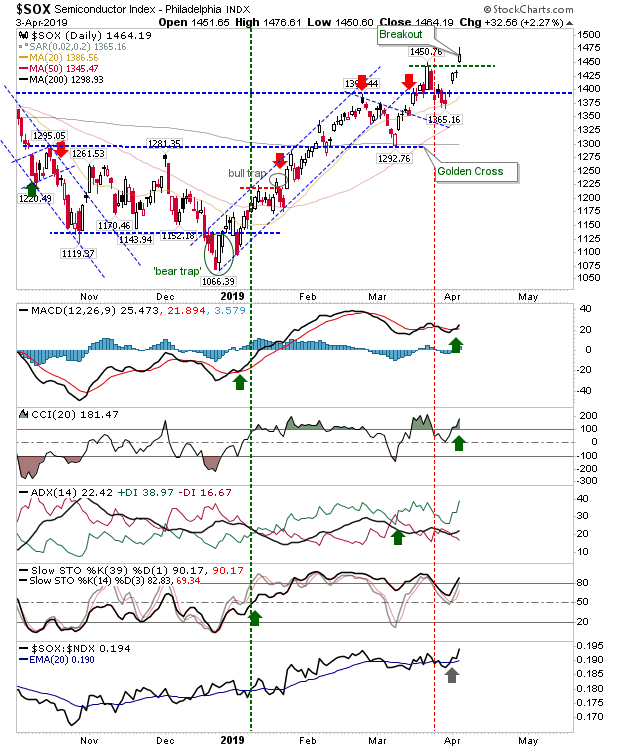

Aside from the Semiconductor Index there wasn't a whole lot going on yesterday. However, Semiconductors did have a very strong day with the negation of the two-bar reversal. The gains returned a new high in relative performance to the NASDAQ 100 with a return of the MACD trigger 'buy'. Following earlier action this week it's a big change on the declines of last week.

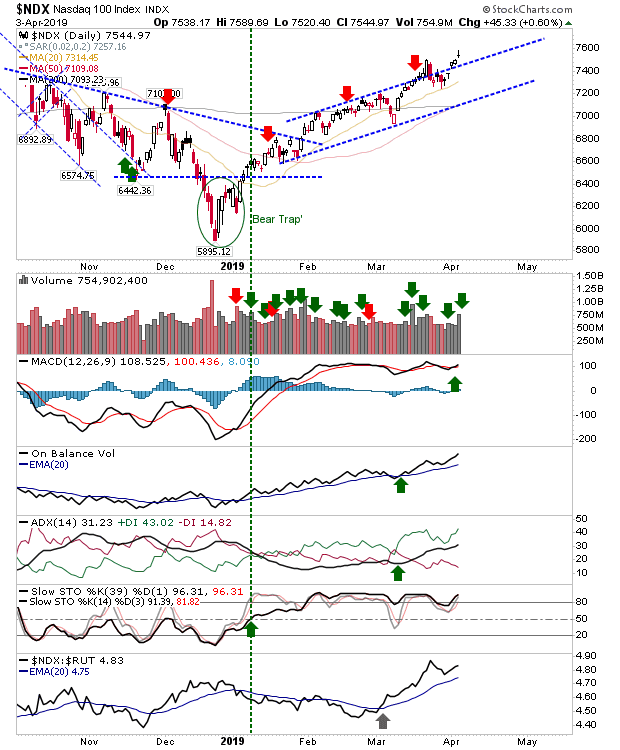

The NASDAQ 100 hasn't kicked on to the same degree as influencing Semiconductors. Yesterday's doji did manage a new high for the rally.

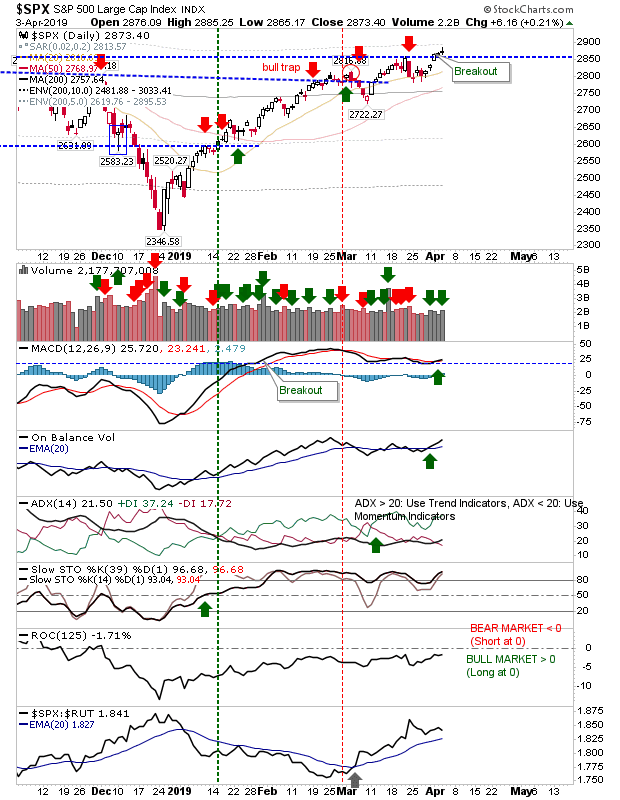

The S&P edged a breakout on higher volume accumulation. Technicals returned net bullish on the breakout

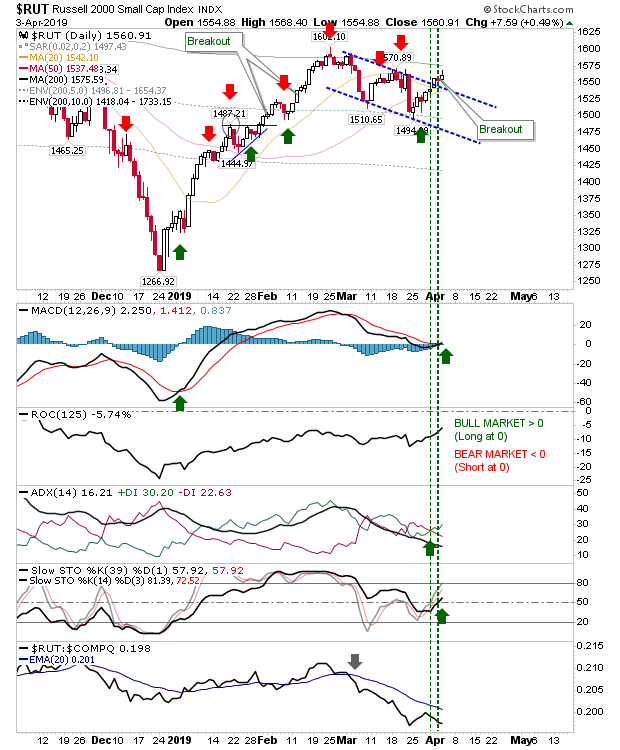

The Russell 2000 continued its channel breakout but will soon be testing its 200-day MA. The breakout came with a MACD trigger 'buy' but it hasn't negated the short plays unlike other indices.

For today, look for further upside from Semiconductors and preferably a close above yesterday's doji for Large and Small Cap indices. Doji are typically neutral candleticks, but a gap down today opens up the possibility of bearish 'evening star' / 'shooting star' candlestick patterns.