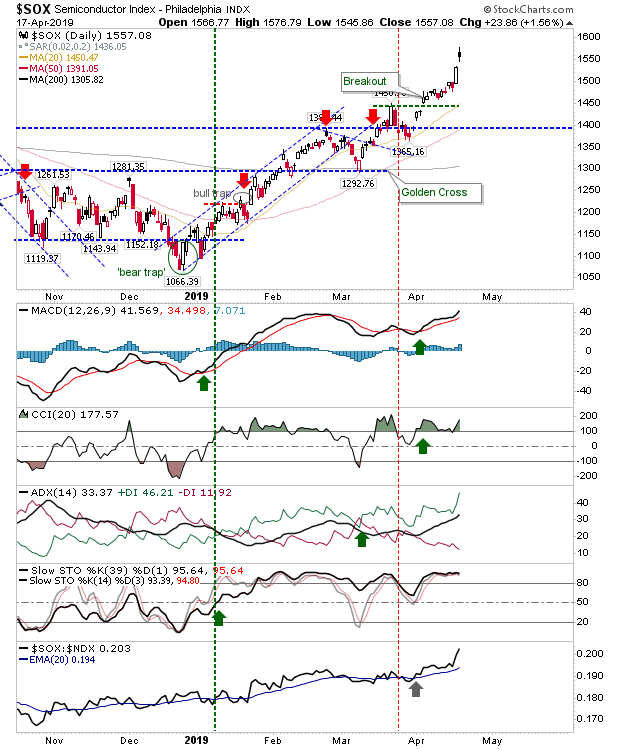

A mixed day for markets yesterday. The only winner was the Semiconductor Index. It gapped higher off Tuesday's strong white candle. With other markets suffering losses, the risk of a 'bearish shooting star' tday is reasonably high.

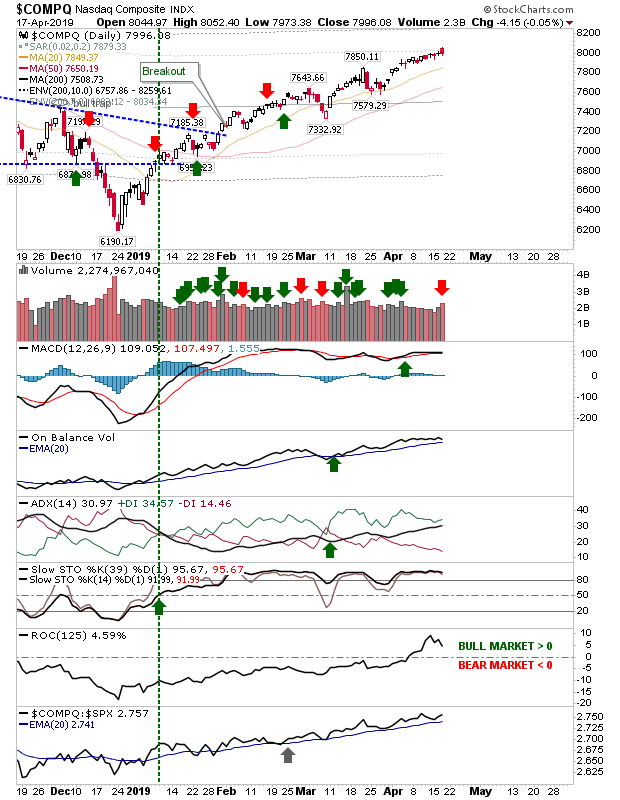

The NASDAQ ran contrary to the Semiconductor Index as it finished on a small bearish engulfing pattern. I would have looked for the Semiconductor Index to feed into the NASDAQ but this hasn't happened; it's hard to see the Semiconductor Index maintaining this form.

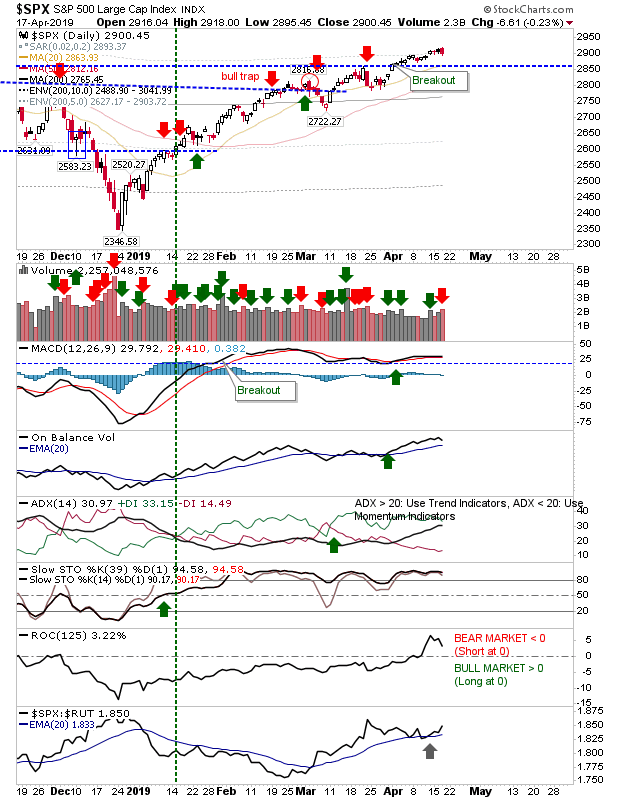

The S&P had a similar day to the NASDAQ, finishing with a bearish engulfing pattern. As with the NASDAQ, volume rose in confirmed distribution. On the bright side, relative performance picked up against the Russell 2000; so whatever money is coming into the market will flow into Large Caps first.

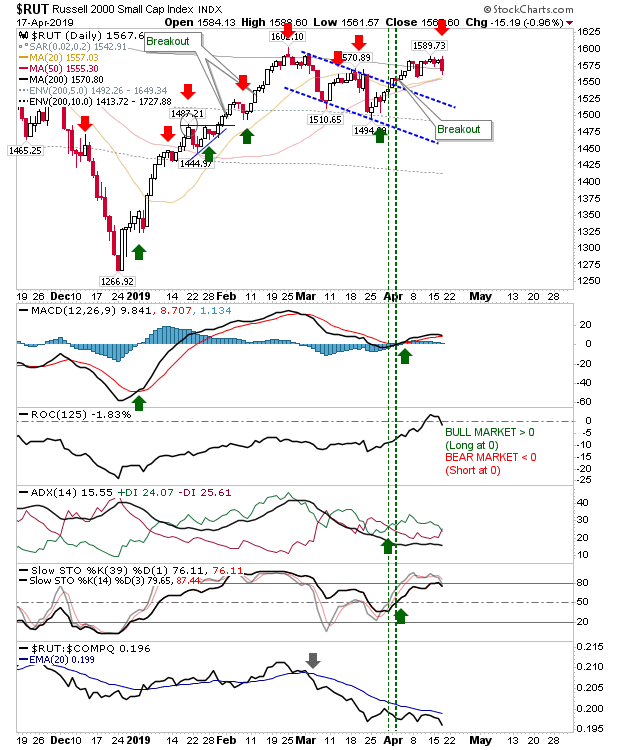

The Russell 2000 experienced a near 1% loss on another bearish engulfing pattern. Today will see the first test of support of converged 20-day and 50-day MAs; I have marked this as a possible shorting opportunity with a bearish divergence in the MACD and a sharp drop in relative performance.

For today, look to the Russell 2000 to add to yesterday's losses. At the same time, watch for a gap down (and bearish evening star) in the Semiconductor Index.