher to catch shorts out, before a reversal return below the 200-day MA. Relative performance is picking up against Small Caps which will help, but in itself is bearish for the rally as money cycles into more defensive Large Cap stocks.

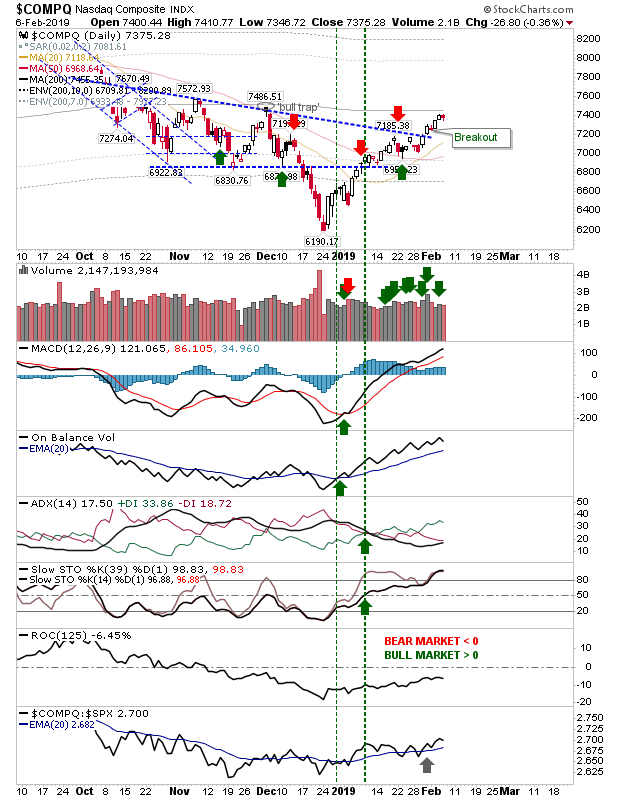

The NASDAQ is flying a little below the radar. It has broken declining resistance but still has the 200-day MA to navigate. Technicals are in good shape and the accumulation trend in on-balance-volume is strong. Yesterday's move in the Semiconductor Index should help push the index above its 200-day MA.

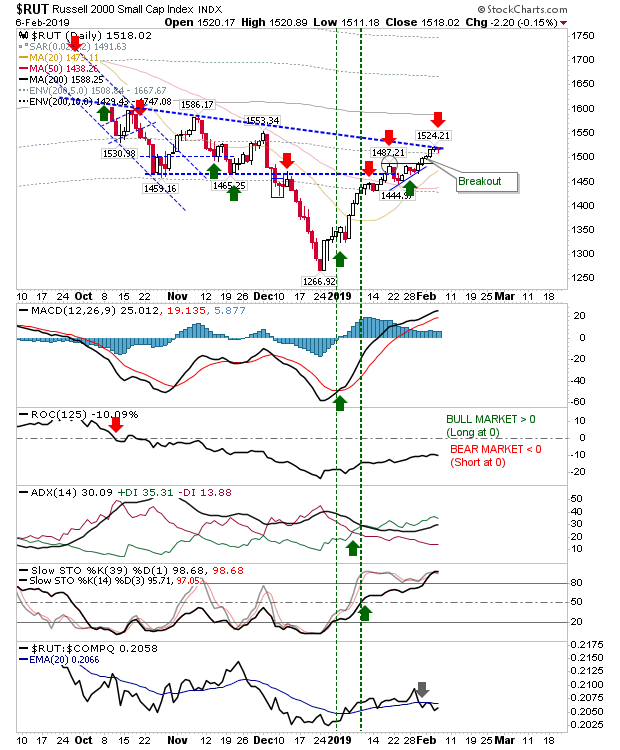

The Russell 2000 sits at an interesting juncture of declining resistance. It's not near the 200-day MA, so the only natural resistance to consider is declining resistance. Relative performance is ticking down, making it an index struggling to attract the attention of traders and investors. I would be looking for sellers/shorts to get aggressive here.

For today, shorts can look to trade the Russell 2000 with stops not far above 1,524. Should the rally continue then the S&P may instead offer the better short play—but only if there is a gap down Friday. There isn't a whole lot for longs; some may look to buy the break in the Semiconductor Index, but only if there is a positive test of breakout support.