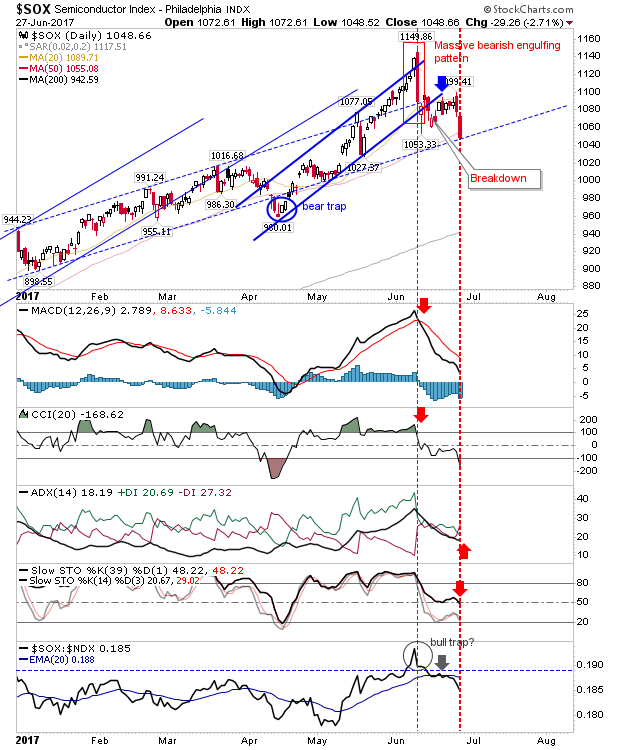

Monday's losses followed through with fresh declines yesterday on higher volume distribution. Worst hit was the Semiconductor Index as it gave up nearly 3%. Yesterday's finish left it at rising channel support and a chance for bulls to mount a rebound. Technicals are net bearish after stochastics undercut the mid-line which suggests a more prolonged trend lower is in the making.

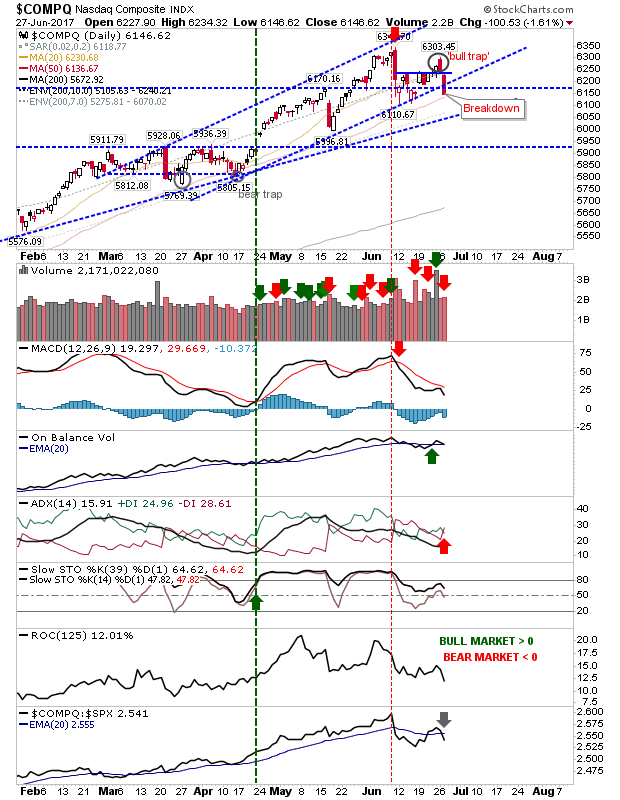

The NASDAQ followed the loss of the 'bull trap' with a breakdown of rising support. This left the index on its 50-day MA which may give bulls a chance to generate some demand. Should this fail, then a slower rising trendline around 6,100 is available.

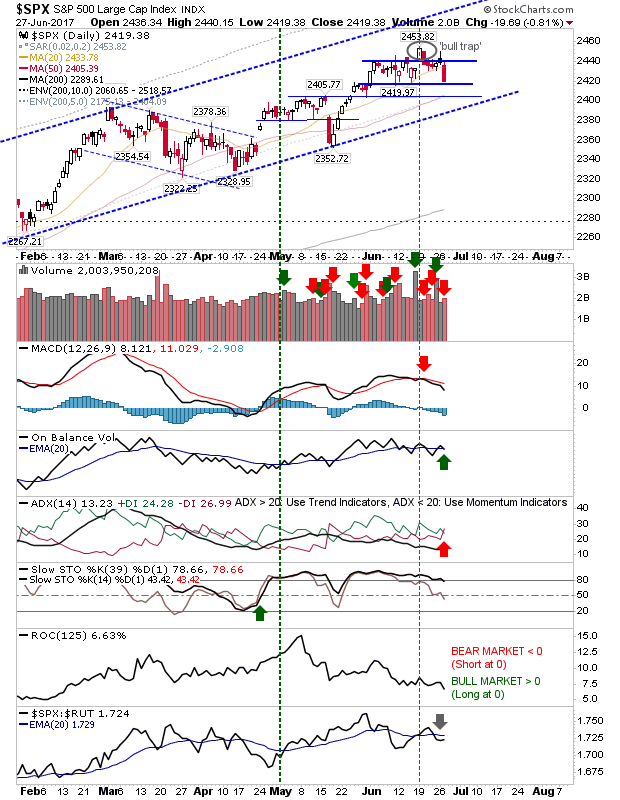

The S&P is at the lower end of the prior range but it hasn't yet lost such support. However, given action in the NASDAQ and Semiconductors it's hard to see it hanging on.

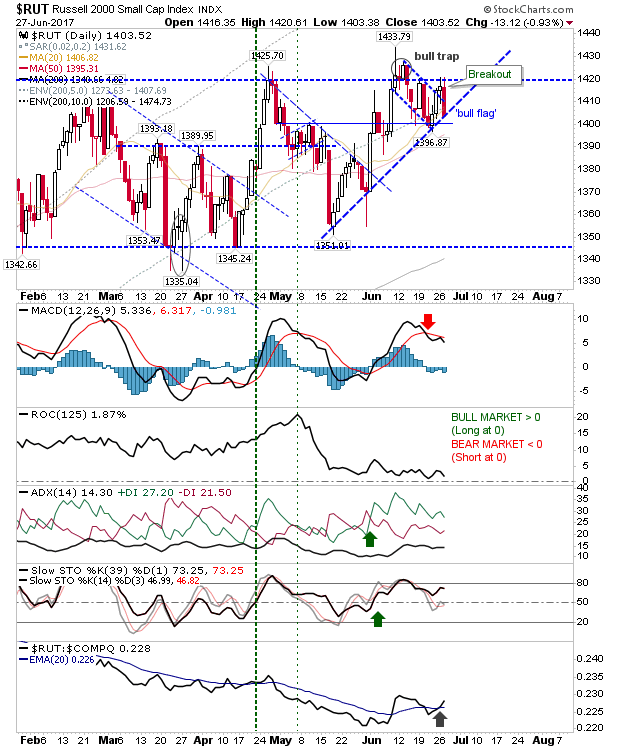

The Russell 2000 wasn't able to defend its breakout gain yesterday, but it finished on rising support which is just a few points below its 20-day and 50-day MA. There wasn't a support loss as for the NASDAQ and Semiconductor Index so like the S&P it's flying below the radar which may help distract shorts and sellers.

For today, value buyers can pick from the Russell 2000, Semiconductors and the NASDAQ to a lesser degree. Shorts don't have a lot to work with as the losses are already in the bag, so watch how the market rebounds for fresh opportunities.