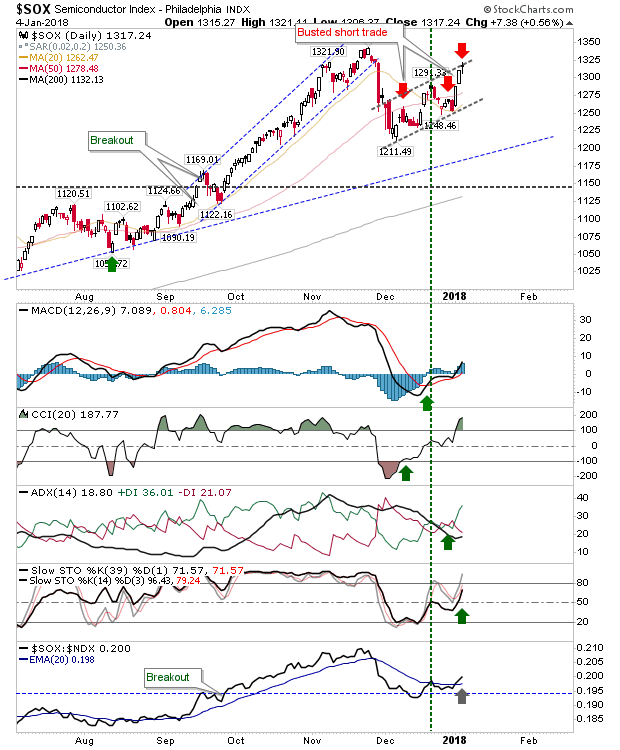

Will this be third time lucky for Semiconductor Index short traders? The last two short trades at the 50-day MA have failed so will the narrow doji at 'bear flag' resistance offer a new opportunity for shorts to reverse the two prior losses? It should be noted, technicals do not support a short position but a stop can be run tight to 1,321 highs as any gain from here will break the 'bear flag'.

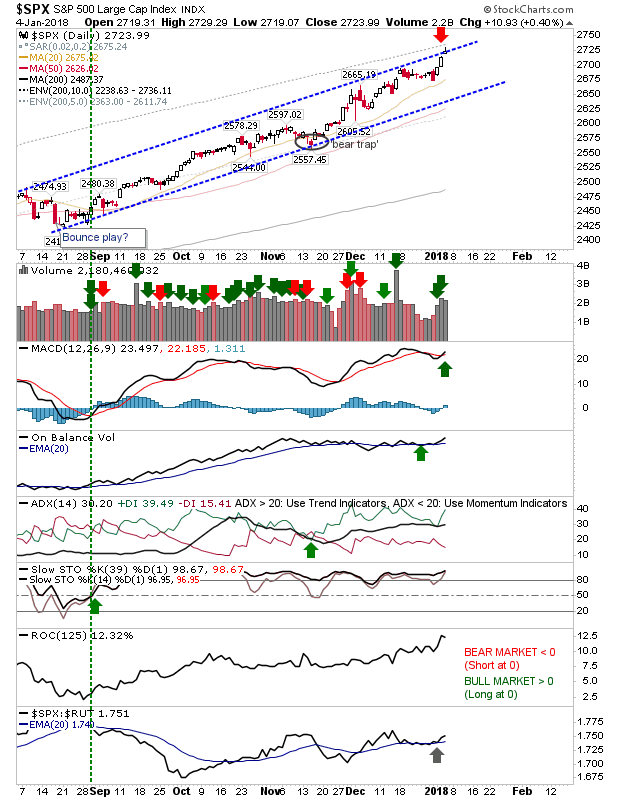

The S&P also experienced a doji at channel resistance so it offers a shorting play for those looking at weak price action. As with the Semiconductor Index, technical action does not support a short position.

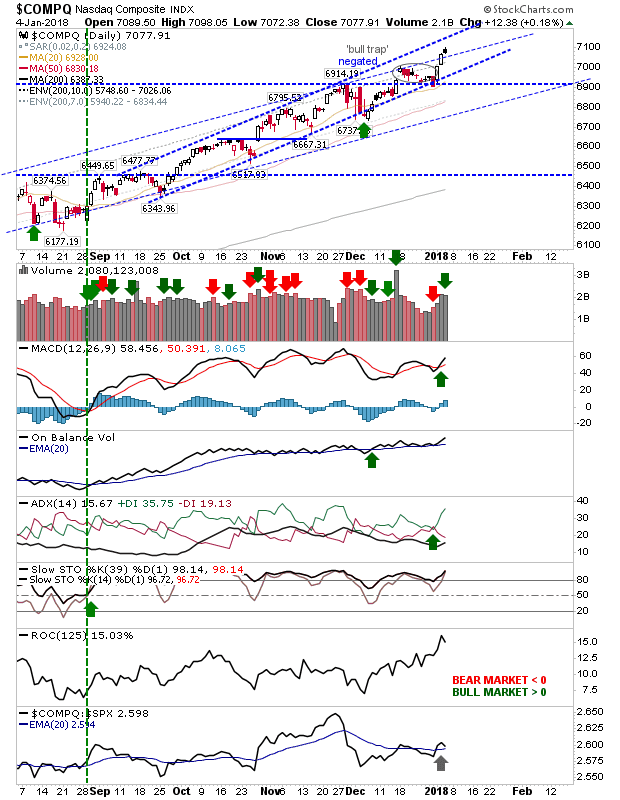

The NASDAQ finished with a bearish 'black candlestick' but it didn't occur near resistance and technicals don't support a short trade either.

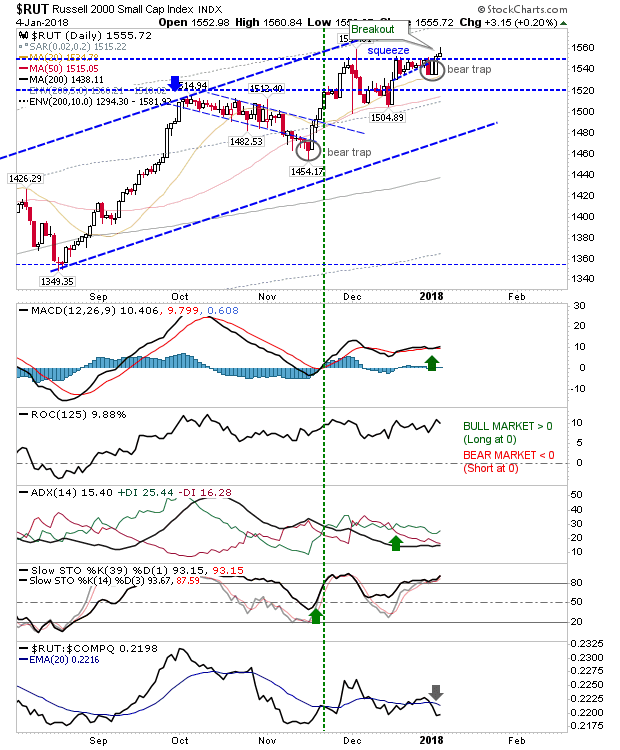

The Russell 2000 didn't add much to Wednesday's breakout and it didn't push away from new-found support either. The breakout is still intact but the risk of a 'bull trap' remains.

Thursday's narrow intraday action is an opportunity for shorts to take relatively low risk plays in some of the lead indices but given the strength of their rallies, there is a high chance for failure.