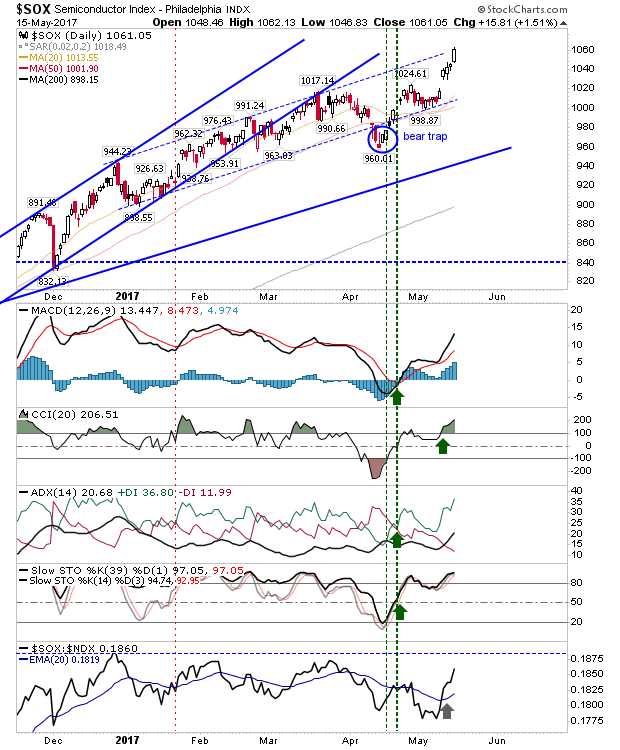

While not one of the primary indices, Semiconductors experienced a strong day of gains yesterday—backed by strong technicals. This index is well on its way to shaping a new rally for 2017, following through from the rally kicked off on Trump's election. Bulls have their index to follow for the summer.

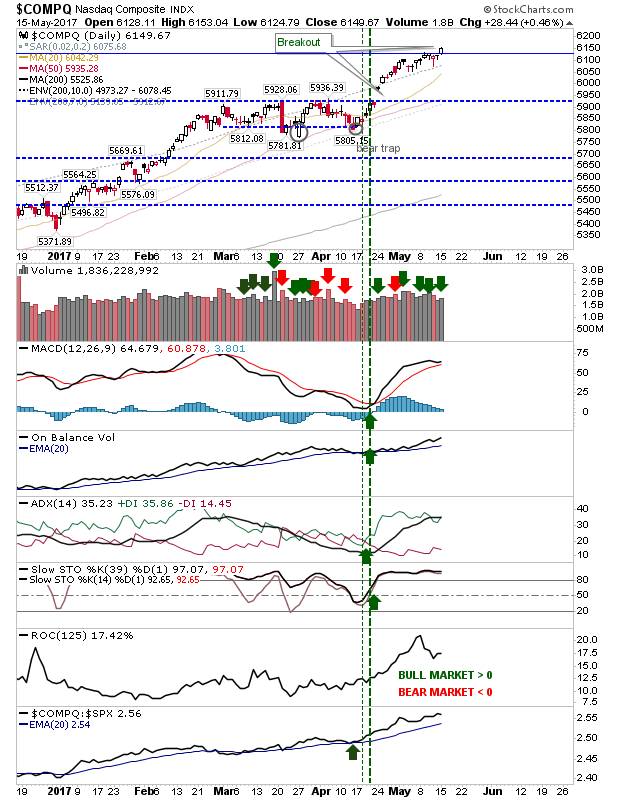

Gains in the Semiconductor Index helped boost a fresh breakout in the NASDAQ on higher volume accumulation. This is good news for long term holders and trend traders with little on offer for shorts.

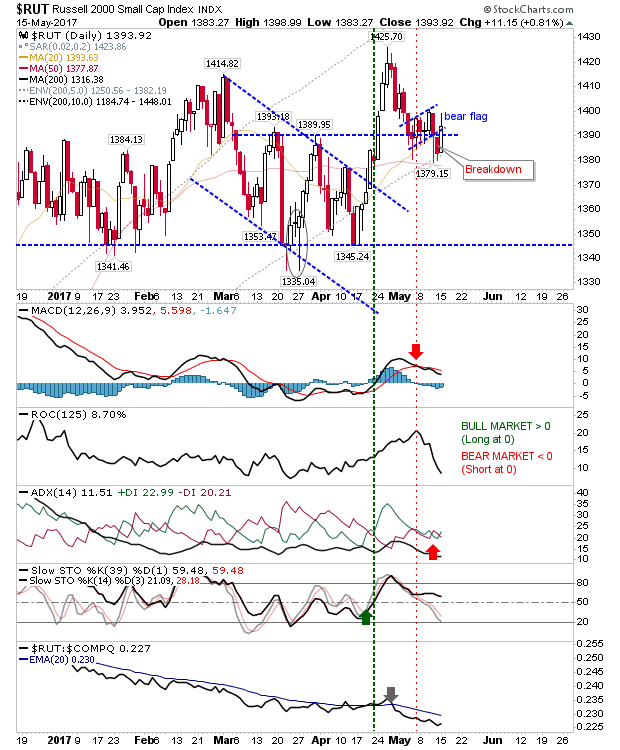

The under-pressure Russell 2000 got some relief, managing a close above 1,390 support and opening up the opportunity for a 'bear trap'; a solid long play opportunity with a stop below 1,379. This could be the sneak long play for the summer.

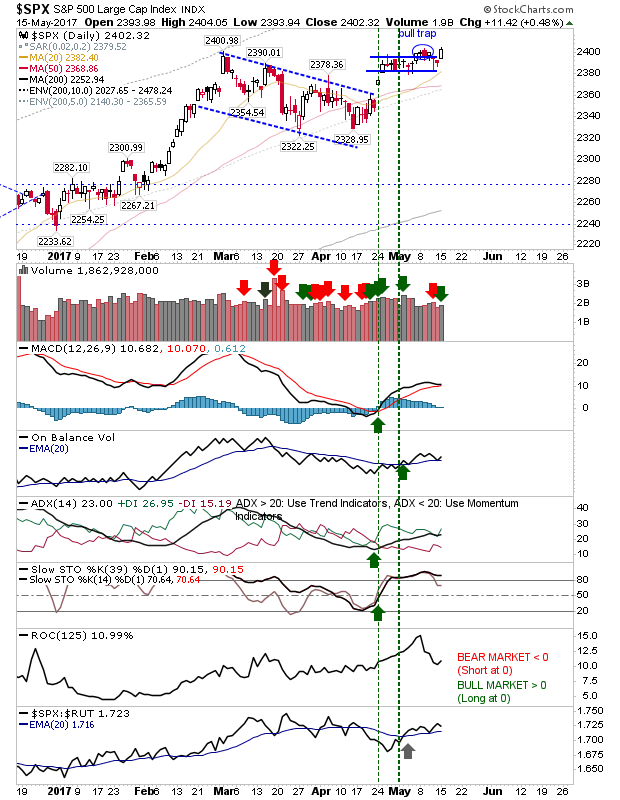

The S&P would also have registered a breakout, but the 'bull trap' has not yet been negated. There may be better plays out there, but the S&P also offers upside opportunity with yesterday's gain coming on the back of volume accumulation.

For today, it may be about riding the bull train and taking advantage of long opportunities at different levels of the bull spectrum:

1. Momentum players can look to the NASDAQ and Semiconductor Index building on a breakout.

2. Value players can look to the Russell 2000 and its discount play.

3. Defensive players can look to the S&P negating the 'bull trap'

Shorts have nothing to see.