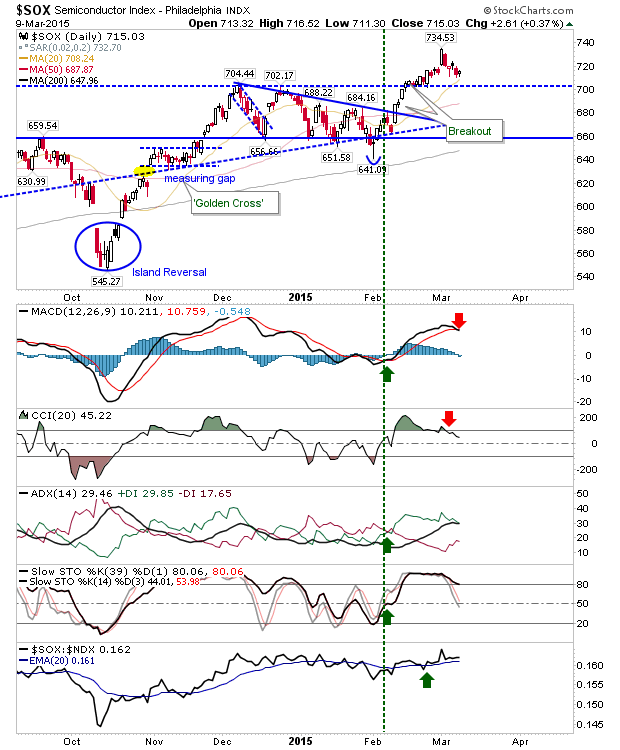

A modest recovery in markets yesterday likely helped bears more than bulls, although indices didn't recover enough to offer bulls anything more than a respite. The exception was the Semiconductor Index (SOX); it finished just above its 20-day MA, which is above 700 breakout support. It flashed a MACD trigger 'sell', which may expand om weakness tomorrow, but the daily chart is looking very good for bulls.

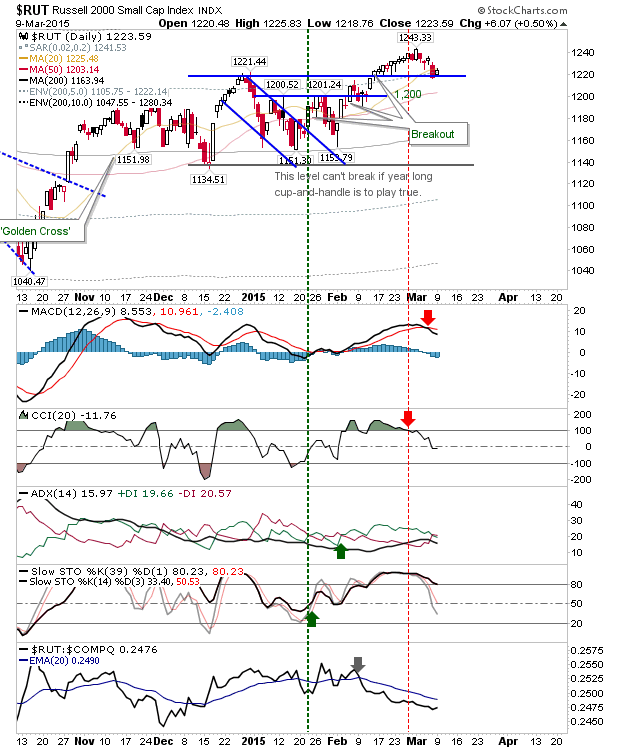

The Russell 2000 also defended its breakout with a successful move to build support at 1220. The index finished just below its 20-day MA, but the inside day completed a bullish harami over the two days.

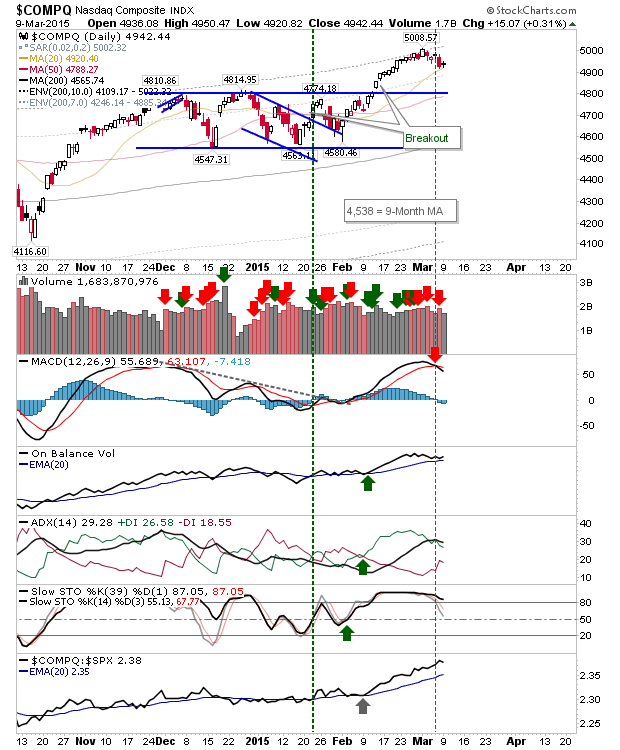

The NASDAQ was another index to successfully defend its 20-day MA. Yesterday's doji completed a bullish harami cross, one of the strongest bullish patterns. Aggressive traders may look to attack at these levels.

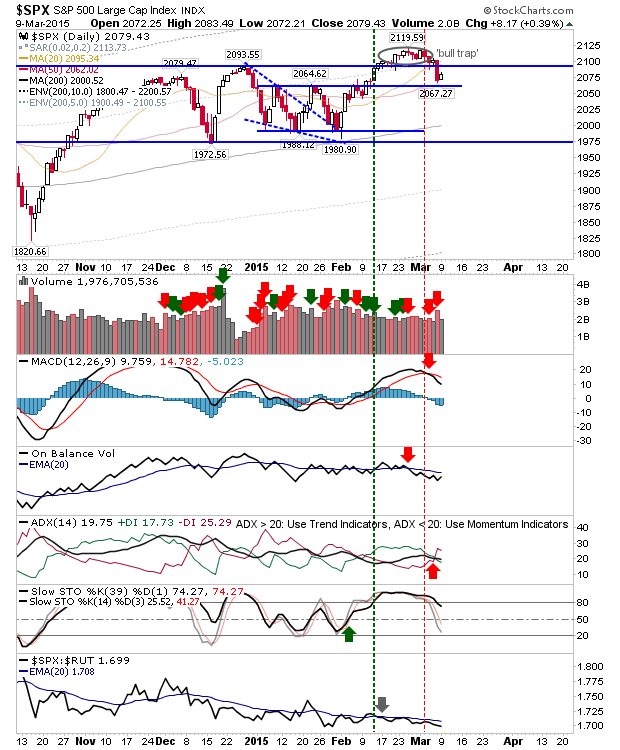

The S&P also finished with a small gain, but not enough to challenge the 'bull trap'. Shorts should continue to monitor this index for opportunities on a rally to 2,100.

For today, watch indices for some follow-through gains. However, the real proof in the pudding will be the reaction once losses generated from Friday are returned. With markets under such bearish influence, shorts will have the opportunity to introduce a fresh wave of selling.