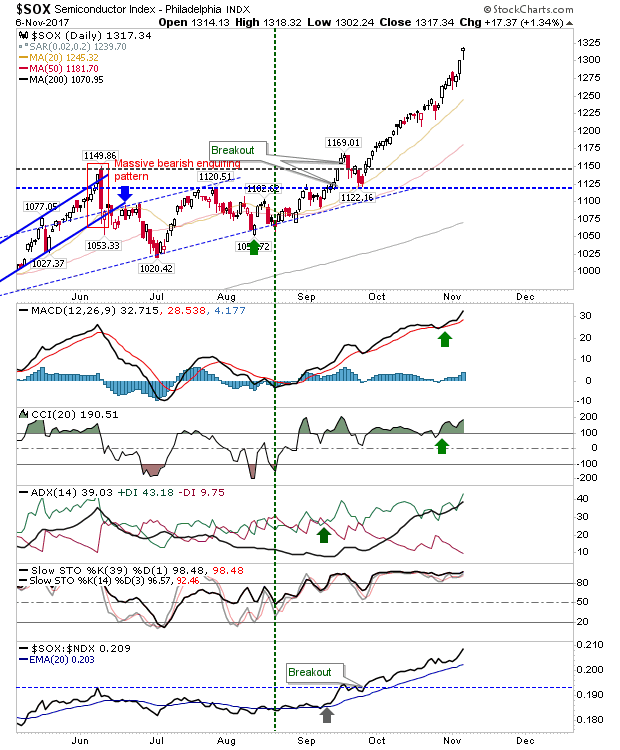

More gains for the market yesterday kept the rally intact which leaves little to add today. The only potential cloud on the horizon is the Semiconductor Index. Yesterday finished with a gap higher with a bearish hammer which may become a bearish shooting star if there is a gap down and further losses by the close today. The rally from September lacks a pullback, so some form of sell-off is anticipated

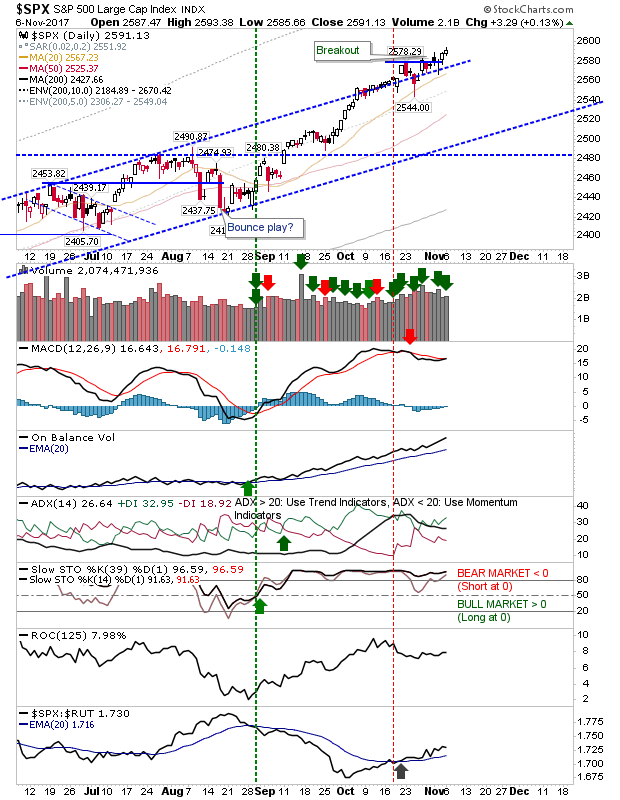

The S&P edged a small gain but not quite a MACD trigger 'buy'

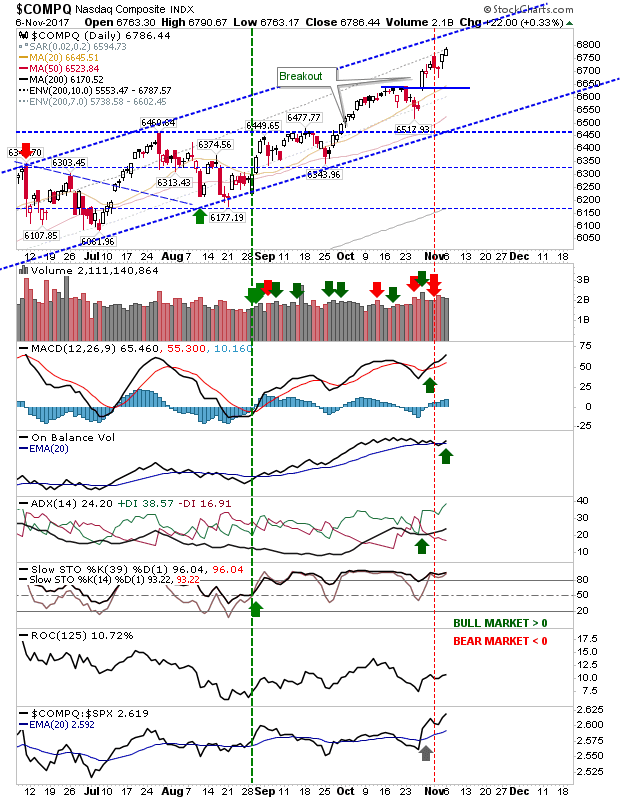

The NASDAQ made it closer to channel resistance and remains the upside target.

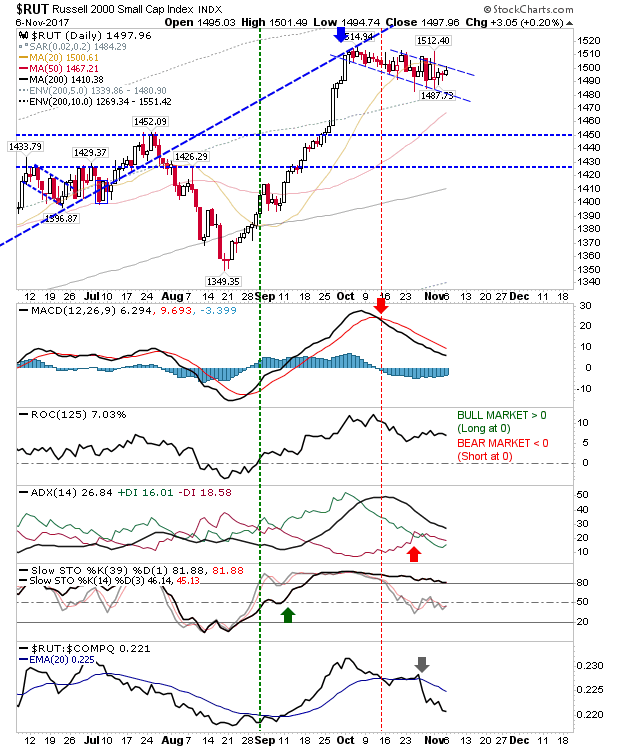

The Russell 2000 looks ready to break out of its 'bull' flag. Yesterday left the index at channel resistance; today could deliver a breakout. Watch this closely.

Keep an eye on pre-market trading today; weakness in lead indices has the potential to set up a bearish 'shooting star' in the Semiconductor Index. In a bullish pre-market, look for the breakout in the 'bull' flag from the Russell 2000.