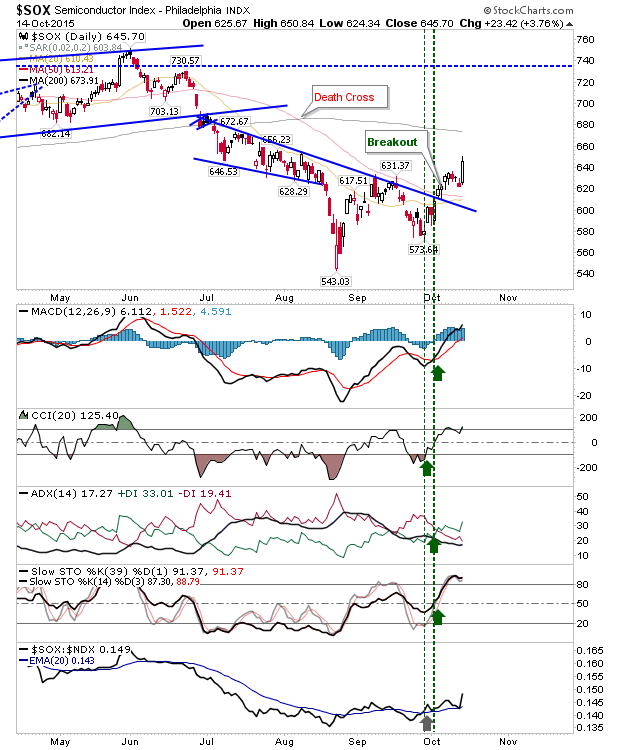

Lead indices continued to experience selling, but Semiconductors posted strong gains which may help drive the Tech indices over the following days (despite minimal positive impact yesterday). The index has already pushed the breakout, and yesterday's looks like a follow through on this breakout, not to mention a break beyond the September swing high.

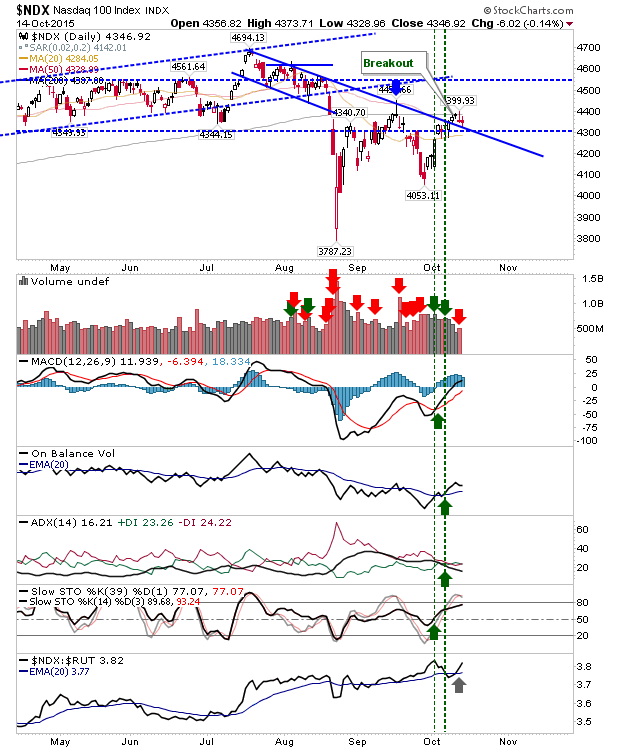

The NASDAQ 100 didn't quite gain on the back of the Semiconductor Index, but it's holding the trendline breakout. It still has the 200-day MA to negotiate as overhead supply. Still anyone's game.

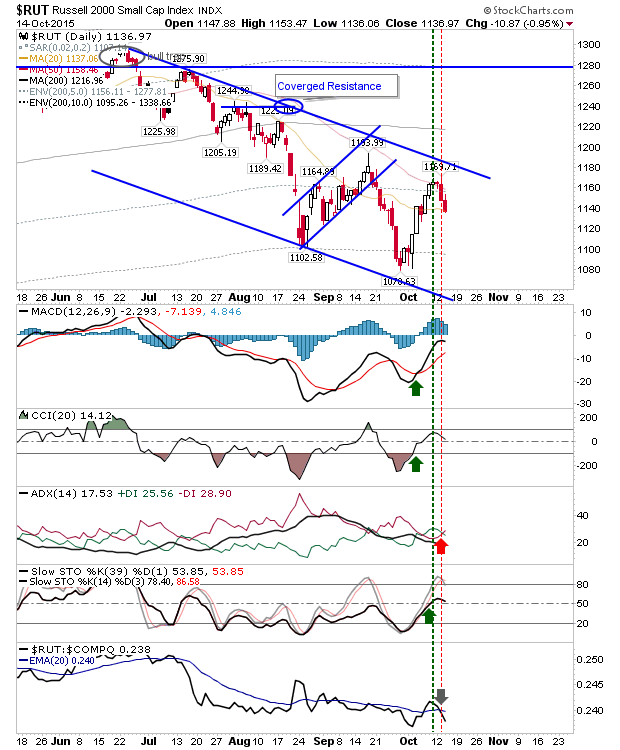

The Russell 2000 experienced the biggest loss on the day and is underperforming relative to the other indices. This is perhaps the most worrying thing for bulls given its leadership roll, and how weakness in July quickly spread to other indices. Will the current swing lower for the Russell 2000 be the start of another leg down for all indices?

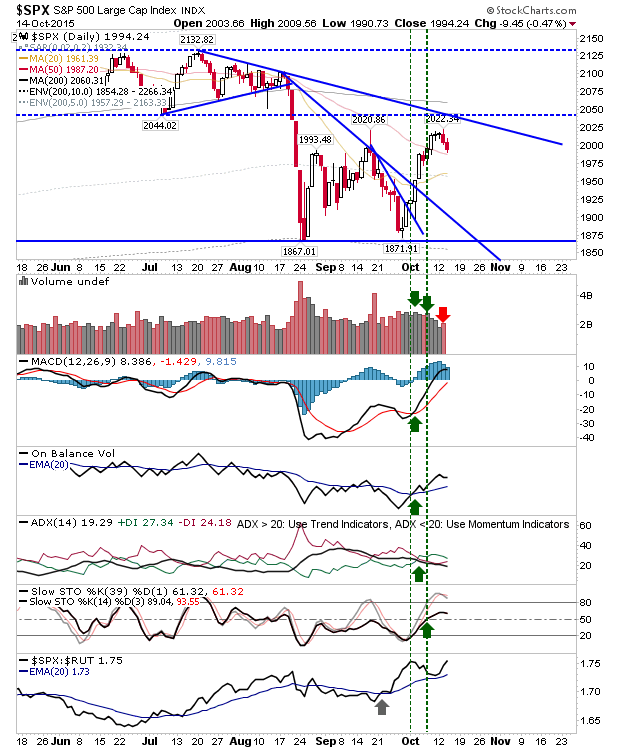

The S&P has come back to its 50-day MA with good technical strength. Good for bulls will be a push lower (below the 50-day MA) and then a recovery into the close.

For today, watch early action for leads. A gap lower may embolden sellers and keep bulls on the sidelines as they wait for a push-back to August/September lows. However, if buyers are able to post gains into the close, it may mark a case for sellers exhaustion.