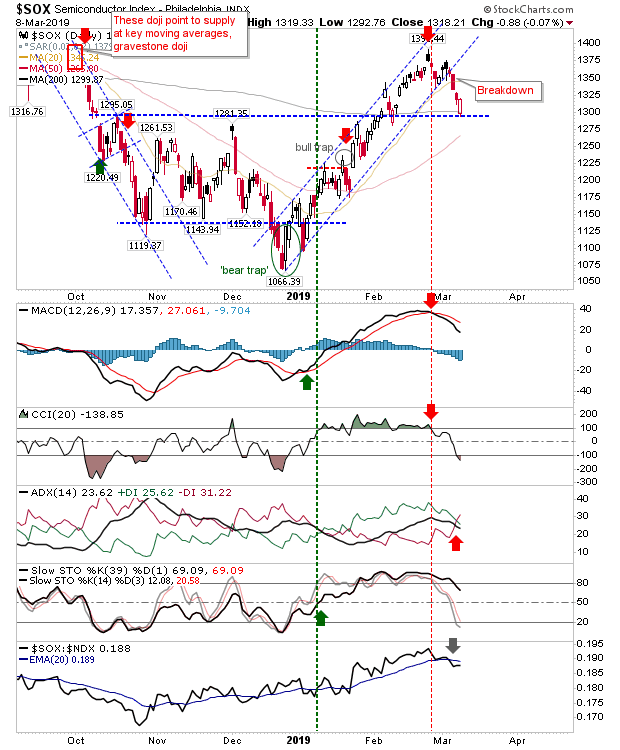

The Semiconductor Index, on Friday, made a support test at converged 200-day MA and horizontal support of 1,295. Technicals for the Semiconductor Index have a bearish MACD trigger 'sell', CCI and ADX bearish cross in the +DI/-DI. Intermediate term stochastics [14,3] are oversold and in a position to mark a new 'buy' trigger.

For other indices, things were looking a little more bearish.

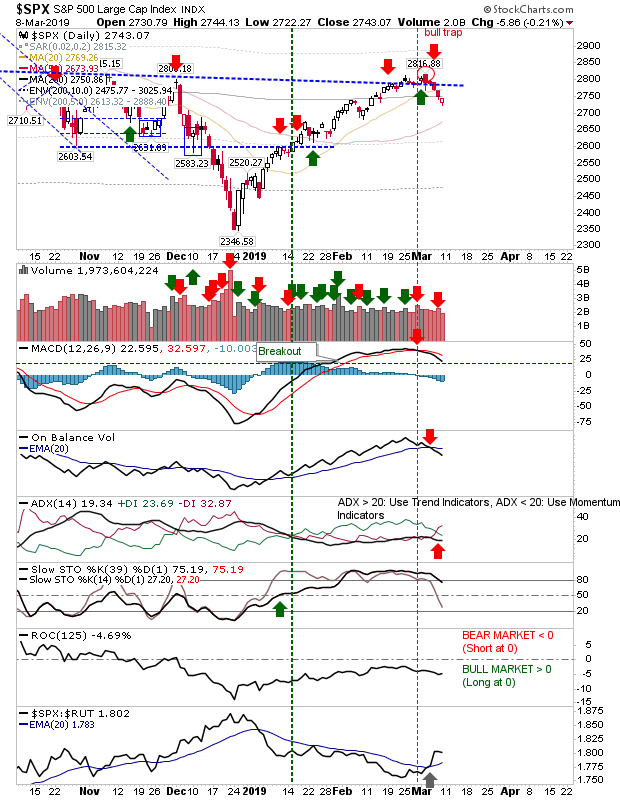

The S&P undercut its 200-day MA without putting up a strong defense, although it did manage to recover enough to suggest a secondary defense could be made on Monday. MACD, On-Balance-Volume and +DI/-DI are all showing bearish 'signals', but relative performance is firmly in bulls favor.

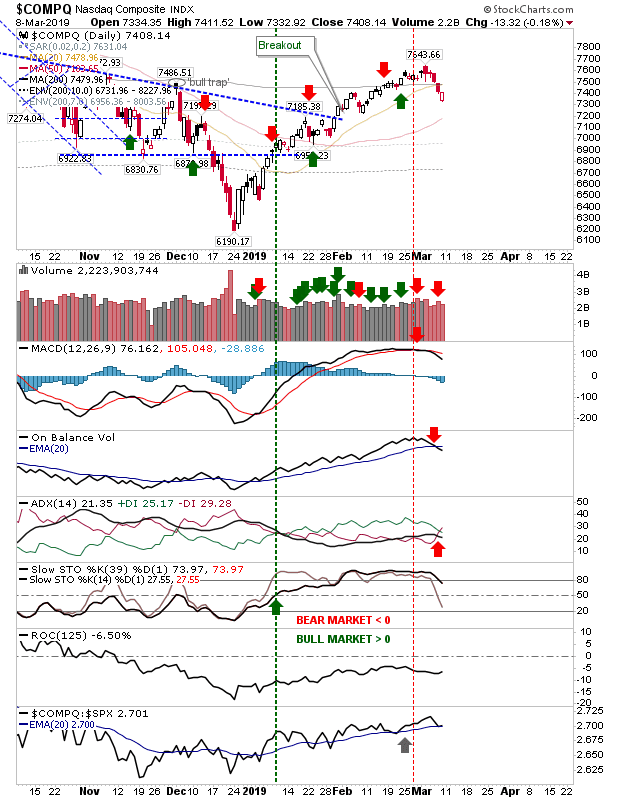

The NASDAQ had already kissed its 200-day (and converged 20-day) MA goodbye. Next it will be looking at the 50-day MA for support. Technicals are showing 'sell' triggers for MACD, On-Balance-Volume and +DI/-DI. While relative performance (vs the S&P) is steadily rising. It too is looking at a possible 'sell' trigger.

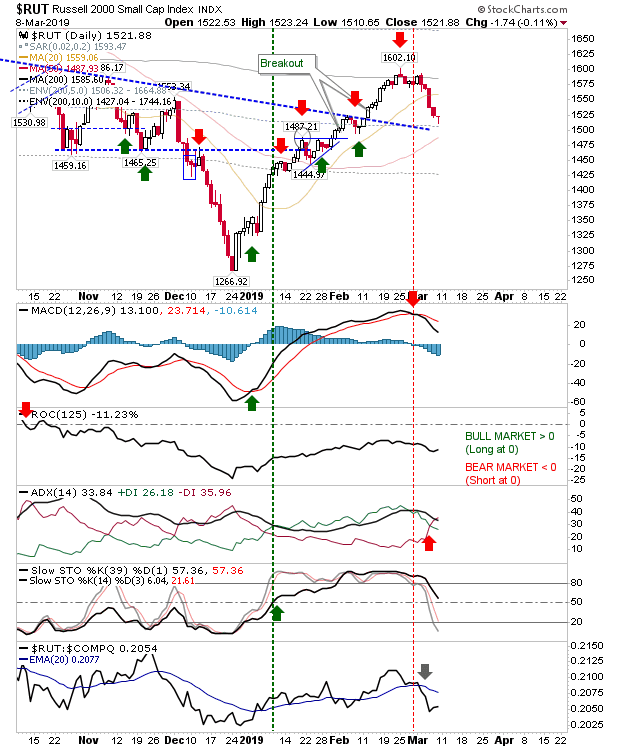

The Russell 2000 flashed a doji at declining support - which is just above a rising 50-day MA. Technicals aren't great but there is the possibility for Stochatics at oversold levels generating a 'buy ' trigger often a test of declining support (former resistance).

For tomorrow, look for a kickstart rally in the Semiconductor Index off support. Other indices have merits in this regard but lack the clear support levels which could jump start a rally.