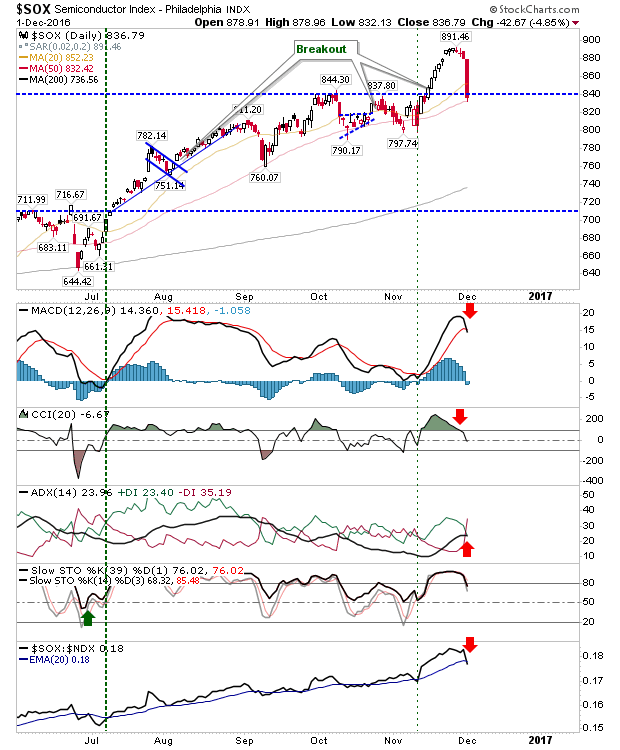

Internet troubles have limited me Thursday night, but the one chart I want to show is the near 5% loss in the Semiconductor Index. Having escaped relatively unscathed from recent day's selling it was a whirlwind of action for the index on Thursday.

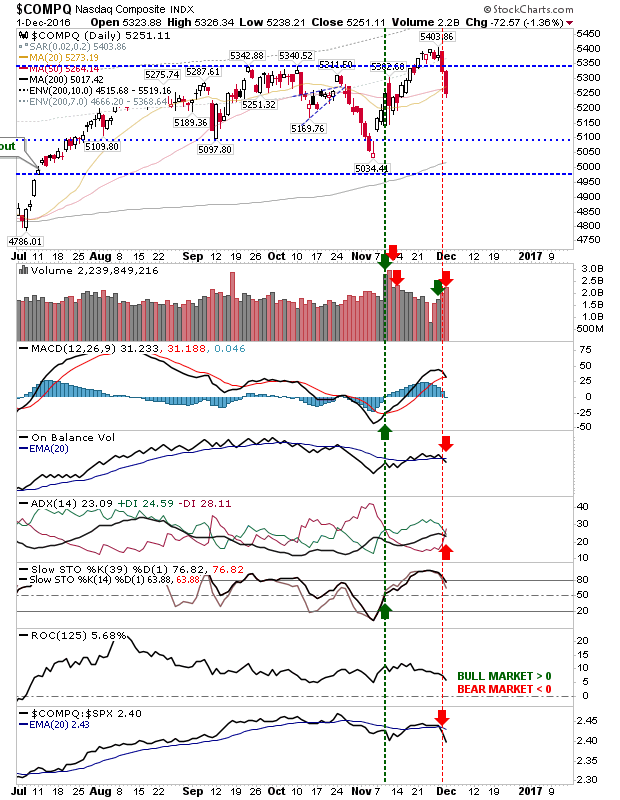

This had obvious consequences on the NASDAQ. The NASDAQ did relatively well to suffer just over a 1% loss. However, there were 'sell' triggers for On-Balance-Volume and Directional Index. There was also an acceleration in the relative underperformance of the index to the S&P. Bulls will look to the 50-day MA as a possible defense point.

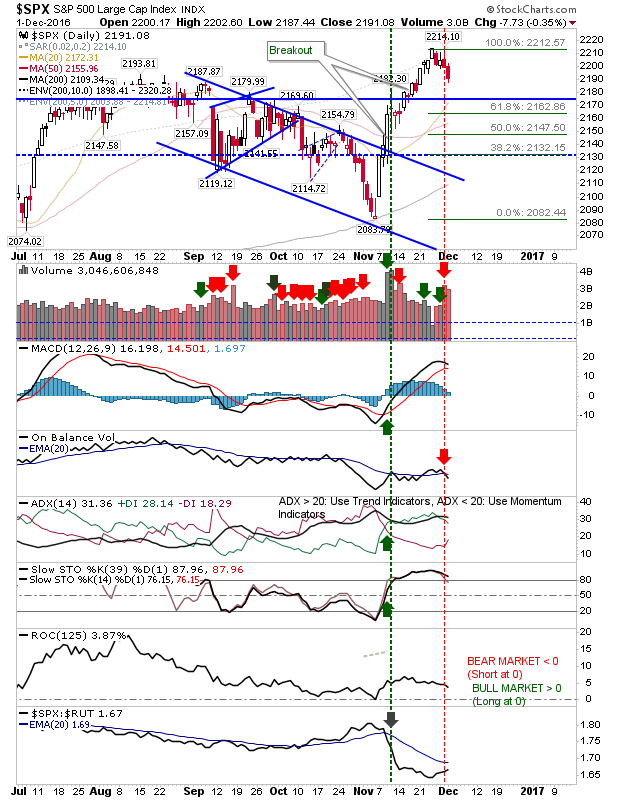

The S&P managed to stay out of the crossfire, experiencing a relatively small loss with only a 'sell' trigger in On-Balance-Volume.

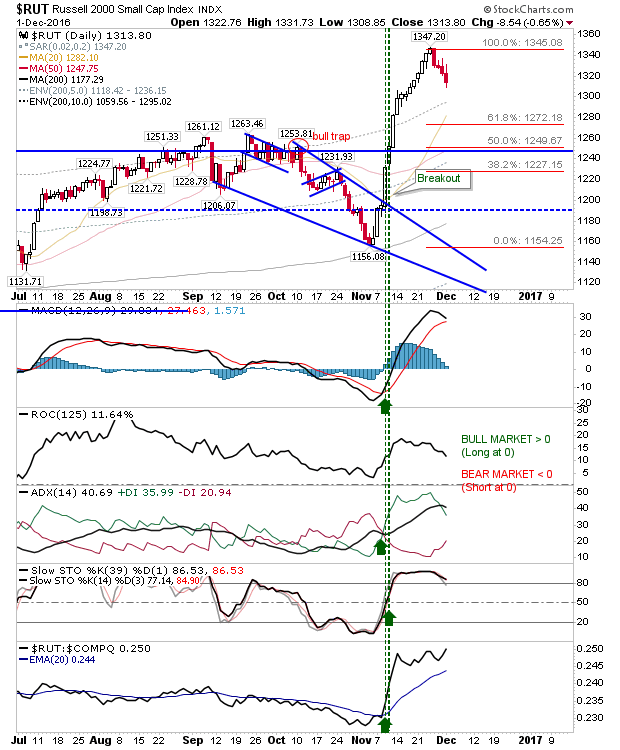

The Russell 2000 also took modest losses having been the first index to experience profit taking after extended gains. Technicals remain net bullish with no 'sell' triggers.

Semiconductors remain vulnerable to further losses as Micron Technology Inc (NASDAQ:MU) weighs on the index. Bulls can look to 50-day MAs to mount a defense, although such action would need to occur in early morning trading for the NASDAQ and Semiconductor Index as both indices finish with tags of these MAs.