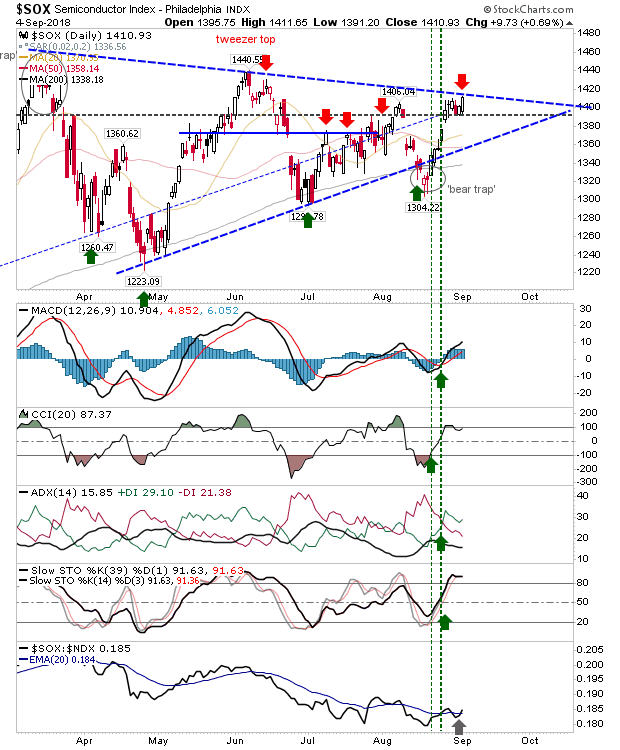

There wasn't a whole lot to work with on Tuesday. The only index showing potential yesterday was the Semiconductor Index; it managed to clear congestion from the last four days as it tagged resistance. While the resistance tag may be viewed as a shorting opportunity the move looks like one to drive a break of the triangle.

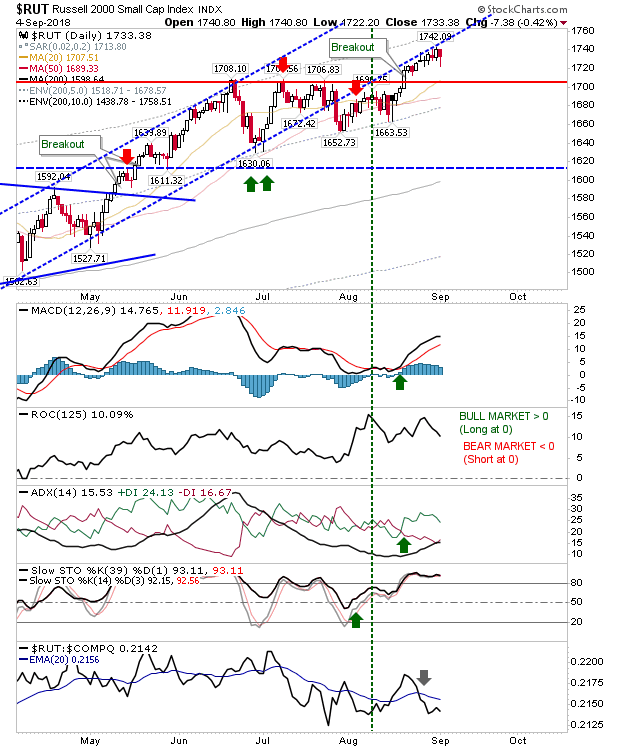

The Russell 2000 experienced a minor sell-off although it ranked the biggest fall on the day. The index remains well above breakout support despite the hugging of channel support-turned-resistance; a sell-off before a break of 1,742 looks more likely but let price be your guide.

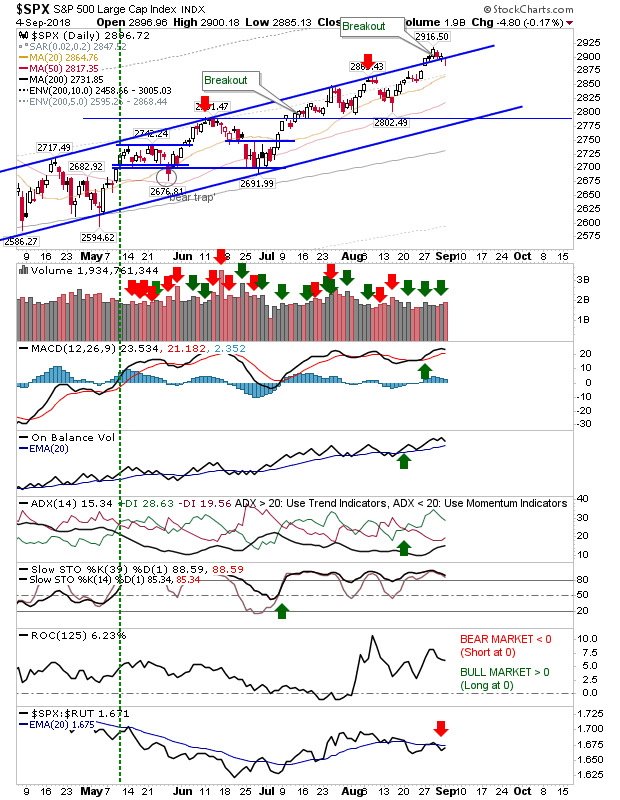

The S&P finished with a small doji at channel resistance-turned-support. Buyers still have an opportunity for a short-term momentum play.

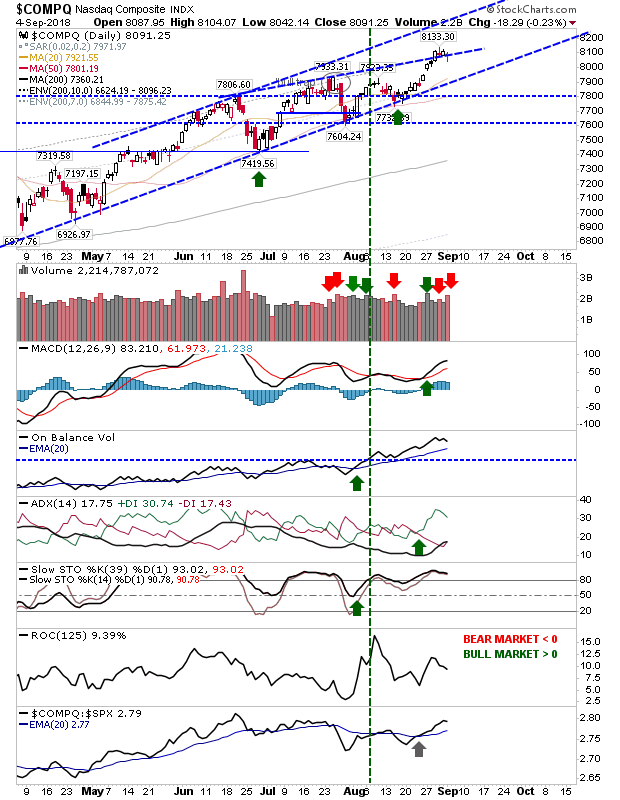

The NASDAQ experienced a heavier volume sell-off but like the S&P closed with a doji. There is a minor buying opportunity here for a move to larger channel resistance.

For today, watch for a breakout in the Semiconductor Index and track buying opportunities in Tech and Large Cap Indices. Shorts could try and work the Russell 2000 but look to cover when breakout support is tested.